With earnings announcements happening daily in the coming weeks, investors may wish to consider buying some temporary insurance in the form of protective puts.

As we wrap up the third week of January, we are entering the "heart" of the Q4 2021 earnings season, one of four such seasons we encounter on an annual basis. We typically find that earnings season produces some added volatility and potholes for investors to avoid. With earnings announcements happening almost daily in the coming weeks, many investors may wonder: "Am I going to hear any bad news from the companies that I own? And if the news is not good, how will my positions hold up?" Fortunately, if you'd rather not just sit aside and hope you are lucky enough to avoid any earnings disasters, you have the option to buy some temporary insurance in the form of protective puts. First, we'll review a few basics on puts, and then we will go over an example that typifies the successful use of the protective put strategy. Many investors have difficulty understanding puts when they are pretty simple. If you own a car, you likely own a put on it, provided you carry collision insurance. A put is simply a contract giving the buyer the right, but not the obligation to sell stock at a specific price (the strike price) during a specified period. The underlying stock can be "put," i.e., sold to the writer of the put for the strike price, anytime between the time the option is purchased and the time it expires. Similarly, if you have an accident in your car, you have an insurance policy that states that the underwriter will pay you the cost of the damage. Conceptually, a put is the same thing -- you pay a premium to protect your stock; the only difference is that you are insuring against damage to the value of your stock rather than to your car. In either case, if an accident occurs, your losses are mitigated by the insurance you purchased.

Example of Using Protective Puts:

Now that we've discussed the basics of how puts work let's look at an example of using protective puts to protect your portfolio during earnings season.

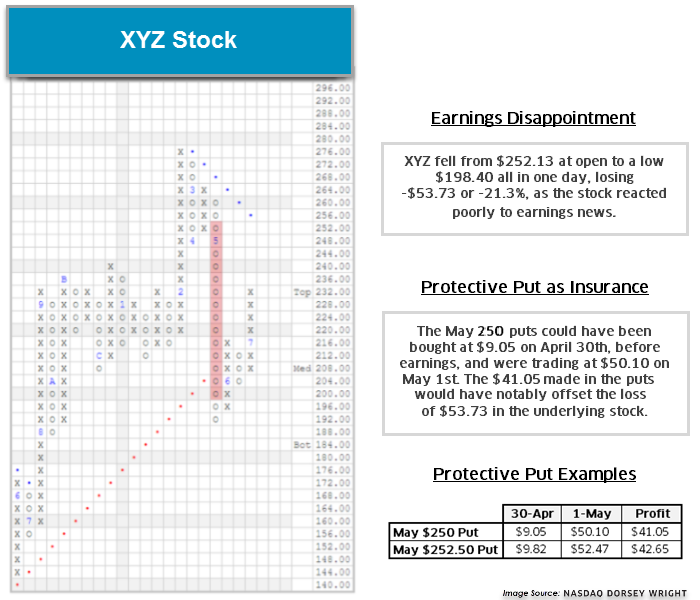

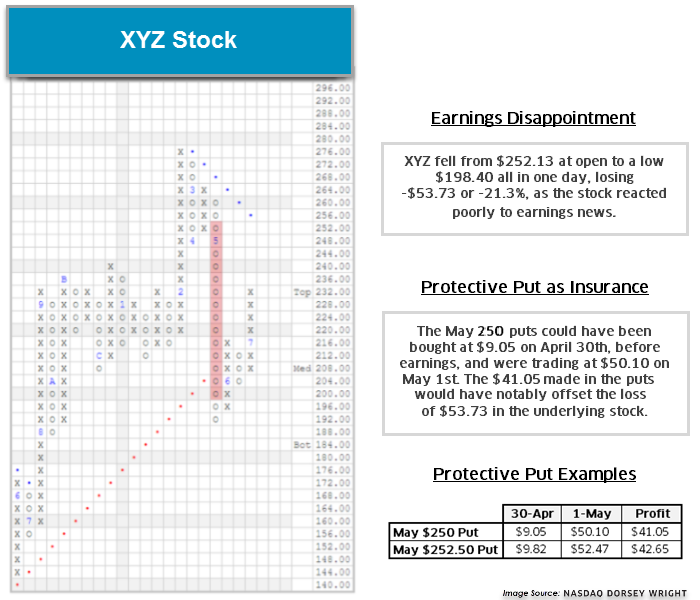

In the chart below, you can see that XYZ Stock broke out of a base at $244 before notching a new high of $276 by the end of February. At that time, XYZ was moderately overbought at around 51% and was in a solid technical uptrend. By the time XYZ had reached its peak, the stock had a technical attribute rating of 3 and gained relative strength versus the market and its peers over the short term.

