Treasury yields and equities declined following the FOMC's March meeting. US government groups have climbed out of the basement of the ACGS fixed income rankings, while equity-related groups have seen large score declines and now sit at the bottom rankings.

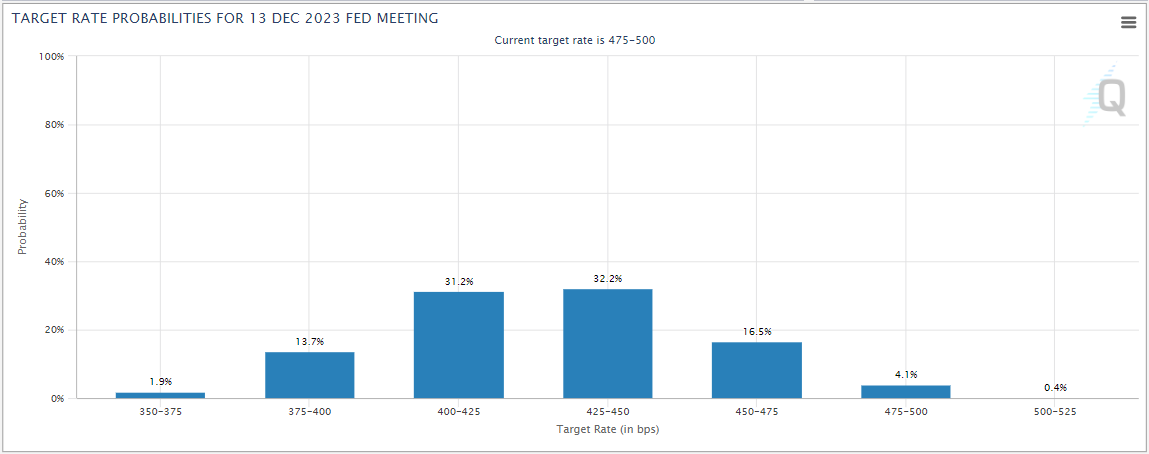

The FOMC wrapped up its March meeting on Wednesday and raised the fed funds target rate by 25 basis points to 475 – 500 bps as had been expected. The FOMC’s summary of economic projections show that members’ median expectation for the fed funds rate in 2023 is 4.3%, up from 4.1% in the December projections. Despite this, and Fed Chair Powell stating that the committee did foresee rate cuts this year, the fed futures market is now pricing in a better than 90% chance of at least one rate cut by the end of the year.

US Treasury yields fell following the meeting with the 10-year US Treasury yield (TNX) closing at 3.5% after trading near 3.65% early in the day. The two-year US Treasury yield closed at around 3.95% after trading above 4.2% earlier in the day. US equities also declined following Powell’s press conference and after Treasury Secretary Yellen told a Senate Panel that officials are not considering expanding FDIC coverage to all deposits. The S&P 500 finished the day down 1.65% after being up in earlier trading.

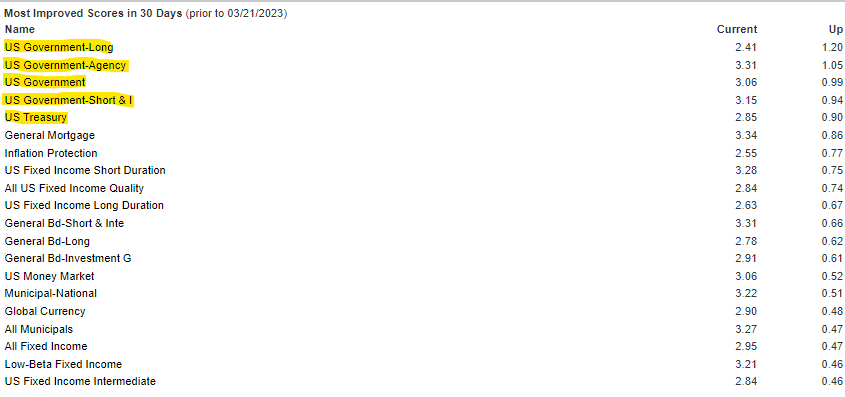

The inverse fixed income group fell in the Asset Class Group Scores (ACGS) rankings since last week, when it ranked second. The average score of the US Government group has improved markedly in recent weeks, going from below 2.0 at the beginning of March to its current reading of 3.06, this is the first time the group has been above the 3.0 score threshold since November 2020. Other rate sensitive groups like US Treasuries, have also climbed out of the red zone as the recent decline in yields has been a tailwind for core bonds. US government groups account for the top five most improved fixed groups over the last month, while equity related groups have seen the largest score declines. Preferreds and convertibles – now sit at the bottom of the rankings, with preferreds now the only fixed income group with an average score below 2.0.