Australia and Norway have both shown improvement in our NDW Country Index Relative Strength Ranking.

The sell-off in domestic equity markets earlier this week saw some carry over into international equity markets, as shown through column reversals on both the iShares MSCI Emerging Markets ETF EEM and iShares MSCI EAFE ETF EFA. Both of these funds pulled back from relative highs toward the middle of their respective trading bands. However, each also still sits on a buy signal and in a positive trend. The decline in EEM was a bit more pronounced, as we might expect given the technology-focus in some of the emerging market economies with heavier allocations, such as China. EEM now has a -1.43 score direction posting, although the fund still maintains a strong score posting of 4.13. On the other hand, EFA has maintained a positive score direction of 0.87 and sits at a suitable score posting of 3.10.

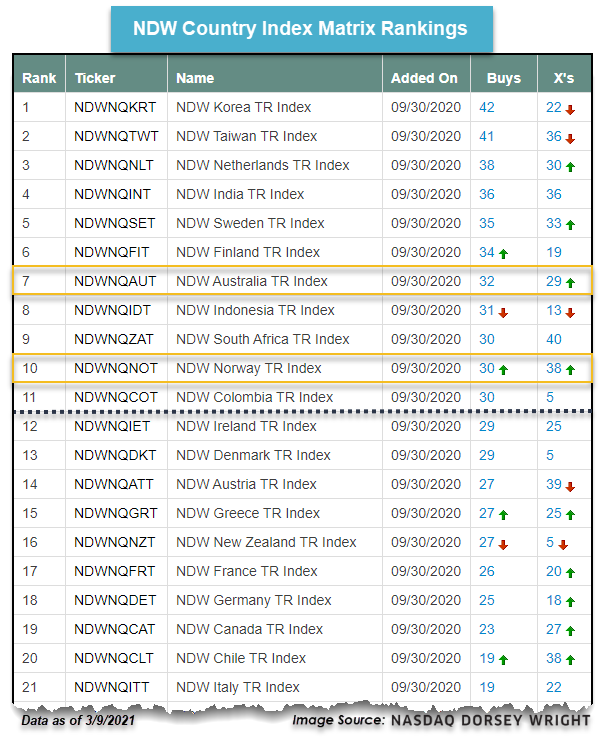

While broad international indices have not seen that much change, there has been some movement from the individual country perspective, as shown in our NDW Country Index Matrix Ranking. This ranking, which can now be accessed under the “Specials” link found on the Premade Matrices page, saw two new additions into the top quartile of names, South Africa and Norway. Australia also showed improvement in rising to the rank of 7 out of the 43 country representatives.

The improvement from Australia and Norway is especially interesting, as both of those countries have actually discussed tightening their lockdown restrictions over the past few weeks. Australia, which saw one of the tightest travel lockdowns globally last March and has yet to reopen its borders since that time, has maintained a significantly lower virus infection rate than other developed nations (source: thegaurdian.com). On a similar note, Norway has seen tighter lockdown restrictions than other European economies, also leading to lower infection rates (source: reuters.com).

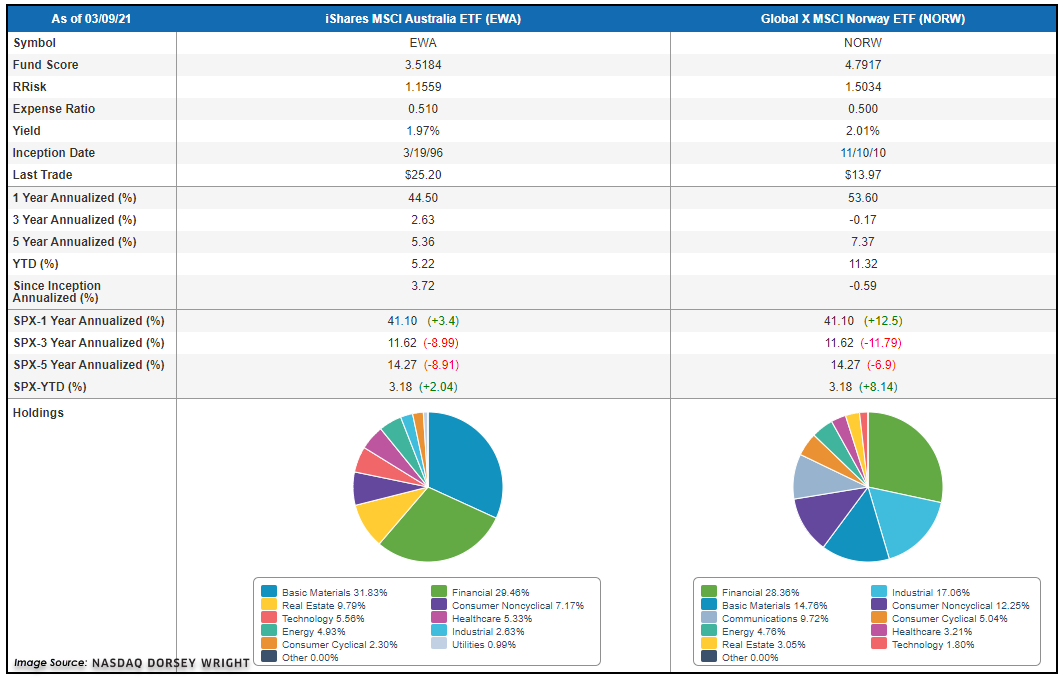

While one might initially expect news of enhancing lockdown restrictions within these countries to push shares lower, international equity investors have remained undeterred. Using the iShares MSCI Australia ETF EWA and the Global X Norway ETF NORW as our fund representatives, we can see that each remains in a column of X's, at multi-year highs and on a buy signal, with favorable fund scores. Looking underneath the hood at the constituents of each fund helps us understand some of the reasons for this movement, as each fund shows overweight positions toward financials and underweight positions in technology. Financials has continued to show improvement within our DALI domestic equity sector rankings, recently overtaking technology for the third-ranked sector position. While that ranking focuses on domestic equities, we have certainly seen that trade carry over into international equity markets, as shown through the movement of these countries as well as others with higher allocations toward financials, such as India.