We review the current technical pictures for some of the largest stocks reporting earnings next week.

The S&P 500 Index has continued to climb this week in the midst of earnings season, notching a 2.46% gain to close above the 4070 level for the first time this year. That brings the index to a 6% gain so far this year, leading it to give a fourth consecutive buy signal on its default chart after returning to a positive trend earlier this week. There are 108 names in the S&P 500 Index slated to release earnings next week, including many of the largest names in the cap-weighted market benchmark. Those names combine to make up over 33% of the market capitalization of the index. This is the largest percentage of the total market capitalization to report in a single week during this earnings season, highlight the importance of the next few trading days. Today, we will review the current technical pictures of the largest names set to report over the next five trading days, including Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL), and Exxon Mobil (XOM).

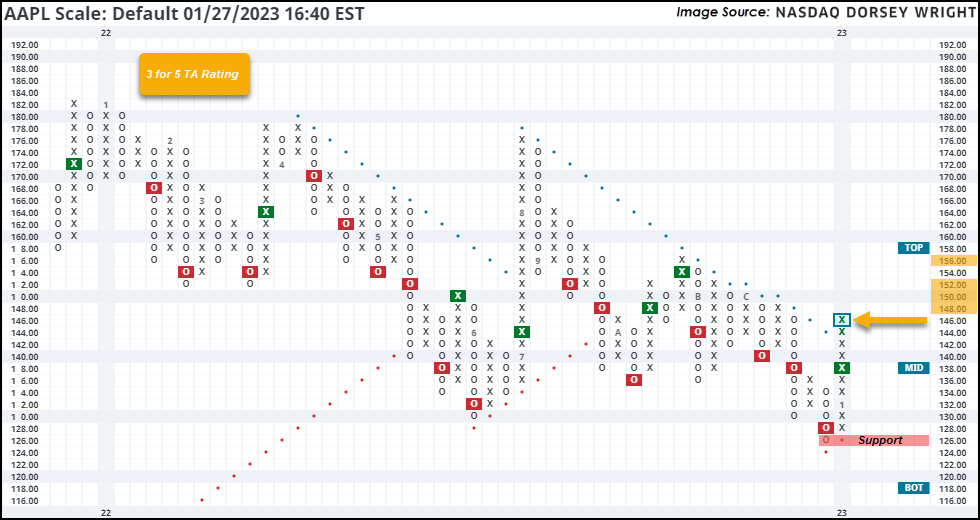

Apple Inc. AAPL – Earnings Expected on Thursday, 2/2/2023

Apple has shown sharp improvement so far this year by reversing up from its 52-week low of $126 to break a double top last week at $138, ending a streak of four consecutive sell signals. This week saw further improvement as the stock pushed through its bearish resistance line to the current chart position of $146. That improves AAPL to a 3 for 5 TA rating, as it has maintained an RS buy signal against the market since 2004 and has been on a buy signal against the DWACOMP group since mid-2017. While the technical picture is still mixed, weekly momentum recently flipped positive, suggesting the potential for further upside from here. Initial support now lies at $126. Overhead resistance may be seen initially at $148 from December, with further resistance seen from $150 - $156.

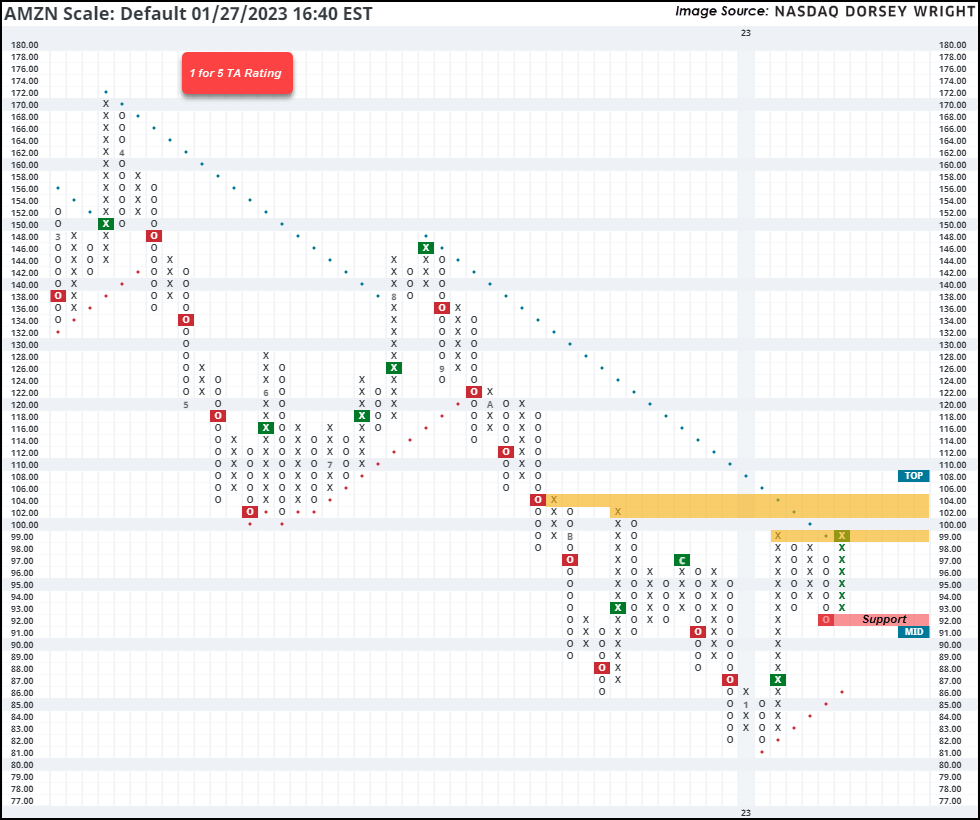

Amazon.com Inc. AMZN – Earnings Expected on Thursday, 2/2/2023

Amazon has shown improvement throughout the first few weeks of the year, notching an 18% gain after the stock moved higher this week to $99. That movement also led the stock to push through the bearish resistance line that had been in place since September, moving it back into a positive trend. However, that is the lone technical attribute that AMZN currently has in its favor, as it continues to sit on an RS sell signal against both the market and the DWAINET group. The weight of the technical evidence is still weak despite the near-term absolute strength. The stock is positioned at resistance from earlier this month, with further resistance seen in the $102-$104 range. Initial support is seen at $92.