In March and the first part of April, XYZ had a relatively significant pullback to $248. In April, the stock reversed back up into a column of X's just ahead of earnings season. By then, XYZ was a prime candidate for a protective put, as the stock was just below February highs, and there was no material support on the default chart until just above the bullish support line. On April 30, the day of Q1 earnings, XYZ May $250 puts could be purchased for $9.05. By doing this, you would have hedged against a possible bad earnings call and provided yourself with some peace of mind.

XYZ's Q1 earnings call took place after the market close on April 30. XYZ's stock opened at $252.13 the following morning; however, by the end of trading, the stock had declined by $53.73 (more than 21%) to close at $198.40. In just one day, XYZ's overall technical picture went from promising to an overall negative trend as it lost all three of its positive technical attributes. By the end of the day, the May $250 put was trading at $50.10, a gain of just over $41 compared to the previous day's price. The $41 gained by the put would have notably mitigated the 21% drop in the stock's price. Ultimately, while most XYZ shareholders experienced significant losses, those who purchased the $250 protective put would have suffered a net loss of only $12 per share than the over $50 per share loss for those who had no insurance. While this example may not be typical, it is not unique either; there is often significant and unpredictable volatility following earnings announcements.

An essential characteristic of protective puts is that they do not cap your upside potential (as does selling calls against a position, for instance). Instead, if the stock you have hedged with puts continues to move higher going forward, you participate in the upside at all points, and your returns are only diminished by the premium paid for the put.

Our example illustrates how protective puts can work to your benefit. But remember, protective puts are just like car insurance – no one appreciates having it until they need it. Just as you don't relish paying for car insurance, no one is excited about paying the premium for a protective put. But, just as with any other insurance, you pay a put premium not because you expect to have an accident, but because you know you'll be protected if you do. You have to ask yourself whether it is worth laying out the premium to have this insurance in place. If the answer is yes, then consider buying protective puts on stocks you may own. In the example above, we presented this strategy to hedge against a negative earnings result in the short term. Of course, you can also buy longer-dated puts if you're seeking protection for a more extended period.

Note: The example above is not fictional. This was the actual experience of LinkedIn shareholders following the company's Q1 2015 earnings release. LinkedIn was acquired by Microsoft in June 2016.

Consider Using Protective Puts as Insurance:

