Just a few months ago, fixed income as an asset class was slowly creeping up the rankings on the Asset Class Group Scores page as equities struggled.

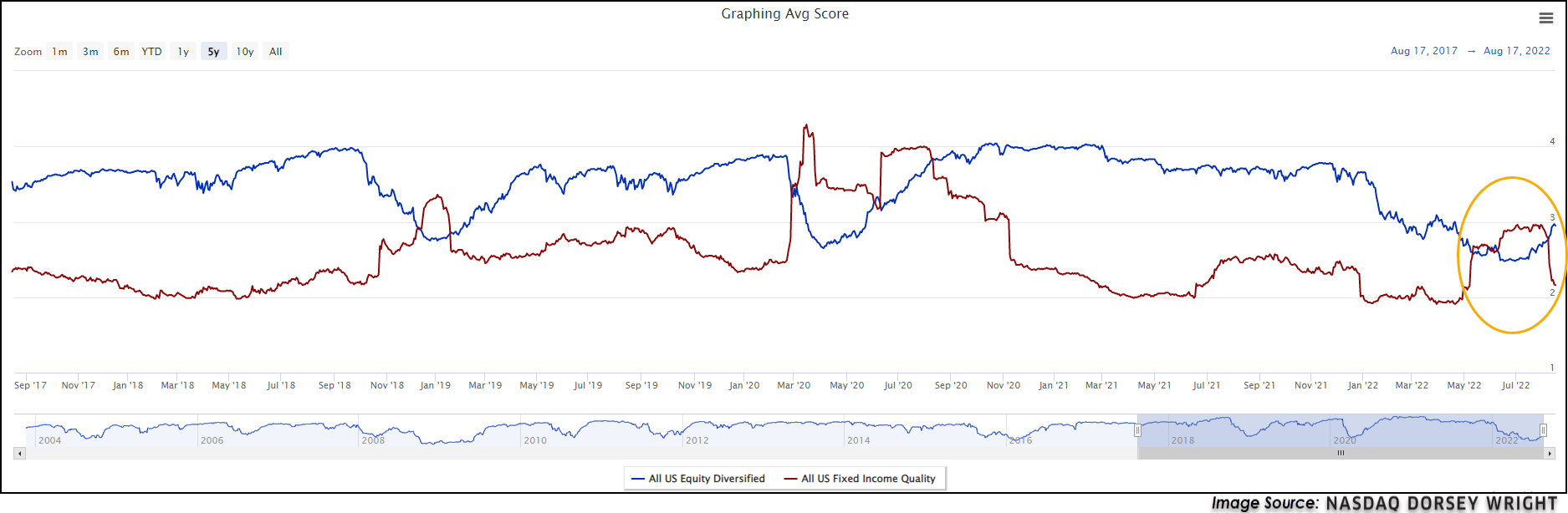

Just a few months ago, fixed income as an asset class was slowly creeping up the rankings on the Asset Class Group Scores page as equities struggled. Despite rising interest rates, fixed income securities weathered the downside seen in the equity market in a much better fashion which led to an increase in relative strength. Fast forwarding to today, domestic equities have rallied strongly over the past two months and while interest rates further out on the yield curve have fallen, they have not fallen enough for most fixed income groups to compete with equities. The fall in relative strength seen in fixed income has led to an abrupt shift in the Asset Class Group Scores rankings. As it currently stands, there are no fixed income groups with an average score above 3.0 and the Inverse-Fixed Income group is one-hundredth of a point away from being the top-ranked fixed income group. When looking at a comparison between the All US Equity Diversified and All US Fixed Income Quality groups, the sharp decline in scores becomes evident with almost all the decline in the All US Fixed Income Quality group coming after the start of August.

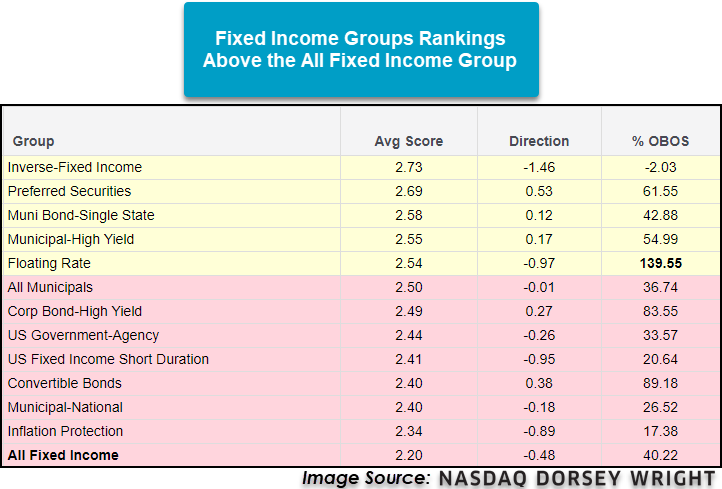

Shifting to just the fixed income landscape, it’s not surprising to see the top two groups with the highest score directions are Preferred Securities and Convertible Bonds, both of which have heavy ties to equity movements. One of the prior leaders of the fixed income space, US Fixed Income Short Duration, fell below the 2.5 score threshold this week but is still one of the best scoring fixed income groups on the system. Despite the recent weakness, in a market environment where the trend for long-duration interest rates is still higher, short duration is still likely to be one of the safer fixed income groups. A higher scoring group in the fixed income space that can lower the risk from rising interest rates is the Floating Rate. The Floating Rate group is one of six fixed income groups with an average score above 2.50 and benefits from rising interest rates. As most clients need fixed income exposure for a variety of reasons, it may not be plausible to completely rotate out of the space, and using a floating rate bond fund can help stabilize fixed income exposure as interest rates rise. Overall, the fixed income market remains weak as interest rates have sustained their intermediate-term trend higher. Low duration or other less interest rate sensitive groups are still preferred for the time being as strength has held up much better in these areas compared to others. As a general rule of thumb, groups that are scoring above their broad representative, in this case, All Fixed Income, are areas to target for exposure within an asset class. Even though fixed income is weak compared to other asset classes, it’s still necessary for many clients’ portfolios.