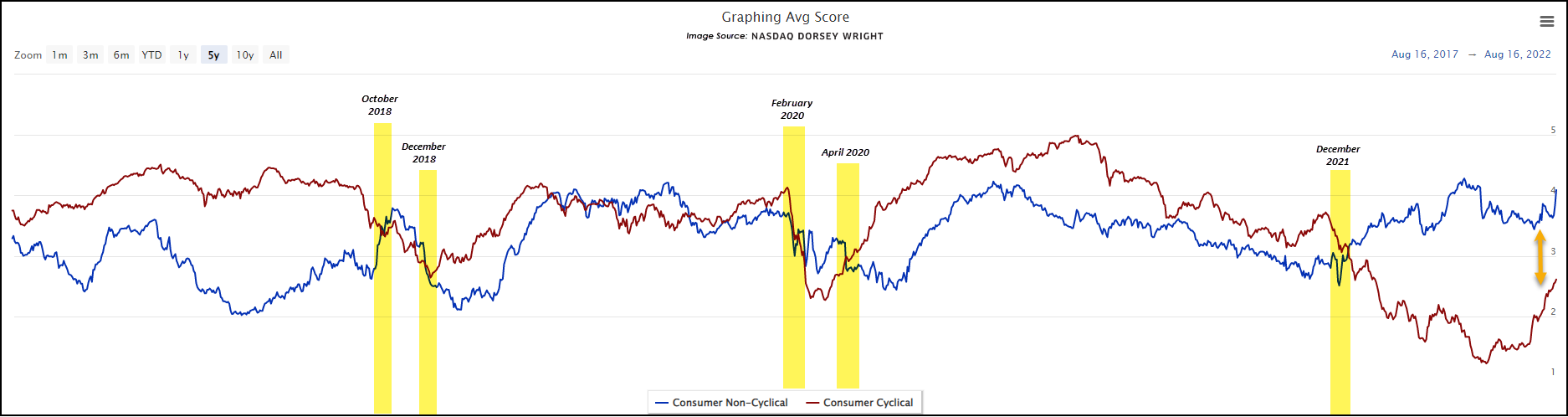

Crosses between traditionally defensive and offensive sectors typically occur around key market inflection points. That said, the consumer discretionary average fund score has not overtaken consumer staples; in fact, the divergence between the two recently widened.

Upcoming RS Institute - Dallas, TX

Register to join us in person for a 3-hour educational symposium on relative strength investing. This event is for financial advisors and will offer 3 hours of CFP/CIMA credit.

- When: September 08, 2022, 10 am – 1 pm CT

- Where: 5000 Riverside Dr., Irving, TX 75039

- Who: Speakers include…

- John Lewis, CMT, Senior Portfolio Manager

- Andy Hyer, CFP, CIMA, CMT, Client Portfolio Manager

- Ian Saunders, Senior Analyst

- Cost: Free!

Lunch will also be provided. Registration is limited to the first 75 advisors, so be sure to act fast!

Content Delivery Update: Over the past few months, the team here at Nasdaq Dorsey Wright has focused on improving our content delivery experience. As a result, we have expanded our reach to include timely updates on YouTube, Twitter, and Apple Podcasts. Be sure to subscribe or follow us on all channels for exclusive content regarding all things NDW!

-

Subscribe to our YouTube channel

-

Follow us on Twitter

-

Listen on Apple Podcasts

Beginners Series Webinar: Join us on Friday, August 19th, at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is Navigating the Models Page. Register Here

2022 has proved to be an interesting market environment, and the recent two-month rally has been no different. As discussed in previous features, strength from small-cap equities and growth stocks is to be expected from bona fide movements off lows. While this evidence is still present, broadly speaking, it should be noted that this market rally has seen continued leadership from more traditionally defensive sectors, namely utilities and consumer staples. Both sectors fought their way into overweight positions over the last two months in the DALI rankings, and currently are the only two broad-based sectors to sit above a 4.0 average score rank on our Asset Class Group Score (ACGS) page. Both sectors have an above-average score direction, suggesting continued strength in comparison to the broader market.

As seen from the chart below, crosses between defensive sectors (non-discretionary in this case) and the more “risk-on” consumer discretionary sector typically occur around key market inflection points. When consumer discretionary is in favor versus consumer staples, market conditions (usually) favor risk allocation over more stable/defensive assets. That said, the consumer discretionary average fund score has not overtaken consumer staples; in fact, the divergence between the two recently widened. Some speculation on why this is happening - dominance from "quasi staple" stocks like Costco (COST) and Estee Lauder (EL) in comparison to more traditional, “old-school” defensive equities. Also, the possibility of lingering inflationary/macro fears could push investors back to the safety of these sectors along with persistently high commodity prices (especially in the case of utilities). Whatever the fundamental case may be, the spread between consumer discretionary and the two defensive sectors is one to watch as we head into the historically weak month of September.