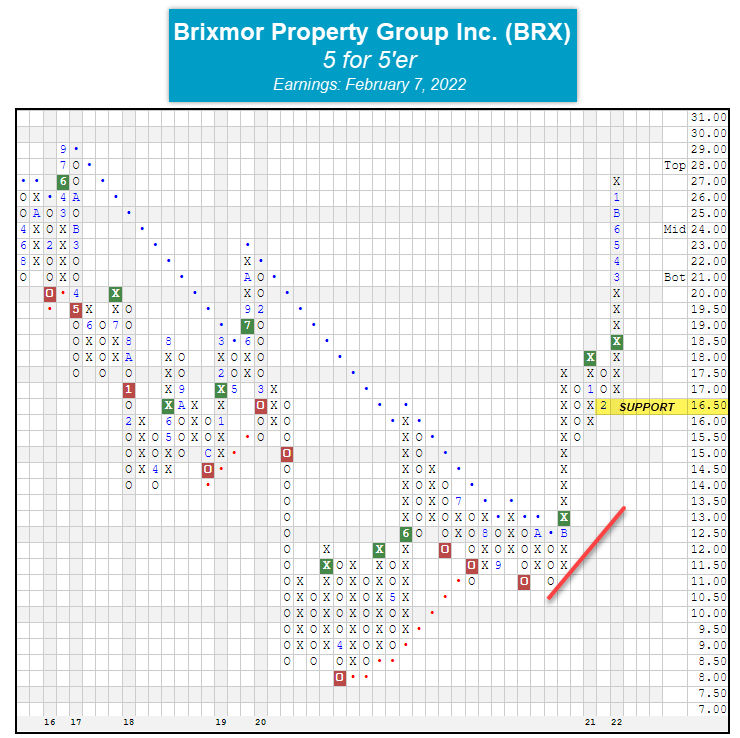

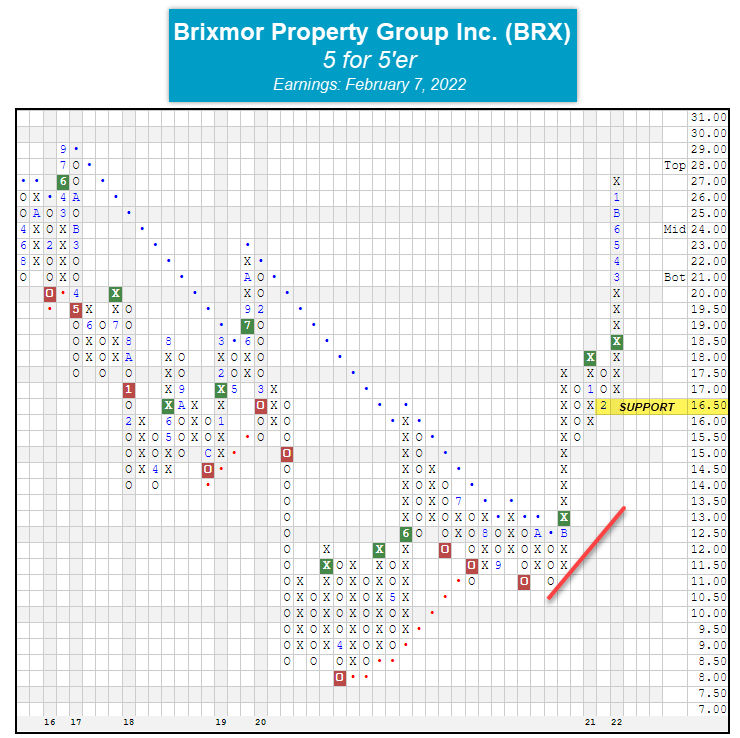

We often find that a hedged approach makes sense in several situations you are likely to encounter during earnings season. One situation when we find the use of protective puts to be especially appropriate is in the case of overbought stocks with upcoming earnings and no meaningful nearby support. A prime example is Brixmor Property Group Inc. , which printed a new multi-year high at $27 with action on Thursday, January 13 and is scheduled to report third-quarter earnings on Monday, February 7. BRX is a perfect 5 for 5’er that ranks in the top quartile of the real estate sector stock matrix, confirming its strength versus its peers. BRX trades on three Point & Figure buy signals and sits well above the bullish support line. Since giving the last buy signal at $18.50 in March of 2021, BRX has pushed significantly higher to $27 where it is trading on a significant stem. When we use Thursday’s closing price of $24.52, we can see that BRX is currently trading about 32% from initial support on the default chart that sits at the $16.50 level. Using BRX’s support level as a stop loss when trading at multi-year highs may not be a palatable option for those with significant capital gains in the position, especially since the stock is up 40.68% over the last year (1/20/2021 – 1/20/2022), significantly outperforming the S&P 500's return of 16.38% over the same period. Given all the aforementioned information, BRX is an ideal candidate for using protective puts to protect against a potential post-earnings decline. Because we are specifically concerned with protecting against earnings-related decline and earnings are expected on February 7, holders of BRX may wish to consider the February 18 $25 puts, which are currently trading around $0.95. We have no way of knowing how the market will react to BRX’s earnings release scheduled in the next few weeks, but we do know that uncertainty around earnings releases increases the potential for price volatility, and therefore, implementing such a strategy ensures that we are protected no matter what happens to the stock.

