Emerging markets have been red hot, but how can we get emerging markets exposure without China?

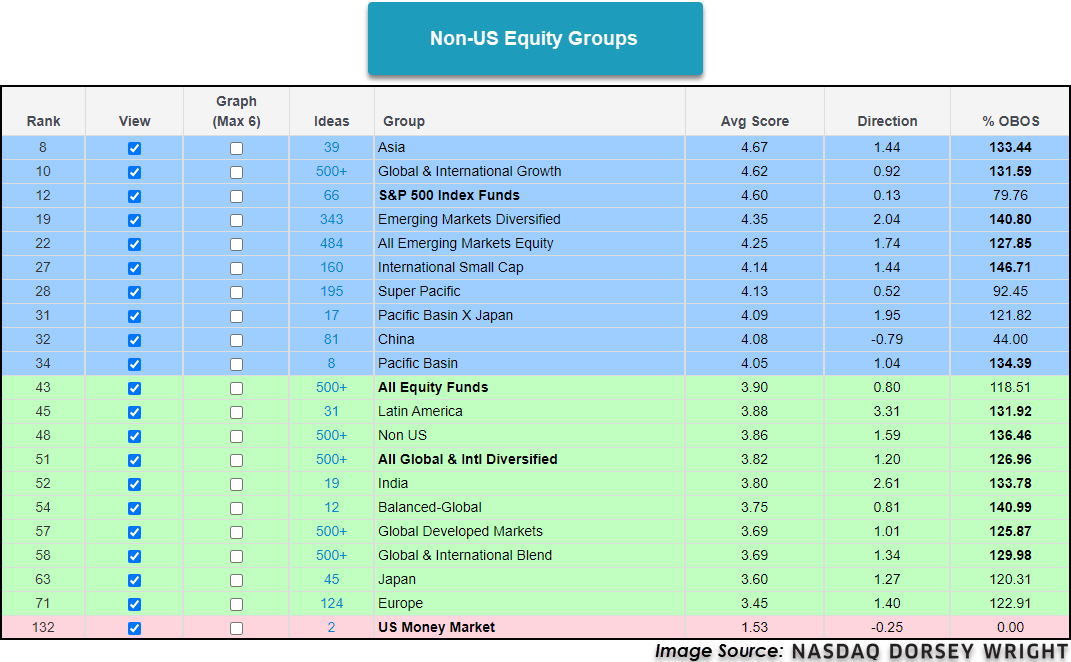

Not only have domestic equities shown strength across the Asset Class Group Scores page, but international equities, specifically emerging market equities, are also in good standing. Emerging markets have been led by China for much of the year, but we’ve seen the strength expand out to the broader Asia-Pacific region and the Latin America group as of late. For a more detailed review of the quick improvement of the Latin America group, please click here. One of the issues with broad emerging markets exposure is the heavy weighting towards China. While this has been a leader in the space for much of the year, many clients and advisors are concerned with the political and legislative risk associated with Chinese equities. The China group has an average group score of 4.08 but a negative score direction of -0.79, showing some weakness recently.

