We review some of the most popular Fund Score Method (FSM) models following this week's evaluations.

This week saw the latest evaluation of our seasonal Fund Score Method (FSM) models, which were updated based on market data through Thursday, August 3. Any corresponding trades were sent out this morning, on Friday, August 4. As a refresher, the seasonal FSM models are checked four times a year, outside the typical calendar quarters. The system checks each model at the beginning of February, May, August, and November. At each of those points, the models are sorted by the fund scores of the corresponding constituents, with the top-scoring funds in each inventory selected as the model holdings. There are a few variations of the models in terms of differing holding counts, evaluation timeframes, or cash triggers, which are discussed more in-depth in our FSM Overview. Each model has the potential to transition to cash in times of broader market weakness, but those cash triggers remained unchanged in the latest evaluation.

Today, we will highlight some notable changes from a few of the most popular FSM models. These include the CoreSolutions US Core, CoreSolutions All Cap World, T Rowe Price, and American Funds models. Those looking for more information on trades for any of the models can review the updates on our Models page or contact our analyst team. Be sure to set alerts for Models you follow through the Models page to be notified of any future updates.

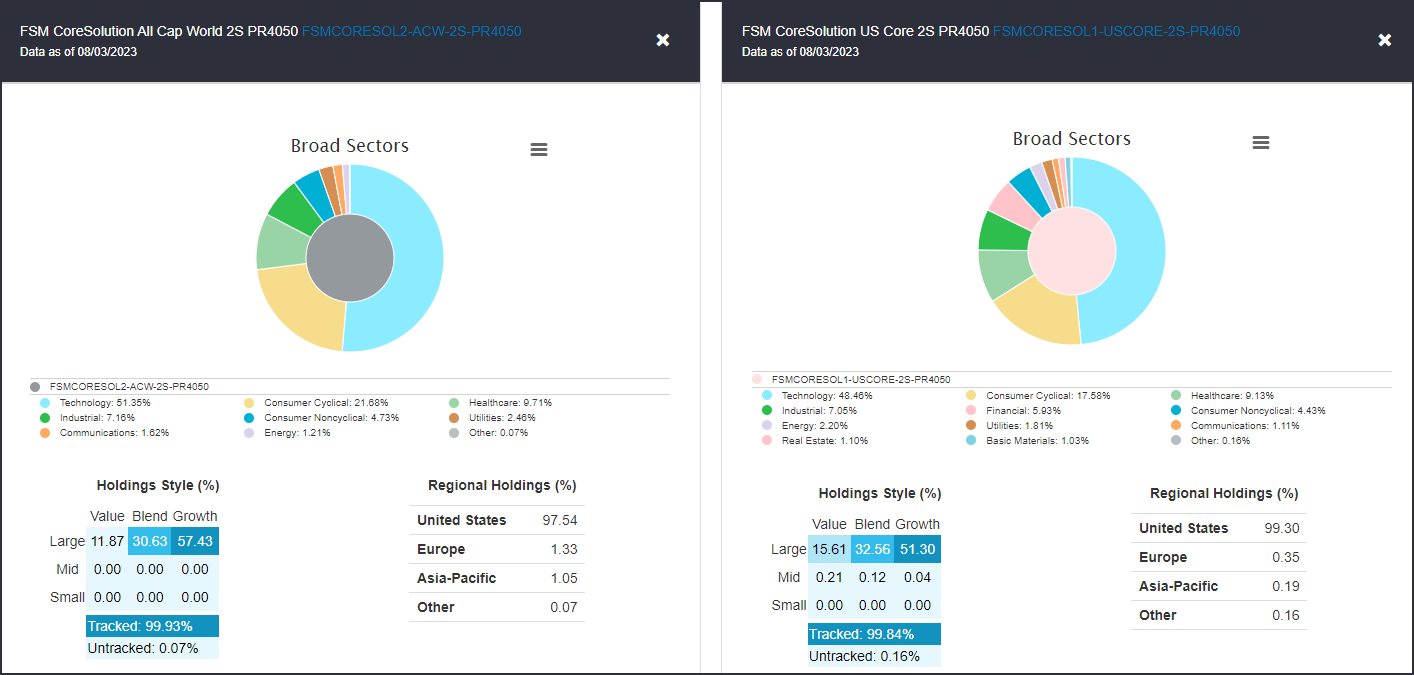

CoreSolutions All Cap World & US Core 2S Models

Each of the CoreSolutions models looks to hold two equity funds at a time, and we saw each model show similar trades at the latest evaluation. The All Cap World Model, which evaluates an inventory of 25 global equity funds, rotated away from international equities by selling the iShares MSCI EAFE ETF EFA this week after it was included as a model holding for the last three months. This was a quicker rotation than many predicted after the broad-developed market fund came into the portfolio in May, but we saw other areas of the marketplace show enough momentum to overtake the space in score. In place of EFA, the Model moved into the Invesco QQQ Trust QQQ, which joins the First Trust Nasdaq-100 Equal Weighted Index Fund QQEW as the two portfolio positions. QQEW came into the Model in May and has gained 12.88% during its time as a model holding (5/4/23 – 8/3/23).