Because our focus is to hedge against unexpected volatility during earnings season and due to the fact that option prices increase as the time to expiration increases, we want to pay for as little time as possible. That said, we will want to focus on February 18 puts. We tend to recommend at-the-money (or slightly in-the-money) puts so that you have sufficient delta going for you (delta is the change in the option's price due to a change in the price of the underlying). Following an earnings announcement, you can reevaluate any put positions you've purchased, depending on how the given chart looks, how the stock has reacted to the earnings announcement, and perhaps how many of its peers may also be reporting soon. Ultimately, you want the reason that you bought the stock (or put) to be the primary determinant for maintaining or closing out a position.

A Few Points to Remember When Considering Protective Puts:

- Only buy 1 put for every 100 shares you own (or want to hedge). Don't over-leverage by buying more options than you need to protect your position.

- Today, the CBOE SPX Volatility Index sits at 26.79 on its Point & Figure trend chart, which is above its long-term average of 19.64.

- The protective put gives you insurance against a significant pullback but doesn't cap your upside potential.

- Lastly, you may own stocks that are still technically sound overall: trading in an overall uptrend and at least a 3 for 5'er (or higher). But they may be extended, and a considerable distance above notable support, similar to BRX in our example above. A protective put strategy is a good way to protect profits you may have built up in these positions in your portfolio.

For those interested, you can go to any number of sources to get a list of stocks due to report earnings in the coming weeks, or you can check our website (check out the "Activity" report in the Portfolio tool or click here to see the "Stocks with Upcoming Earnings Releases" report, which can be found in the Security Screener -> Database Reports -> Stocks with Upcoming Earnings Releases). With earnings season in full swing, there are many stocks that will be announcing earnings soon and are viable candidates for protective puts. With that said, below is a list of S&P 500 Index stocks that are due to report over the next two weeks. (Source: FactSet) *All price and technical attribute data below are through 1/20/2022. All expected earnings dates are as of 1/20/2022 and are subject to change.

Monday, January 24, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Halliburton Company |

28.14 |

5 |

Oil Service |

|

|

International Business Machines Corp. |

130.82 |

0 |

Computers |

|

|

Zions Bancorporation |

64.23 |

5 |

Banks |

|

Tuesday, January 25, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Archer-Daniels-Midland Company |

68.89 |

4 |

Food Beverages/Soap |

|

|

American Express Company |

160.92 |

1 |

Finance |

|

|

Brown & Brown, Inc. |

64.24 |

5 |

Insurance |

|

|

Capital One Financial Corporation |

150.27 |

4 |

Finance |

|

|

F5 Inc. |

226.79 |

4 |

Internet |

|

|

General Electric Company |

98.25 |

2 |

Electronics |

|

|

Invesco PLC |

22.64 |

1 |

Wall Street |

|

|

Johnson & Johnson |

165.25 |

3 |

Drugs |

|

|

Lockheed Martin Corporation |

375.13 |

2 |

Aerospace Airline |

|

|

3M Company |

173.57 |

0 |

Chemicals |

|

|

Microsoft Corporation |

301.60 |

5 |

Software |

|

|

NextEra Energy, Inc. |

83.51 |

4 |

Utilities/Electricity |

|

|

PACCAR Inc. |

92.30 |

1 |

Autos and Parts |

|

|

Raytheon Technologies Corp. |

88.36 |

3 |

Aerospace Airline |

|

|

Texas Instruments Incorporated |

173.45 |

1 |

Semiconductors |

|

|

Verizon Communications Inc. |

53.40 |

0 |

Telephone |

|

Wednesday, January 26, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Abbott Laboratories |

