The S&P 500 Index has seen three separate 10% declines so far this year, which is tied for the most in any year since 1950.

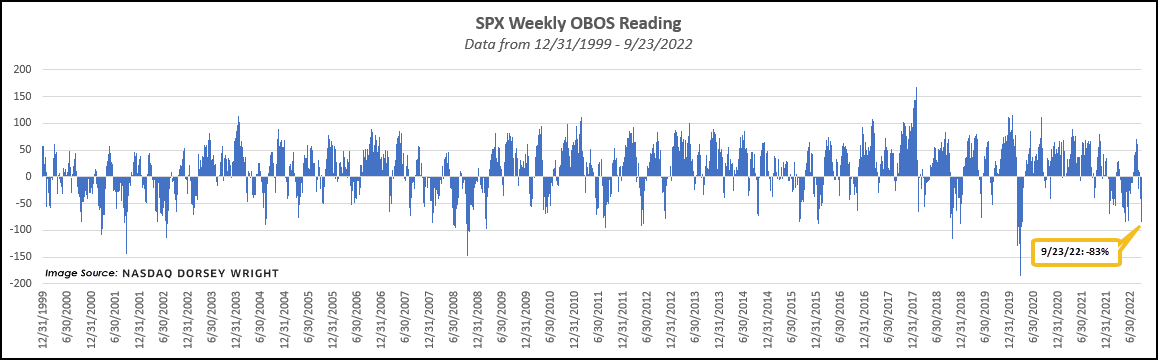

Declines across broad domestic equity indices continued Friday, with the S&P 500 Index SPX posting an intraday loss of -1.72% to bring it to a -4.65% return over the past week. Sharper declines earlier in the day led the 20-point chart of SPX to violate support previously seen at 3740 before falling to 3680 intraday. The chart now sits just a few boxes shy of the 3640 low seen in June and has given two consecutive sell signals over the past week. The sharp decline this week has also led to a weekly OBOS reading of -83% Friday, which marks one of the lowest end-of-week oversold readings for SPX since 2020. SPX has seen a reading of -83% on two prior instances this year, occurring on 5/20 and 6/17. The oversold nature of the index does suggest a heightened potential for a near-term rally, but it will remain to be seen if such a rally can be sustained.

The most recent drop for SPX led to its third 10% correction so far this year, which is tied for the most in any year dating back through 1950. To qualify in this count, the SPX needs to see a 10% decline followed by a 10% rally off that relative bottom. Other years that saw three separate 10% moves include 2008 and 1987. The first such occurrence this year came at the end of February, with that low coming on March 8. The S&P 500 then saw an 11% rally over the next three weeks, before again declining at the beginning of April. That movement saw a 20% drop ending at a bottom of 3666 on June 16, only to have the index turn around and climb 17% by August 16. The index has now seen a decline of about 14% from that date through movement Friday.

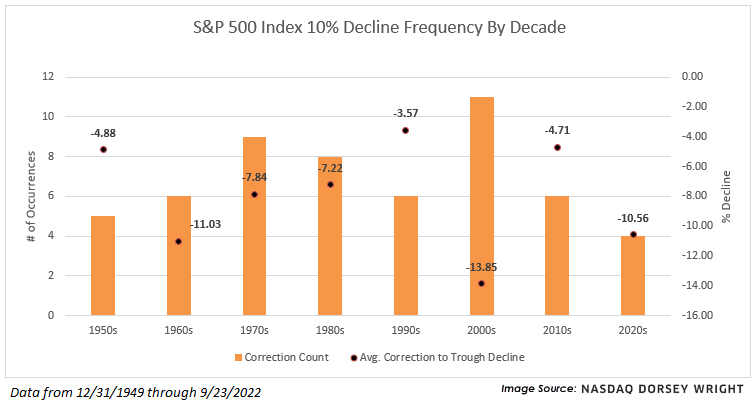

We have now seen four separate 10% corrections in the 2020s including the drop in early 2020. That compares to six such instances throughout all the 2010s. The 2000s saw significantly more corrections, at a count of eleven. Since the beginning of 1950, the S&P 500 has averaged between just under seven corrections in each decade, with those instances seeing an average correction-to-trough decline of -7.96%. Some decades, like the 1960s and 2000s, have seen double-digit correction-to-trough averages.

On the other hand, the 1990s and 2010s saw average further declines of -3.57% and -4.71%, respectively. We are currently at a 4.65% move lower from the 10% drop seen on 9/16. If we were to see a decline in line with the -7.96% average further decline since 1950 would place the index near 3580, or just beneath the bottom of the current trading band.