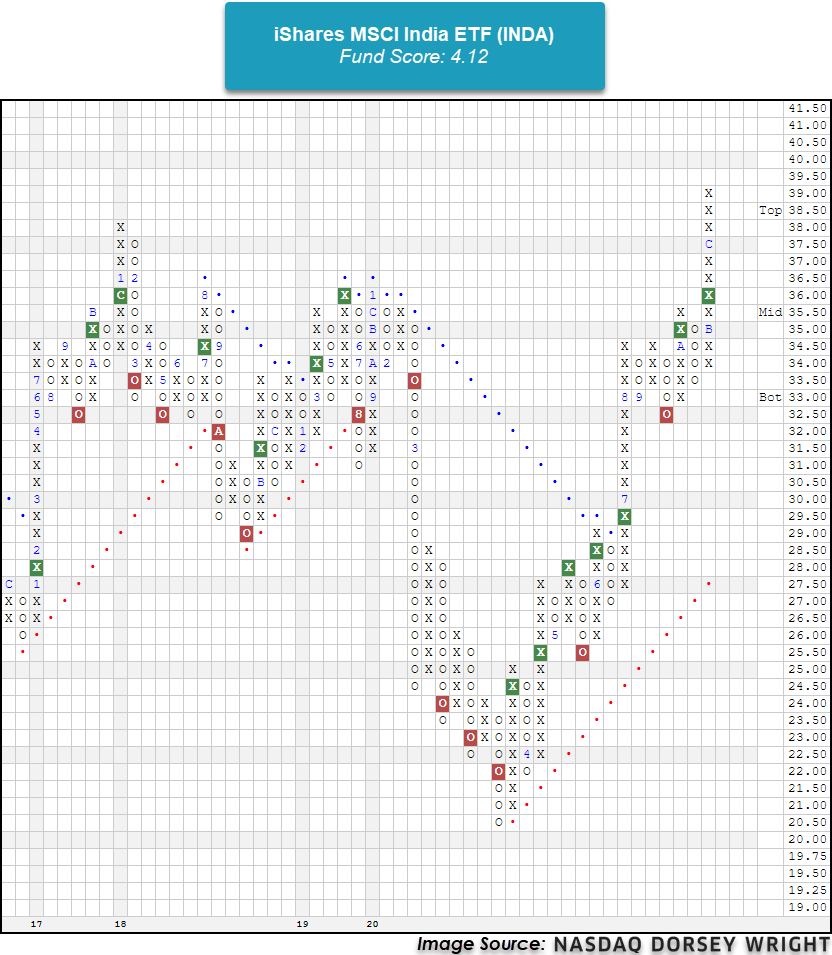

For those in search of emerging markets exposure without having China included, individual country exposure is a possible solution. The India group has an average group score of 3.80 with a positive score direction of 2.61 highlighting the swift improvement. The iShares MSCI India ETF INDA is a strong candidate deserving consideration with a fund score of 4.12 and score direction of 3.58. Currently charting at $39, INDA is at a multi-year high but the recent improvement has put the fund into heavily overbought territory with a weekly overbought/oversold reading of 123%.

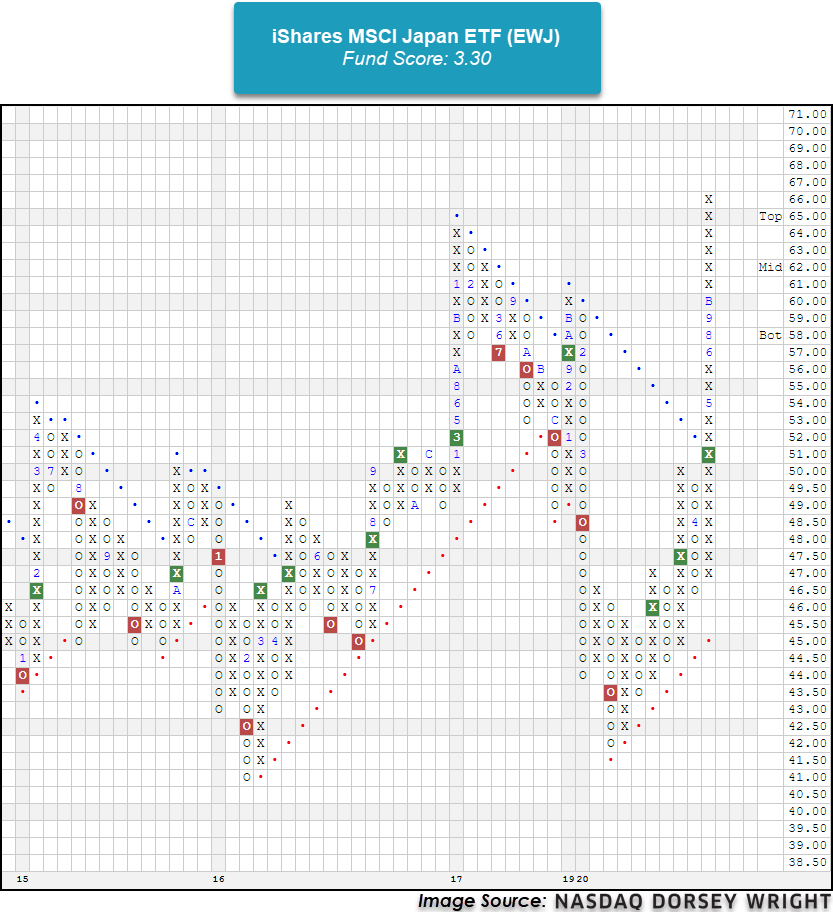

Another individual country group is the Japan group which has an average group score of 3.60 and a positive score direction of 1.27. One of the more popular FSM models, the FSM T Rowe Price 5S PR4050, is holding the T. Rowe Price Japan Fund PRJPX, so we’ve seen some of the FSM models take notice of the strength in Japan. The iShares MSCI Japan ETF EWJ possesses a strong fund score of 3.30 with a positive score direction of 1.86, but recent price action has also put EWJ into heavily overbought territory.

The continuing improvement and strength in emerging markets has been noticeable, especially in the current market environment where the US dollar has continued to weaken over the past few months. Concerns around China stemming from a variety of reasons like political and legislative risks have made it difficult for investors to find broad emerging market exposure that doesn’t include China, but using a few individual country and region funds together can provide the international exposure many are craving while still sticking to groups that exhibit high relative strength characteristics. To look for new ideas and stay on top of ever changing market trends, be sure to visit the Asset Class Group Scores page and set alerts.