124.71 |

5 |

Drugs |

|

|

Automatic Data Processing, Inc. |

220.31 |

4 |

Business Products |

|

|

Anthem Inc. |

452.72 |

3 |

Healthcare |

|

|

Amphenol Corporation |

77.91 |

5 |

Electronics |

|

|

The Boeing Company |

214.19 |

1 |

Aerospace Airline |

|

|

Boston Properties |

116.63 |

2 |

Real Estate |

|

|

Citrix Systems, Inc. |

102.42 |

2 |

Software |

|

|

Edwards Lifesciences Corporation |

115.56 |

5 |

Healthcare |

|

|

Freeport-McMoRan Inc. |

43.19 |

3 |

Metals Non Ferrous |

|

|

General Dynamics Corporation |

208.98 |

3 |

Aerospace Airline |

|

|

Corning Incorporated |

35.13 |

1 |

Telephone |

|

|

Hess Corporation |

88.97 |

4 |

Oil |

|

|

Intel Corporation |

52.04 |

0 |

Semiconductors |

|

|

Kimberly-Clark Corporation |

141.57 |

2 |

Household Goods |

|

|

Lam Research Corporation |

619.67 |

4 |

Semiconductors |

|

|

Las Vegas Sands Corp. |

43.61 |

2 |

Gaming |

|

|

MarketAxess Holdings Inc. |

369.29 |

0 |

Wall Street |

|

|

The Nasdaq Inc. |

179.97 |

5 |

Wall Street |

|

|

Servicenow Inc |

515.00 |

2 |

Software |

|

|

Norfolk Southern Corporation |

279.21 |

2 |

Transports/Non Air |

|

|

PTC Inc |

115.77 |

2 |

Software |

|

|

Rollins, Inc. |

31.65 |

1 |

Business Products |

|

|

Seagate Technology |

100.43 |

5 |

Computers |

|

|

AT&T Inc. |

27.02 |

1 |

Telephone |

|

|

TE Connectivity Limited |

154.00 |

4 |

Electronics |

|

|

Tesla Inc. |

996.27 |

5 |

Autos and Parts |

|

|

Vertex Pharmaceuticals Incorporated |

228.61 |

4 |

Biomedics/Genetics |

|

|

Xilinx, Inc. |

185.61 |

2 |

Semiconductors |

|

Thursday, January 27, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Apple Inc. |

