The S&P 500 just posted its sixth consecutive weekly gain for the first time in over four years; today we review how markets have historically behaved going forward.

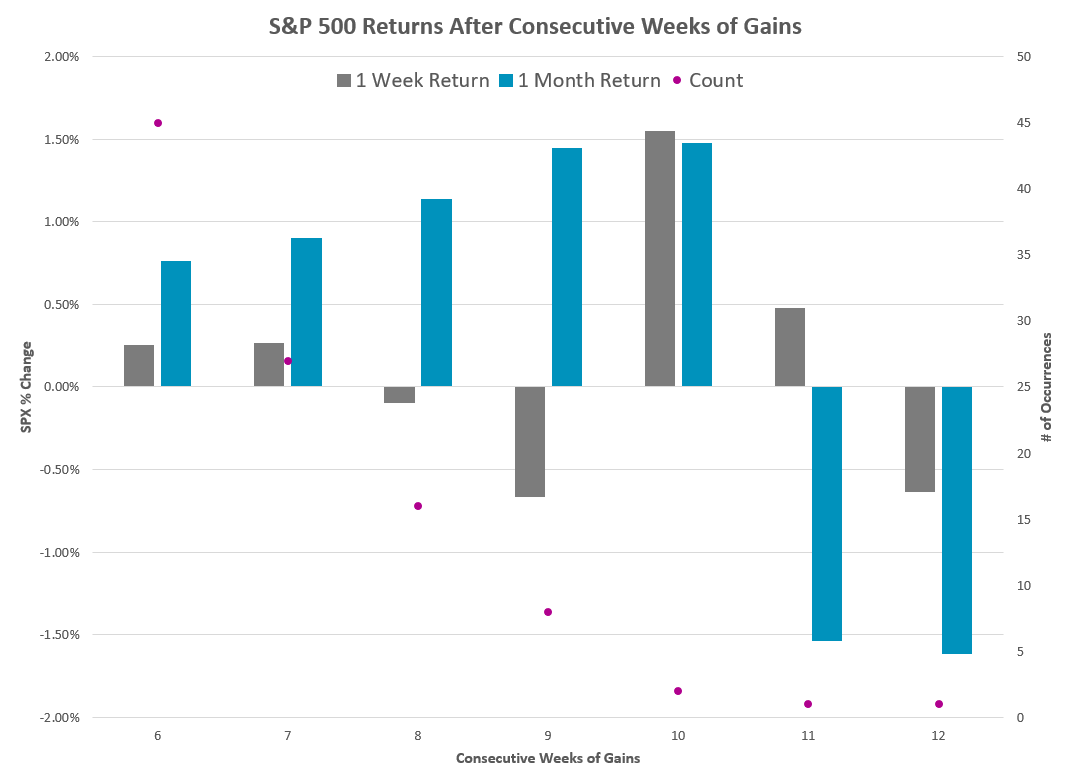

Last Friday (12/8), the S&P 500 (SPX) posted its sixth consecutive weekly gain…which is surprisingly rare. The last time SPX advanced for six straight weeks was at the end of 2019. Since 1958, SPX has gone on a six-week win streak just 44 other times (that’s about a 1.3% hit rate). The longest stretch of consecutive weekly gains ended at 12 in December 1985.

The bar chart below visualizes some of the above statistics.

So, what can we say about the present six-week win streak other than it is rare?

- SPX posted a gain the next week 60% of the time.

- SPX was also positive 60% of the time two-weeks and one-month after.

- If the win streak ended (average if loss), the index declined by about 90bps. Conversely, when the six-week win streak continued, the index gained about 98bps.

- When looking at two-week and one-month returns, the magnitude of positive returns is greater than negative returns. For instance, the one-month average SPX return when positive was 2.1%, but the one-month average SPX return when negative was -1.5%.

- Interestingly, one-month forward returns generally improved with more consecutive weeks of gains.

- This trend dies at 11 and 12 weeks, which was just one occurrence in December 1985.

- Three-months after SPX went on a six-week win streak, the index was up 75% of the time with an average gain of 2.5% (median of 3.3%).

The current win streak comes at an interesting time given the slew of economic data expected this week. November CPI comes out tomorrow (12/12) followed by PPI on Wednesday (12/13); we then get November retail sales numbers on Thursday (12/14). There are also notable earnings releases this week including ORCL today, ADBE on Wednesday, and COST and LEN on Thursday. Although, likely the most important item on the agenda is the Fed meeting which wraps up on Wednesday. The Fed futures market is currently pricing in around a 98% chance of no hike.