As a result of recent market volatility, we've seen more defensive sectors like consumer staples pick up near-term momentum. Today, we'll review the strength in the broader staples sector and review a handful of high-RS names to consider if looking for individual stock exposure.

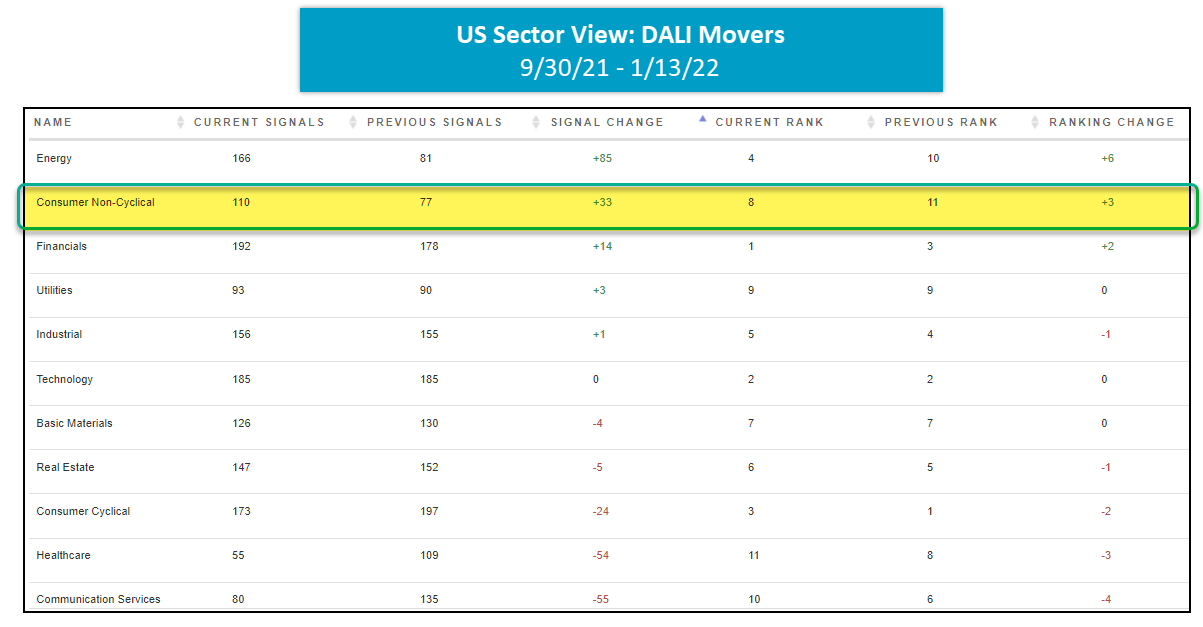

As a result of recent market volatility, we have continued to see more defensive sectors like utilities and consumer non-cyclical pick up near-term relative strength. Although the consumer non-cyclical (consumer staples) sector still resides in the bottom half of the DALI rankings at #8, the sector has gained 33 signals since 9/30, trailing only energy which has gained 85. Additionally, on the Asset Class Group Scores page, consumer non-cyclical is one of the most improved groups in terms of score over the past 30 days, up 0.28 points. As a result, the group has an average group score of 3.48, placing it well into the green zone. We’ve also seen absolute outperformance from the broader staples sector as the Consumer Staples Select Sector SPDR Fund XLP has outperformed the S&P 500 Index SPX over the last 30-, 60-, and 90-day periods by 1.69%, 6.07%, and 4.39%, respectively. Despite being down 29bps on a year-to-date basis, the XLP has continued to outperform the broader market by 1.96% over the first two weeks of 2022. When compared to the other broad sector proxies in the SPDR sector lineup, XLP is the second-best performing sector behind energy XLE over the last 60- and 90-day periods, up 5.56% and 8.59%.