164.51 |

5 |

Computers |

|

|

Arthur J. Gallagher & Co. |

155.67 |

5 |

Insurance |

|

|

Alaska Air Group Inc |

53.81 |

1 |

Aerospace Airline |

|

|

Ameriprise Financial |

309.40 |

5 |

Finance |

|

|

A.O. Smith Corporation |

78.21 |

3 |

Building |

|

|

Ball Corporation |

90.54 |

1 |

Business Products |

|

|

Crown Castle International Corp. |

181.65 |

2 |

Real Estate |

|

|

Comcast Corporation |

50.22 |

2 |

Media |

|

|

Danaher Corporation |

282.96 |

5 |

Healthcare |

|

|

Dover Corporation |

174.68 |

5 |

Machinery and Tools |

|

|

Dow, Inc. |

57.81 |

1 |

Chemicals |

|

|

Duke Realty Corporation |

57.79 |

5 |

Real Estate |

|

|

HCA Healthcare Inc. |

240.76 |

5 |

Healthcare |

|

|

International Paper Company |

48.17 |

0 |

Forest Prods/Paper |

|

|

Juniper Networks, Inc. |

33.31 |

3 |

Computers |

|

|

KLA Corp |

383.28 |

5 |

Semiconductors |

|

|

Southwest Airlines Co. |

44.34 |

0 |

Aerospace Airline |

|

|

Mastercard Incorporated Class A |

364.00 |

3 |

Finance |

|

|

McDonald's Corporation |

253.13 |

3 |

Restaurants |

|

|

Mondelez International Inc. |

67.76 |

2 |

Food Beverages/Soap |

|

|

McCormick & Company, Incorporated |

95.34 |

1 |

Food Beverages/Soap |

|

|

Marsh & McLennan Companies, Inc. |

158.19 |

5 |

Insurance |

|

|

Altria Group Inc. |

50.33 |

1 |

Food Beverages/Soap |

|

|

MSCI Inc. |

515.85 |

2 |

Finance |

|

|

Northrop Grumman Systems Corporation |

397.41 |

2 |

Aerospace Airline |

|

|

Nucor Corporation |

100.34 |

3 |

Steel/Iron |

|

|

NVR, Inc. |

5187.72 |

2 |

Building |

|

|

Packaging Corp of America |

135.22 |

0 |

Forest Prods/Paper |

|

|

Robert Half International Inc. |

108.88 |

4 |

Business Products |

|

|

Raymond James Financial Inc |

101.65 |

4 |

Wall Street |

|

|

ResMed Inc |

237.96 |

2 |

Healthcare |

|

|

Rockwell Automation, Inc. |

313.75 |

4 |

Electronics |

|

|

The Sherwin-Williams Company |

297.66 |

5 |

Building |

|

|

Stryker Corporation |

257.02 |

3 |

Healthcare |

|

|

Teledyne Technologies Incorporated |

417.97 |

4 |

Aerospace Airline |

|

|

Teradyne, Inc. |

145.48 |

5 |

Semiconductors |

|

|

T. Rowe Price Group, Inc. |

164.79 |

1 |

Wall Street |

|

|

Tractor Supply Company |

209.89 |

4 |

Retailing |

|

|

Textron Inc. |

73.24 |

4 |

Aerospace Airline |

|

|

United Rentals, Inc. |

307.11 |

3 |

Machinery and Tools |

|

|

Visa Inc. |

214.35 |

3 |

Finance |

|

|

Valero Energy Corp |

81.41 |

2 |

Oil |

|

|

Western Digital Corporation |

59.92 |

4 |

Computers |

|

|

Whirlpool Corporation |

201.40 |

4 |

Household Goods |

|

|

W. R. Berkley Corporation |

83.30 |

3 |

Insurance |

|

|

Xcel Energy, Inc. |

68.18 |

2 |

Utilities/Electricity |

|

Friday, January 28, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Caterpillar, Inc. |

216.63 |

3 |

Machinery and Tools |

|

|

Celanese Corporation |

164.99 |

3 |

Chemicals |

|

|

Church & Dwight Company |

101.98 |

2 |

Household Goods |

|

|

Charter Communications, Inc. |

572.16 |

2 |

Media |

|

|

Colgate-Palmolive Company |

83.29 |

1 |

Food Beverages/Soap |

|

|

Chevron Corporation |

128.45 |

3 |

Oil |

|

|

Eastman Chemical Company |

122.17 |

1 |

Chemicals |

|

|

LyondellBasell Industries NV |

96.27 |

1 |

Chemicals |

|

|

Phillips 66 |

85.50 |

2 |

Oil |

|

|

Synchrony Financial |

45.16 |

4 |

Finance |

|

|

V.F. Corporation |

66.63 |

0 |

Textiles/Apparel |

|

|

Weyerhaeuser Company |

38.29 |

3 |

Forest Prods/Paper |

|

Monday, January 31, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

L3Harris Technologies Inc |

224.46 |

4 |

Telephone |

|

|

Otis Worldwide Corporation |

82.21 |

3 |

Machinery and Tools |

|

|

Trane Technologies PLC |

173.75 |

4 |

Machinery and Tools |

|

Tuesday, February 1, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Amcor PLC |

