Barbie turned 62 yesterday and has seen a resurgence in popularity over the past year.

Wednesday’s intraday reading for the Bullish Percent for NYSE BPNYSE eclipsed the 66% level as of 3 pm ET, which should cause a reversal up into Xs to the 66% level after market close when the BP calculations are finalized. As a refresher, the BPNYSE indicator measures the percentage of stocks in the NYSE that are trading on Point & Figure buy signals and is used as a gauge for market participation and therefore, overall risk. The BPNYSE reversed down into a column of Os on February 23 before moving to 60% last week. In keeping with the Bullish Percent Playbook, this potential reversal back up into Xs returns the offensive team onto the field, calling for a more “risk-on” approach in the management of equity exposure. Those looking to increase equity allocation should still focus on areas with strong relative strength and favorable technical attribute/fund scores. Intraday BP readings are available via the Major Intraday Changes widget (shown in the image below) and are also provided in the Intraday Reports section under the Security Selection menu.

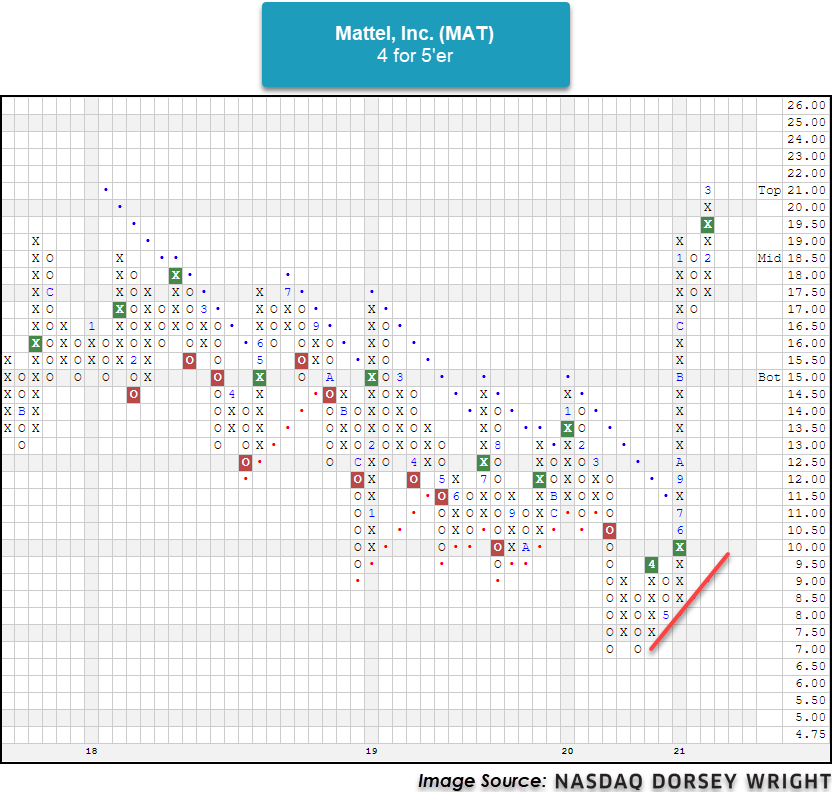

Yesterday marked the 62nd anniversary of the launch of the Barbie doll which was initially released by Mattel Inc. MAT on March 9, 1959, at the American Toy Fair in New York City (Source: History.com). Throughout the last year of lockdowns, MAT has seen a boost in its Barbie sales by 16%, leading to the toy manufacturers' best sales year since 2017. (Source: BBC). Not only has the fundamental picture for MAT improved, but the technical picture has as well. Currently, MAT is a healthy 4 for 5’er that is showing superior strength versus the broader market. Additionally, MAT is up over 12% year-to-date and is currently trading at multi-year highs on three consecutive buy signals. Since breaking out into a positive trend last July, Mattel has gained a staggering 69.13%, outperforming the S&P 500 Index by over 49%! New positions are welcome at current levels as MAT is trading in actionable territory with a weekly overbought/oversold reading of 31%. Initial support sits at the $17 level.