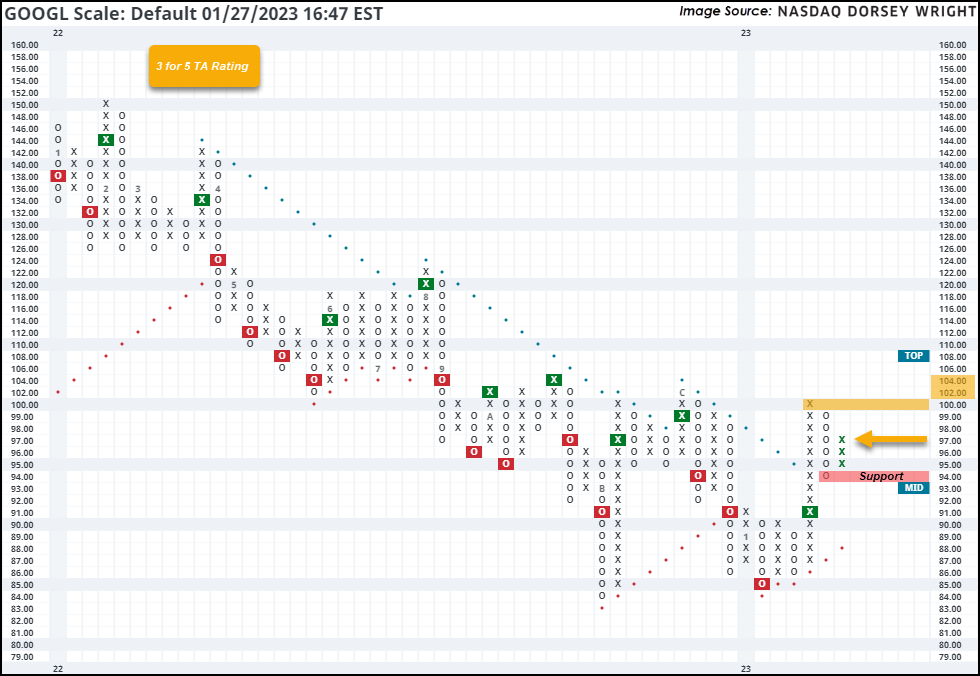

Alphabet Inc. Class A GOOGL – Earnings Expected on Thursday, 2/2/2023

GOOGL has shown improvement alongside other mega-cap names to start off 2023, as the stock moved back to a buy signal earlier this month before continuing to break through the bearish resistance line last week. This promoted GOOGL back to a 3 for 5 TA rating. The stock has maintained an RS buy signal against the market since 2014. The technical picture is mixed here but is showing near-term strength. Movement this week led the stock to reverse back up into a column of Xs to the current chart position at $97, marking a higher low with initial support now seen at $94. Overhead resistance may be found at $100 with further resistance seen in the $102-104 range from last year.

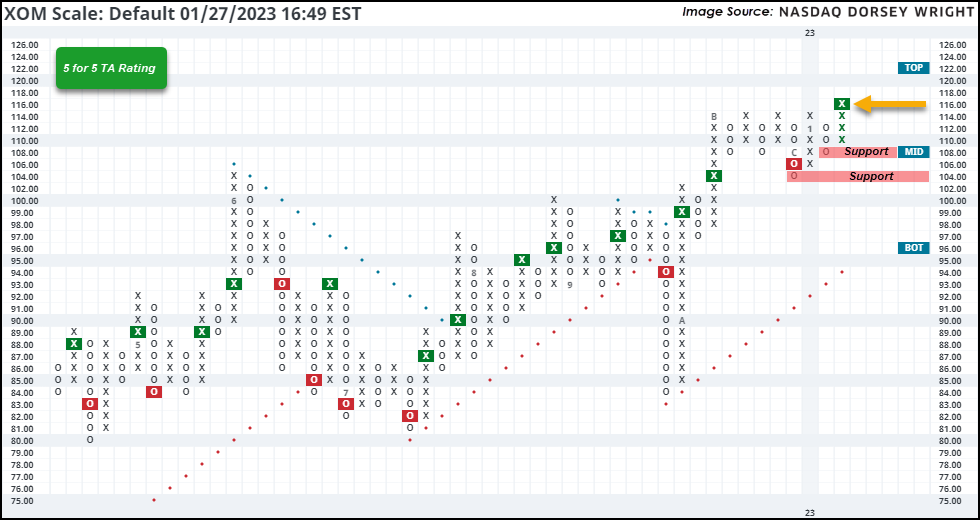

Exxon Mobil Corporation XOM – Earnings Expected on Tuesday, 1/31/2023

XOM moved higher this week to break a quintuple top at $116, marking a new all-time high. This stock is now the eighth largest name in the S&P 500 Index and is the third largest stock that currently possess a 5 for 5 TA rating (behind BRK.B and NVDA). XOM has maintained a positive trend since October and has been on an RS buy signal against the market since January 2022. It also sits in the top quintile of the oil sector RS matrix. Monthly momentum just flipped positive as well, suggesting the potential for further price appreciation. The weight of the technical evidence is favorable and continues to improve. Support is seen initially at $108 and $104, with further support offered at $97.