12.13 |

1 |

Business Products |

|

|

Advanced Micro Devices, Inc. |

121.89 |

3 |

Semiconductors |

|

|

Alexandria Real Estate Equities, Inc. |

198.33 |

2 |

Real Estate |

|

|

Franklin Resources, Inc. |

32.72 |

3 |

Wall Street |

|

|

Broadridge Financial Solutions Inc. |

159.79 |

4 |

Business Products |

|

|

Electronic Arts Inc. |

138.88 |

3 |

Software |

|

|

Gilead Sciences, Inc. |

67.81 |

2 |

Biomedics/Genetics |

|

|

General Motors |

54.65 |

2 |

Autos and Parts |

|

|

Alphabet Inc. |

2670.13 |

5 |

Internet |

|

|

Alphabet Inc. Class A |

2666.15 |

5 |

Internet |

|

|

NXP Semiconductors NV |

199.61 |

3 |

Semiconductors |

|

|

PulteGroup, Inc. |

52.37 |

2 |

Building |

|

|

PerkinElmer, Inc. |

175.14 |

5 |

Electronics |

|

|

Pentair Inc |

64.47 |

2 |

Machinery and Tools |

|

|

Paypal Holdings Inc |

173.28 |

1 |

Software |

|

|

Starbucks Corporation |

95.72 |

2 |

Restaurants |

|

|

Stanley Black & Decker, Inc. |

179.85 |

1 |

Machinery and Tools |

|

|

Bio-Techne Corporation |

377.22 |

3 |

Biomedics/Genetics |

|

|

United Parcel Service, Inc. |

202.29 |

4 |

Aerospace Airline |

|

|

Waters Corporation |

316.42 |

2 |

Electronics |

|

|

Exxon Mobil Corporation |

73.27 |

4 |

Oil |

|

Wednesday, February 2, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

AbbVie Inc. |

133.03 |

3 |

Drugs |

|

|

AmerisourceBergen Corporation |

132.88 |

4 |

Drugs |

|

|

Align Technology, Inc. |

490.71 |

1 |

Healthcare |

|

|

Avery Dennison Corporation |

203.06 |

5 |

Business Products |

|

|

Boston Scientific Corporation |

43.45 |

3 |

Healthcare |

|

|

Chubb Ltd |

193.11 |

3 |

Insurance |

|

|

C.H. Robinson Worldwide, Inc. |

105.04 |

1 |

Transports/Non Air |

|

|

Cognizant Technology Solutions |

85.69 |

3 |

Computers |

|

|

D.R. Horton, Inc. |

88.36 |

3 |

Building |

|

|

DXC Technology Co |

32.03 |

3 |

Computers |

|

|

eBay Inc. |

60.71 |

2 |

Internet |

|

|

Emerson Electric Co. |

93.65 |

2 |

Machinery and Tools |

|

|

Equity Residential |

88.35 |

3 |

Real Estate |

|

|

Meta Platform Inc. |

316.56 |

3 |

Internet |

|

|

Fortune Brands Home & Security Inc. |

96.55 |

1 |

Building |

|

|

Globe Life Inc |

103.31 |

3 |

Insurance |

|

|

Hologic Incorporated |

69.85 |

3 |

Healthcare |

|

|

Humana Inc. |

383.01 |

1 |

Healthcare |

|

|

Howmet Aerospace Inc. |

33.58 |

3 |

Aerospace Airline |

|

|

IDEXX Laboratories, Inc. |

511.15 |

2 |

Healthcare |

|

|

IDEX Corporation |

216.10 |

1 |

Machinery and Tools |

|

|

Johnson Controls International PLC |

72.70 |

5 |

Protection Safety Equipment |

|

|

McKesson Corporation |

251.84 |

4 |

Drugs |

|

|

Marathon Petroleum Corp. |

71.99 |

5 |

Oil |

|

|

Match Group, Inc. |

118.66 |

0 |

Internet |

|

|

Old Dominion Freight Line, Inc. |

306.99 |

5 |

Transports/Non Air |

|

|

QUALCOMM Incorporated |

166.50 |

4 |

Semiconductors |

|

|

Qorvo Inc. |

137.15 |

1 |

Semiconductors |

|

|

Royal Caribbean Cruises Ltd. |

81.18 |

2 |

Leisure |

|

|

Roper Technologies Inc. |

439.74 |

3 |

Machinery and Tools |

|

|

Thermo Fisher Scientific Inc. |

588.16 |

5 |

Healthcare |

|

|

T-Mobile US Inc. |

104.06 |

2 |

Telephone |

|

|

Waste Management, Inc. |

153.23 |

4 |

Waste Management |

|

Thursday, February 3, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Abiomed, Inc |