The CoreSolutions US Core 2S Model looks at a more focused inventory of broad US large-cap representatives at each evaluation, in addition to our DWA Money Market Proxy MNYMKT, which is included in each of the FSM model inventories. MNYMKT saw a high enough score at the May evaluation to move into the portfolio at a 50% allocation, which was undone at this week’s evaluation due to weakening from that defensive position. In place of the money market proxy, the Model moved into the SPDR S&P 500 ETF Trust SPY. This fund joins QQQ as an existing holding, speaking to the pervasive nature of strength from large-cap growth across the ETF model lineup.

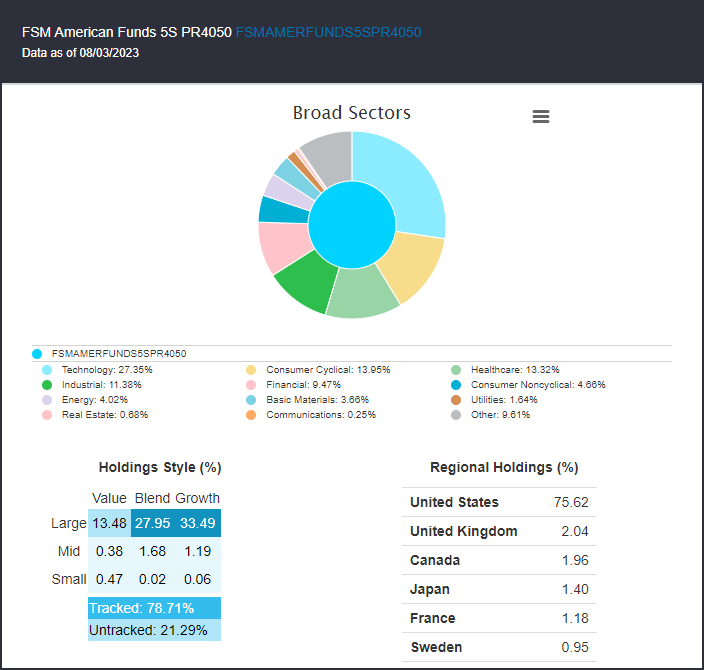

American Funds 5S Model

The American Funds lineup saw some notable changes to their score rankings over the past several weeks. The 5S model sold out of the focused international equity representatives, moving away from Europacific Growth AEPGX, International Growth & Income IGAAX, and New World NEWFX. This follows the broader theme of rotation away from foreign equities that was seen across many of the FSM models in this evaluation. It is worth noting that these funds that were sold did not necessarily show drastic score deterioration, as they each continue to possess fund scores north of the 4.00 threshold. Instead, we simply saw other areas of the equity market show enough score improvement to transition into areas of focus for the next three months. The new holdings included the Growth Fund of America AGTHX, the Investment Company of America IGAAX, and the Capital World Growth & Income CWGIX. This leaves the American Funds model with a diverse holding lineup, overweight growth while seeing some value-like representation, and a small amount of international exposure through the new addition of World Growth & Income.

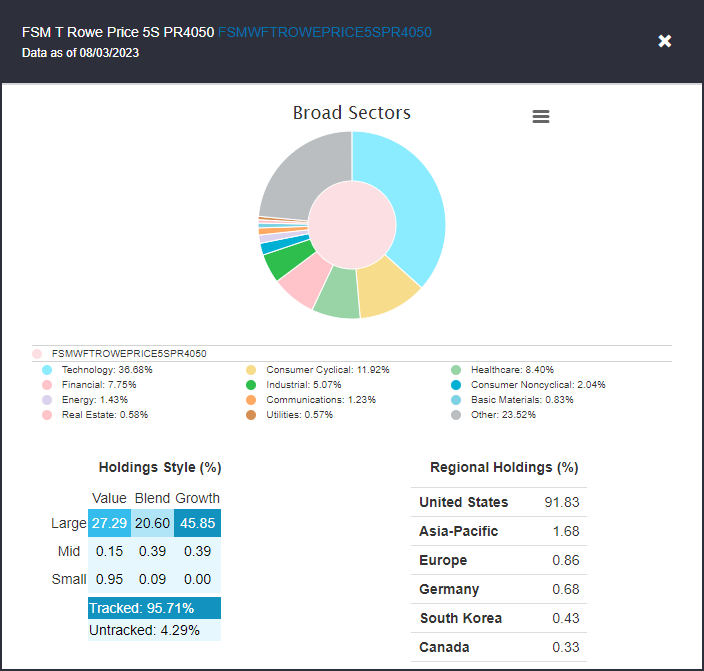

T Rowe Price 5S Model

The final model we will review is the T Rowe Price 5S portfolio, which sold International Equity PIEQX, Dividend Growth PRDGX, and Small Cap Growth PRDSX. In their place, the Model purchased All Cap Opportunities PRWAX, Blue Chip Growth TRBCX, and US Equity Research PRCOX. This leaves the strategy with a significant overweight toward technology at almost 37% of the portfolio, more than three times the exposure of any other sector. We can also see that the portfolio is 45% allocated toward large-cap growth, furthering the themes we saw play out across other portfolios.