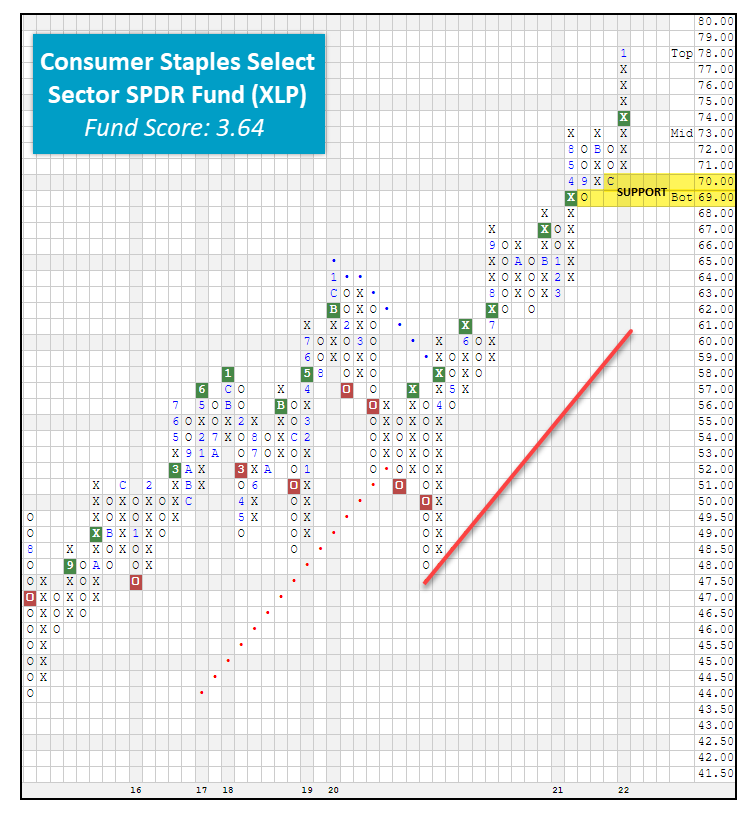

On its trend chart, the XLP continues to trade at all-time highs first printed back on January 5, 2022, at the $78 level. Since returning to a Point & Figure buy signal in April 2020 following the COVID-19 sell-off, XLP has given a total of six consecutive buy signals, confirming that demand has the upper hand. The most recent buy signal occurred on December 10, 2021, when XLP managed to move through significant overhead resistance, breaking a triple top at $74. In addition to its orderly trend chart, the XLP has a solid NDW fund score of 3.64 with a strongly positive score direction of 1.33, speaking to the fund’s improvement within the last six months. This recent score posting is the highest recorded for the XLP since the November 2020 timeframe. Currently, the XLP is 64% overbought based on its 10-week trading band and has cooled off over the last few weeks after printing a relatively high OBOS% reading of 85%, making the ETF actionable here if looking to initiate new long exposure.

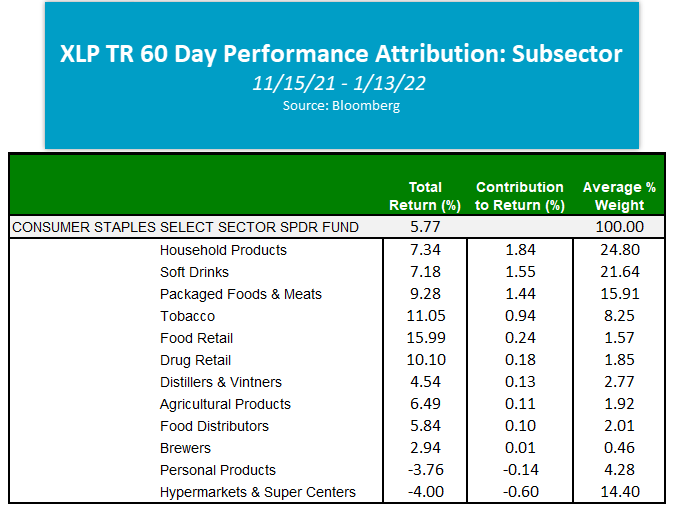

Below is a snapshot of XLP’s performance attribution over the last 60 days, providing us with an in-depth look at the top contributing subsectors and stocks. Since November 15th, household products have contributed the most to XLP’s total return, adding 1.84% on a total-return basis, while soft drinks added 1.55%. On average, household products accounted for most of the exposure within XLP over the last 60 days at about 25%. Personal products and hypermarkets and supercenters were the only two sub-sectors to cause a drag on the portfolio with respective total contributions of -0.14% and -0.60%. On a total-return basis, the food retail subsector has been the top-performer over the last 60 days with a return of 15.99% however, due to its relatively low subsector weighting of 1.57%, this only added 0.24% to the XLP’s performance.

When we take it one step further and break down the performance attribution of the individual stocks that make up the XLP ETF, we find that Procter & Gamble PG has led the way in terms of total contribution to return, adding an impressive 1.23%. As we mentioned above, soft drinks added the second-most to XLP’s total return over the last 60 days, so it comes as no surprise to see the Coca-Cola Company KO and PepsiCo PEP next on the top attributions list, each adding 0.80% and 0.72%, respectively. Notably, the top 10 contributors account for over half of XLP, and out of the 5.77% returned, contributed 4.87%. Currently, all 10 top contributors are trading above their bullish support lines i.e., in overall positive trends and maintain Point & Figure buy signals. At this time, PG and Kroger KR are the only two high attribute names on our list with attribute ratings of 3 or higher. Since relative strength is based on relative performance, many stocks, particularly those that are higher-yielding or lower beta like the names within the staples sector, have a harder time beating the market benchmark on a relative strength basis, especially since relative strength is measured on a price return basis. As a result, some higher-yielding names like KO and PEP are likely to possess lower technical attribute ratings of 2 or lower, which is what we're seeing in the table below. The rule of thumb is that higher-yielding, low attribute names are acceptable as long as they’re also trading in a positive trend and maintain a Point & Figure buy signal.

Because the broader staples sector has shown improvement on a relative and absolute basis, today we are going to use the XLP as the starting universe for a screen that we’ll run using the NDW Security Screener tool. Doing so allows us to easily identify those technically-sound individual consumer staples names that can then be added to a potential shopping list/watch list. To run your own stock screen using the NDW Security Screener tool, type the “XLP” symbol into the blank box on the blue Universe section and add the additional technical criteria detailed below before hitting the green “Preview” button (note: if you run this exact screen after the close on 1/14, you may get a different list). Using the search criteria outlined below, we were able to generate eight stocks. These names are listed in the table below. Underneath the table, we have highlighted two individual stock ideas.

