Energy equities are gaining momentum. The Energy Select Sector SPDR Fund (XLE) is near all-time highs and April seasonality may give it the final push needed.

Chicago RS Institute: Register to join us in person for a 3-hour educational symposium on relative strength investing. This event is for financial advisors and will offer 3 hours of CFP/CIMA credit.

When: April 23, 2024, 8 AM CT - 11 AM CT

Where: 1 South Wacker Drive, Chicago, IL, 60606

Who: Speakers include...

John Lewis, CMT, Senior Portfolio Manager; Andy Hyer, CFP, CIMA, CMT, Client Portfolio Manager; Ian Saunders, Senior Research Analyst

Cost: Free! Breakfast will also be provided.

Registration is limited to the first 75 advisors, so be sure to act fast!

As noted in a recent Alternative Assets Update, crude oil prices (CL/) tend to ride a seasonal tailwind this time of year. Year-to-date (YTD, through 3/22) crude is up 13% yet in the past 30-days alone the commodity has rallied over 4%.

Energy equities have certainly benefitted from the crude gains. For instance, the Energy Select Sector SPDR Fund (XLE) is now the second best performing of the major 11 SPDR funds YTD (up 10.21%), trailing communication services (XLC) by about 2%. Although, XLE now fights with multiyear resistance.

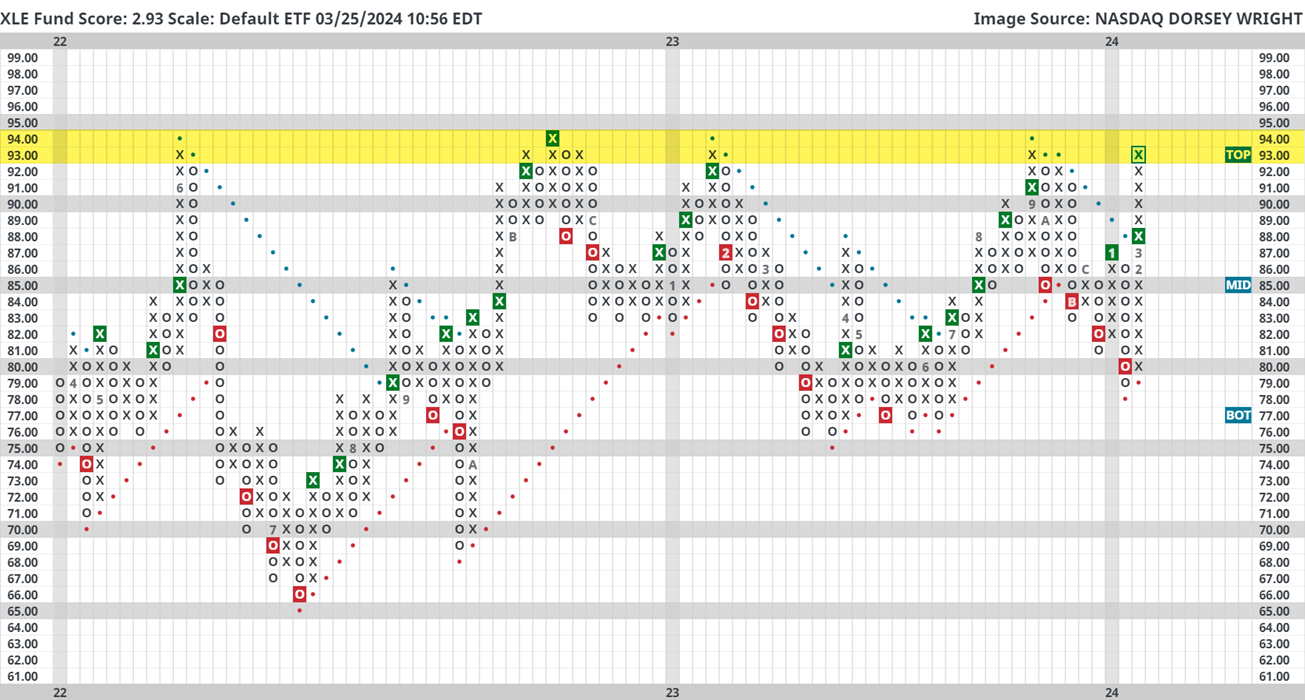

Said area of resistance is highlighted on the Point & Figure chart below. Note that XLE peaked in June 2022 at $93, in November 2022 at $94, in January 2023 at $93, and in September 2023 at $93. XLE currently charts at $93...again.

Despite the big area of resistance nearby, April seasonality could give it the final push needed to breakout to fresh highs…and with a 2.93 fund score XLE could use all the help available.

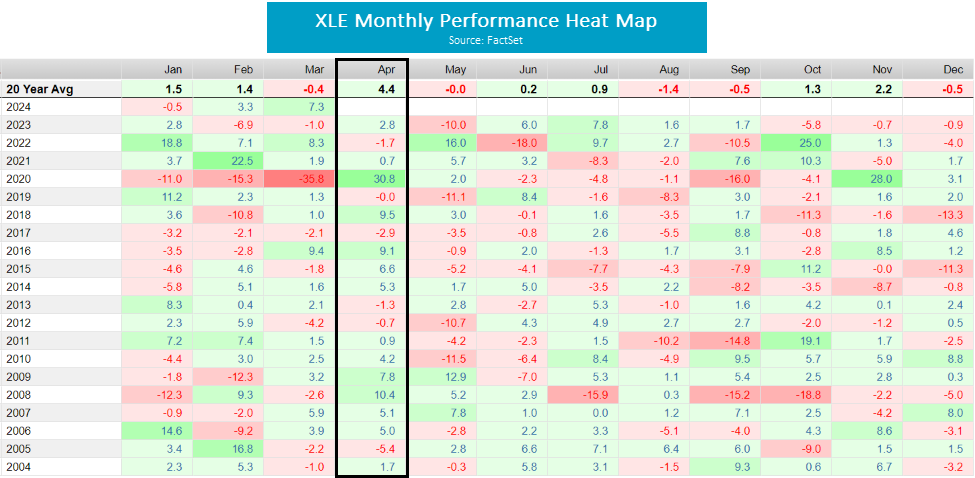

The table below shows the absolute performance of XLE every month for the past two decades. Notice that April has historically been the best month (even without the 30% gain in 2020). Furthermore, not only has April produced the best average return, it also has been positive 60% of the time which is tied with September for the highest hit rate. In the past ten years, XLE has posted a gain 70% of the time.

In addition to the strong magnitude of returns and positive hit rate, XLE has also tended to outperform the S&P 500 (SPY) in April. The table below displays the relative performance of XLE and SPY, so the positive/green numbers mean XLE outperformed SPY for the month while the negative/red numbers mean XLE underperformed SPY for the month. All this said, look out for energy.

Fun Fact: Of the major 11 SPDR sector funds, XLE has been the second-best performing fund in the second quarter (Q2) since 1999.