Yields pulled back slightly this week; the recently volatility in the equity market has weakened convertible bonds.

The US Treasury 10YR yield Index gave an eighth consecutive buy signal in last week’s trading when it reached 1.625%. It pulled back slightly on Tuesday and Wednesday and currently sits at 1.525% on its default chart.

Rising yields have been a headwind for many areas of the fixed income market and in Monday’s trading, the iShares US Core Bond ETF AGG gave a fourth consecutive sell signal when it broke a double bottom at $114, its lowest level since April of last year. AGG has a weak 1.44 fund score and negative -2.39 score direction.

Although they continue to lead the fixed income rankings in the Asset Class Group Scores, the recent volatility in the equity market has weakened convertible bonds. The average score for the convertible bonds has fallen below 4.0 for the first time since June of last year, it now sits at 3.90.

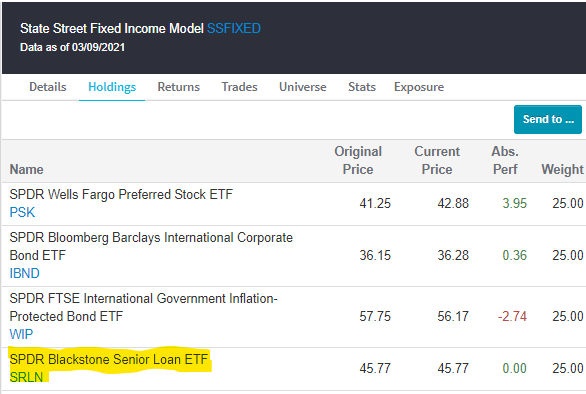

In a related move, this week the SPDR Bloomberg Barclays Convertible Bond ETF CWB was sold from the State Street Fixed Income Model SSFIXED because its rank in the model’s relative strength matrix had fallen below the threshold to remain a holding in the portfolio. CWB had been a holding in the model since May 2020. In place of CWB, the model added the SPDR Blackstone Senior Loan ETF SRLN.

The floating rate group has moved up in the Asset Class Group Scores fixed income rankings, where it now ranks second behind convertibles with an average group score of 3.14. Unlike many other areas of the fixed income market, floating rate bonds typically perform well in a rising interest rate environment. High yield bonds are also an area of strength as the corp bond-high yield group ranks third among all fixed income groups with an average group score of 3.11.