The breadth of strength among international equity markets has continued to expand over the past week, with specific emerging market economies showing the most significant improvement.

The breadth of strength among international equity markets has continued to expand over the past week, with specific emerging market economies showing the most significant improvement. This can be seen on the non-US view of the Asset Class Group Scores (ACGS) page, which shows Latin America as the group with the highest average score direction among the international groups examined at a recent posting of 3.16. We can see that this improvement has essentially only been over the past six weeks, as the Latin America group began November at an average fund score of only 0.92 and has risen rapidly to its current group score of 3.74 through trading Tuesday. The group has not been able to maintain an average score above 4.00 for a prolonged period of time since the fourth quarter of 2018, making the potential further improvement of Latin America an important place to monitor as we look towards 2021.

The iShares S&P Latin America 40 ETF ILF has been indicative of this recent improvement, as it has ascended from a double bottom formation at $21 in November to march higher in a single column of Xs, reaching $29 earlier this month. Although the fund still sits in negative territory from a year-to-date performance standpoint with a return of -14% through Tuesday, ILF has risen over 17% in the past 30 days, besting the gains of the broad international fund ACWX as well as the broad emerging markets representative EEM, which have each gained just over 4% during the same timeframe. Looking underneath the hood at the country exposure within ILF reveals, perhaps unsurprisingly, that Brazil makes up a vast majority of the fund at an allocation of 62%. However, Mexico also has a substantial allocation at 21%, as the only other country representative with their percentage exposure in double-digits.

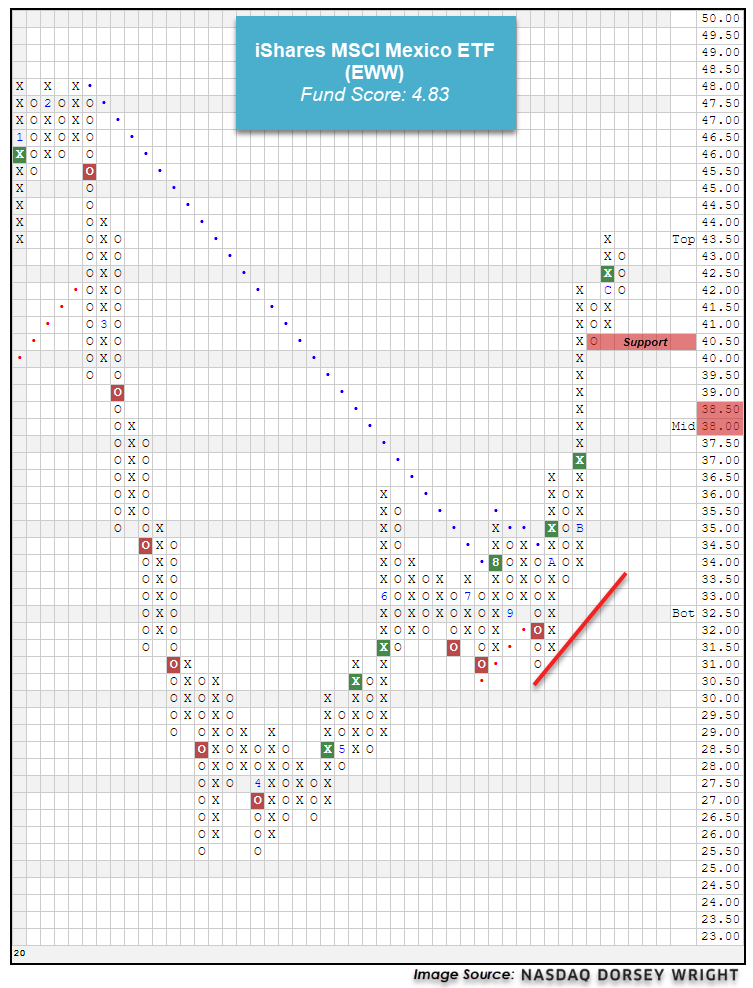

Those looking for investment ideas in Latin America outside of Brazil may consider the iShares MSCI Mexico ETF EWW as a potential candidate for further examination. This fund has moved substantially higher off its September low of $31 to break through to a positive trend and ultimately give three consecutive buy signals before reaching its December high of $43.50. The fund has since pulled back from heavily overbought territory and current sits at $42 on its default chart. This improvement can also be seen in its strongly positive score direction of 4.37 that brings its recent score posting to an impressive 4.83, which bests the average non-US equity fund (3.84) as well as the average Latin American fund (3.74). Exposure to EWW may be considered either at current levels or upon further normalization of the fund’s trading band, as it remains in slightly overbought territory with a recent weekly overbought/oversold (OBOS) reading of 77%. Initial support can be found at $40.50 on the default chart, with further support found on the more sensitive ¼ point chart at $38.25.