In this Macro Update from the Nasdaq Economic Research Team, Chief Economist Phil Mackintosh discusses the US debt downgrade and earnings.

Fitch Downgrades US Debt

The biggest “news” on the economy this week will probably be remembered as the decision by Fitch to downgrade US debt from AAA to AA+. Fitch had three reasons for the downgrade – one related to the fact we only just avoided a default (again) with the persistent debt ceiling debate. They are also concerned about the level of US government deficits (which are now running at over $1tr each year) and the impact of that for future spending and taxation.

We talked about some of this when the debt ceiling debate was happening. The US government debt is already running at close to 100% of GDP, a level only previously seen after the second world war. And remember, S&P already downgraded us (for a similar reason) back in 2011 – and haven’t reversed their decision either. Data shows the US started running deficits consistently starting in the 70’s (see red line below). But it’s also worth highlighting that around that time, the frequency of grey bars (recessions) also dropped. This is a text-book economic result – governments intervene to boost the economy ahead of recessions, and slow the economy as bubbles form – to smooth the economic boom-bust cycles that tend to naturally form. It’s one reason why we are in a rate-hike cycle now.

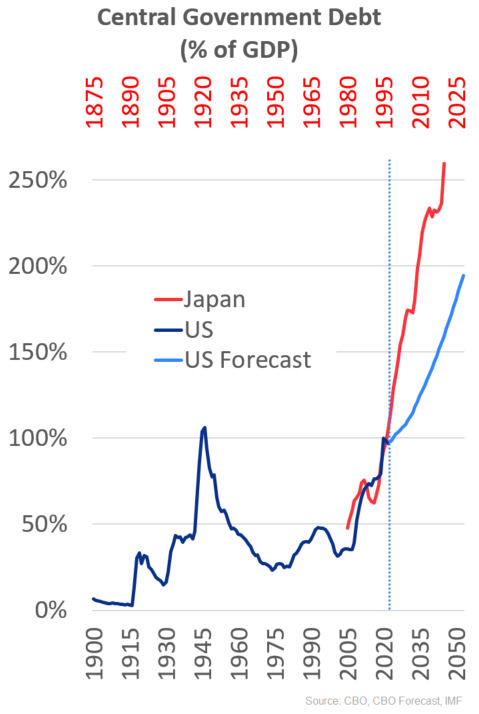

However, these persistent deficits, combined with an aging population which is expected to add to Medicare and social security costs, have some forecasting US debt will increase to 200% by 2050. That’s not unheard of - Japan was in a similar situation back in the 1990’s (red color in chart below), and they now have debt to GDP over 250%.

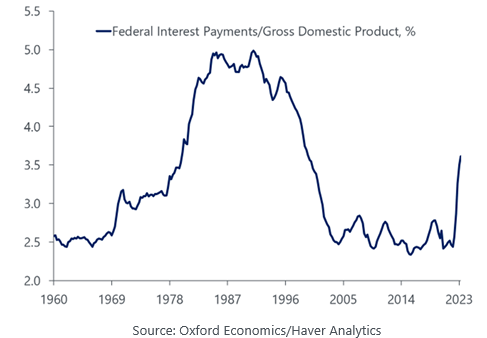

The problem with all that debt is that, just like all of us, the government needs to pay interest to its lenders. Japan has managed to continue deficit spending to support their economy because their interest rates are so low. Luckily, for now, the average interest rate the US government needs to pay on debt is also still pretty low. But, if inflation doesn’t recede, and debt keeps growing, it’s possible net US government interest costs could more than quadruple to 7.2% of GDP by 2052, That would soak up nearly 40% of federal revenues – compared to around 10% today – which would necessitate much higher taxes or much lower government spending. Or both.

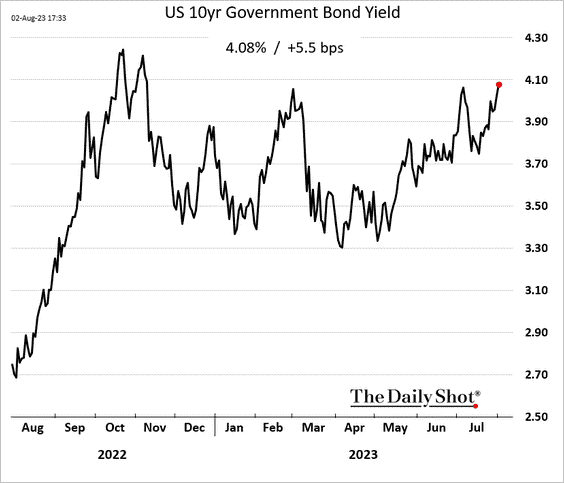

And in theory, if the US debt repayment is less reliable, the interest rate the world charges us to borrow should go up too. We did see US interest rates spike this week. The 10-year Treasury yield increased to the highest level since last November – and well above the 3.5% level it spent a lot of this year at. Today it is almost 4.2%. That could start to create headwinds for stocks again – just like we saw in 2022. And in line with that, stocks have been softer this week, with the Nasdaq falling around 3% so far.

Higher rates could also be due to “good” jobs data

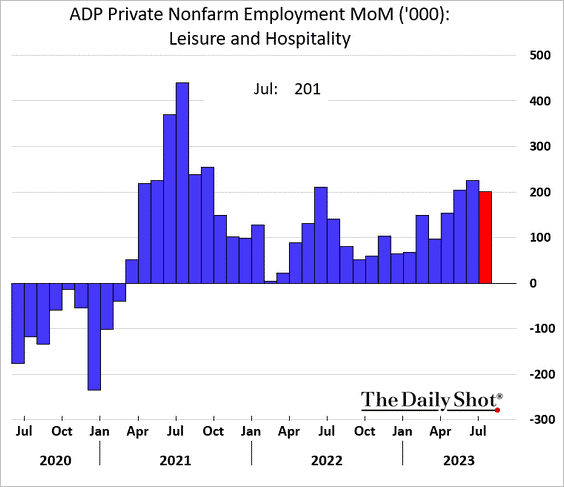

Although the rising US interest rates could also be due to this week’s jobs numbers – which were relatively strong. Layoffs and new jobless claims fell. Although manufacturing sector lost workers, leisure and hospitality hiring continued to grow.

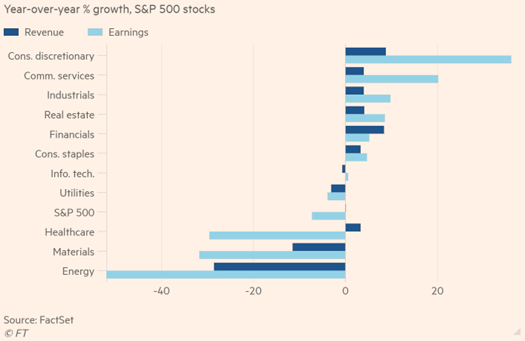

Earnings data shows consumer companies still growing too

We are seeing a similar story from company earnings too. Consumer sectors are still growing revenues and earnings. Leisure and Hospitality (Airlines, hotels, cruise ships) are helping industrials and consumer discretionary results. However, the Manufacturing slowdown is affecting Energy and Materials companies. Thanks to that, and a couple of other sectors, market-wide earnings are still tracking to fall around 7% year over year – the third quarter in a row of contraction. In short, the consumer still seems to be holding the US economy together. But as spending changes, not every company is a winner.