- Universe = XLP constituents

- Optionable Only

- Tech Attribute: 3, 4, 5

- Trend: Positive

- Trend Chart Signal: Buy

| Symbol | Name | Price | Tech Attrib/Score | DWA Sector | Yield |

|---|---|---|---|---|---|

| ADM | Archer-Daniels-Midland Company | 70.90 |

|

Food Beverages/Soap | 2.10 |

| KR | The Kroger Co. | 49.48 |

|

Retailing | 1.78 |

| LW | Lamb Weston Holdings Inc | 69.04 |

|

Food Beverages/Soap | 1.42 |

| MNST | Monster Beverage Corp. | 94.37 |

|

Food Beverages/Soap | 0.00 |

| PEP | PepsiCo, Inc. | 174.18 |

|

Food Beverages/Soap | 2.47 |

| PG | The Procter & Gamble Company | 158.29 |

|

Food Beverages/Soap | 2.19 |

| SYY | Sysco Corporation | 80.42 |

|

Food Beverages/Soap | 2.40 |

| TSN | Tyson Foods, Inc. | 93.21 |

|

Food Beverages/Soap | 2.03 |

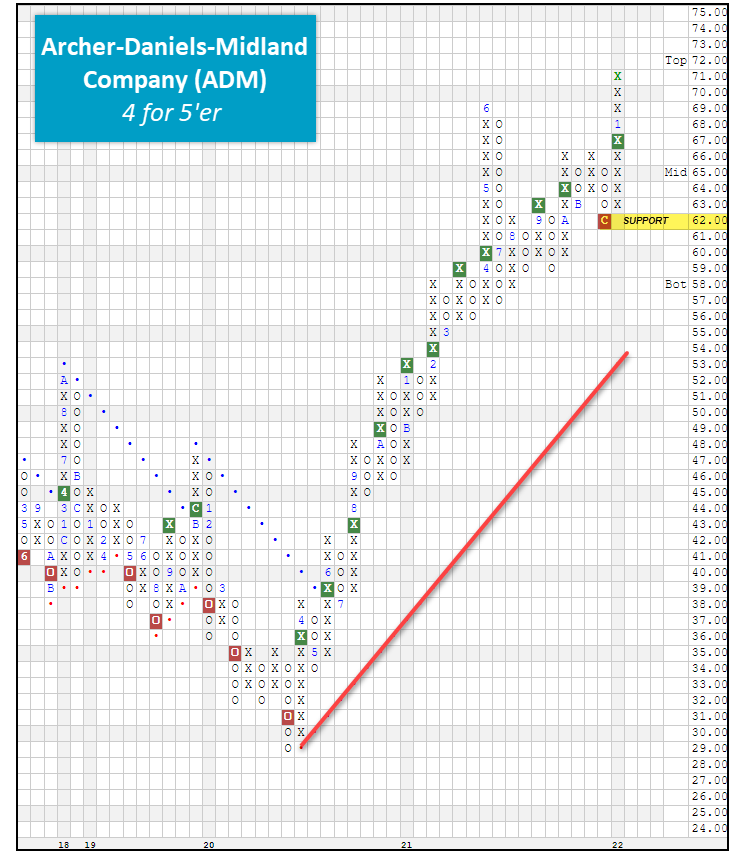

ADM Archer-Daniels-Midland Company ($71.41) - Food Beverages/Soap – ADM is a healthy 4 for 5’er that ranks within the top quartile of the food and beverages/soap sector stock matrix. ADM, which has already managed to post a solid year-to-date gain of 4.90%, trades on a Point & Figure buy signal given in late December with the completion of a shakeout pattern and is sitting at all-time highs as a result of Thursday’s market action. Monthly momentum just flipped positive after having experienced six months of negative monthly momentum while weekly momentum has been positive for three weeks, both adding to the overall positive technical picture. At current levels, ADM is technically overbought with an OBOS% reading of 83% so those looking to initiate new long exposure may want to scale in here or wait for a potential pullback. Initial support sits at $62. ADM yields 2.1% and is set to announce earnings on 1/24/2022.

KR The Kroger Co. ($49.22) - Retailing – Another technically strong name within the broader staples sector is the Kroger Company KR, which was also one of the top 10 contributing names in XLP over the last 60 days. KR ranks in the top decile of the retailing sector stock matrix and has maintained a high attribute rating (3 or higher) since August 2021. Additionally, KR trades well above the bullish support line that has been in place since March 5th, 2020, and trades on four consecutive Point & Figure buy signals. Like ADM, KR hit a new all-time high with yesterday’s market action. As a result, KR has already printed a strong 2022 return of 9.32% just two weeks into the new year, outperforming the S&P 500 Index SPX by a whopping 11.57%. New positions are welcome at current levels. Initial support sits at $44, with additional support available at the $39 level. Note KR yields 1.78%.