302.75 |

1 |

Healthcare |

|

|

AFLAC Incorporated |

61.90 |

2 |

Insurance |

|

|

The Allstate Corporation |

119.49 |

2 |

Insurance |

|

|

Ametek Inc |

136.62 |

3 |

Electronics |

|

|

Amazon.com Inc. |

3033.35 |

3 |

Internet |

|

|

Aptiv PLC |

142.00 |

3 |

Autos and Parts |

|

|

Activision Blizzard, Inc. |

81.76 |

3 |

Software |

|

|

AvalonBay Communities, Inc. |

243.37 |

4 |

Real Estate |

|

|

Becton, Dickinson and Company |

263.97 |

3 |

Healthcare |

|

|

Biogen Inc. |

225.91 |

0 |

Biomedics/Genetics |

|

|

Cardinal Health, Inc. |

51.61 |

1 |

Drugs |

|

|

CIGNA Corporation |

240.39 |

2 |

Insurance |

|

|

The Clorox Company |

175.98 |

1 |

Household Goods |

|

|

Cummins Inc. |

226.72 |

3 |

Machinery and Tools |

|

|

CMS Energy Corporation |

63.53 |

2 |

Utilities/Electricity |

|

|

ConocoPhillips |

85.63 |

4 |

Oil |

|

|

Corteva Inc |

46.54 |

3 |

Chemicals |

|

|

DuPont de Nemours Inc. |

79.18 |

1 |

Chemicals |

|

|

Quest Diagnostics Incorporated |

137.17 |

3 |

Healthcare |

|

|

Estee Lauder Companies |

301.06 |

3 |

Retailing |

|

|

Essex Property Trust Inc |

335.78 |

3 |

Real Estate |

|

|

Ford Motor Company |

21.65 |

4 |

Autos and Parts |

|

|

Fortinet Inc. |

304.99 |

5 |

Software |

|

|

Fortive Corp. |

71.31 |

1 |

Machinery and Tools |

|

|

W.W. Grainger, Inc. |

490.96 |

2 |

Machinery and Tools |

|

|

Honeywell International, Inc. |

208.92 |

3 |

Aerospace Airline |

|

|

The Hershey Company |

199.16 |

3 |

Food Beverages/Soap |

|

|

IntercontinentalExchange Inc. |

126.12 |

3 |

Wall Street |

|

|

Illinois Tool Works Inc. |

237.67 |

3 |

Machinery and Tools |

|

|

Eli Lilly and Company |

243.13 |

5 |

Drugs |

|

|

Lincoln National Corporation |

70.53 |

5 |

Insurance |

|

|

Mid America Apartment CMMTYS |

203.95 |

5 |

Real Estate |

|

|

Microchip Technology Incorporated |

73.97 |

2 |

Semiconductors |

|

|

MetLife, Inc. |

66.46 |

3 |

Insurance |

|

|

Merck & Co., Inc. |

80.75 |

2 |

Drugs |

|

|

Motorola Solutions Inc. |

238.85 |

5 |

Telephone |

|

|

NortonLifeLock Inc. |

26.28 |

4 |

Software |

|

|

News Corp. Class B |

21.91 |

4 |

Media |

|

|

News Corp. Class A |

21.75 |

4 |

Media |

|

|

Penn National Gaming Inc |

41.93 |

0 |

Gaming |

|

|

Parker-Hannifin Corporation |

314.23 |

4 |

Machinery and Tools |

|

|

Ralph Lauren |

109.94 |

0 |

Textiles/Apparel |

|

|

Snap-on Incorporated |

209.72 |

1 |

Machinery and Tools |

|

|

Skyworks Solutions, Inc. |

142.99 |

0 |

Semiconductors |

|

|

WEC Energy Group Inc |

96.67 |

2 |

Utilities/Electricity |

|

|

WestRock Co |

45.24 |

2 |

Forest Prods/Paper |

|

|

Xylem Inc |

106.52 |

3 |

Machinery and Tools |

|

Friday, February 4, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Aon Corporation |

270.25 |

4 |

Insurance |

|

|

Air Products & Chemicals, Inc. |

286.98 |

2 |

Chemicals |

|

|

Bristol-Myers Squibb Company |

64.58 |

2 |

Drugs |

|

|

CBOE Global Markets Inc. |

120.35 |

2 |

Wall Street |

|

|

Eaton Corporation |

161.06 |

4 |

Machinery and Tools |

|

|

The Hartford Financial Services Group |

71.10 |

4 |

Insurance |

|

|

Prudential Financial, Inc. |

112.43 |

3 |

Insurance |

|

|

Regeneron Pharmaceuticals, Inc. |

614.38 |

5 |

Biomedics/Genetics |

|

Monday, February 7, 2022

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Amgen Inc. |

228.90 |

2 |

Biomedics/Genetics |

|

|

Catalent Inc. |

102.02 |

3 |

Drugs |

|

|

Hasbro, Inc. |

98.15 |

2 |

Leisure |

|

|

Loews Corporation |

59.09 |

3 |

Insurance |

|

|

Simon Property Group, Inc. |

147.43 |

5 |

Real Estate |

|

|

Tyson Foods, Inc. |

90.46 |

3 |

Food Beverages/Soap |

|

|

Take-Two Interactive Software, Inc. |

164.46 |

1 |

Software |

|

|

Zimmer Biomet Holdings |

123.04 |

0 |

Healthcare |

|