We discuss further changes within the DALI rankings.

Year-End Review Webinar with RIA Database: With inflation concerns impacting many facets of the US markets in 2021, we will address how leadership trends across major asset classes and US equity sectors have adapted to these pressures in an upcoming webinar with RIA Database. The discussion will take place on December 8th at 2pm ET and is approved for one hour of CFP®, CFA® & CIMA®, CIMC® or CPWA® CE Credit for webcast attendees. Click Here to Register.

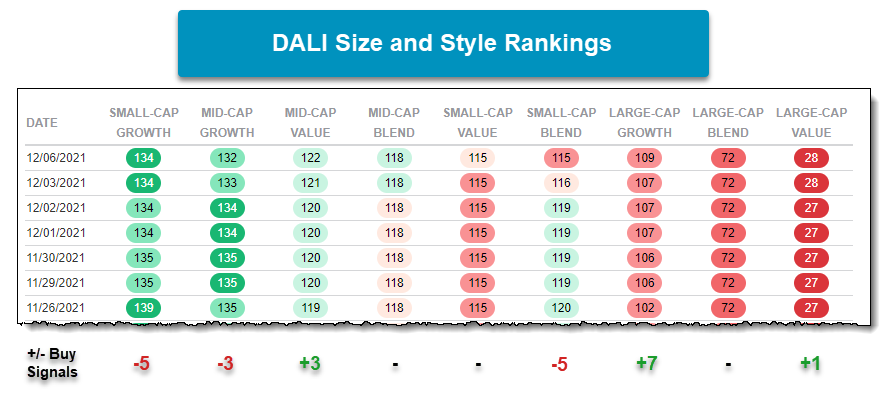

Our long-term relative strength rankings through DALI have had quite a few shakeups over the past two weeks. Last Friday, we discussed the shifts that had transpired within the fixed income rankings in DALI as Convertibles & Preferreds continue to lose signals while Long Duration U.S. Treasuries continue to gain. The size and style rankings have also had notable changes occur since the close on November 26th. While the top two ranking size and style groups, Small-Cap Growth and Mid-Cap Growth, continue to reside at the top, they have lost 5 and 3 buy signals, respectively. Probably the most noteworthy change to the rankings is Small-Cap Blend falling from the 3rd rank to 6th and losing 5 buy signals since November 26th. The size and style group that has gained the most signals over this time is Large-Cap Growth, up 7 buy signals. As of the close on the 6th, Large-Cap Growth is the highest-ranking size and style group within the Asset Class Group Scores page with an average group score of 3.90.

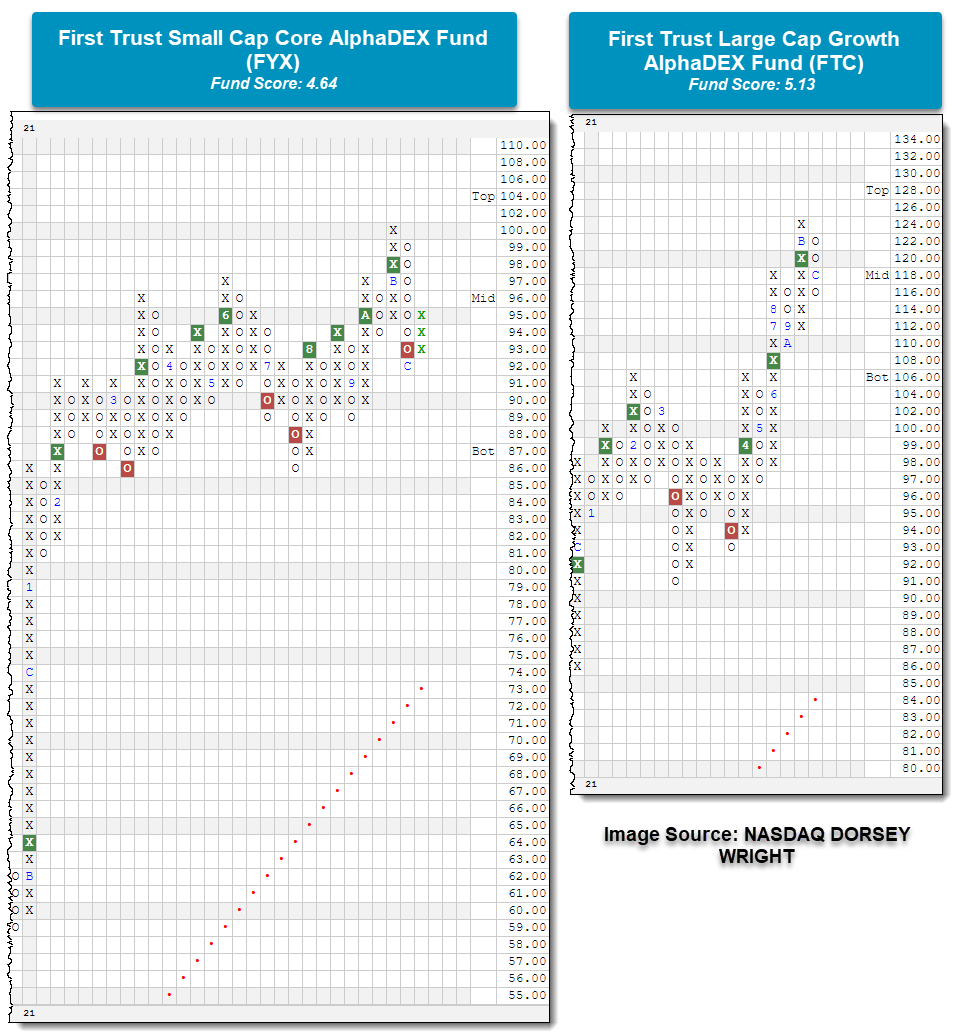

Below we have a couple of proxies as representatives for the Small Cap Blend and Large Cap Growth areas of the size and style rankings.

First, we have the chart of the First Trust Small Cap Core AlphaDEX Fund FYX. The fund still maintains a high fund score of 4.64, but the chart returned to a sell signal by breaking a double bottom at $93 on 11/30. This followed the chart rallying to a new all-time high earlier in November at $100. Ultimately, FYX fell to $92, its lowest level since September of this year, before reversing back into a column of X’s at $95 with action on December 6th. The recent action has led FYX to move back within the trading range of $86 to $97 that it spent roughly 8 months of this year within prior to breaking to a new all-time high in early November.

On the chart of the First Trust Large Cap Growth AlphaDEX Fund FTC, the fund still maintains a buy signal following its third consecutive breakout at $120. FTC rallied up to a new all-time high at $124 before reversing down last week at $118 and falling to $116 on the chart. FTC maintains a fund score of 5.13, speaking to the fund’s resilience.

As can be seen from both charts, each fund has pulled back along with the broader market. But both pictures shed light on the broader size and style groups themselves as Small Cap Blend has pulled back to its prior trading range and Large Cap Growth has maintained its strong trending picture. On a relative basis, this has led to Large Cap Growth to gain signals while Small Cap Blend has lost signals in recent weeks.