Treasury yields reversed up Wednesday. International bonds continue to benefit from a weak dollar.

The US Treasury 10YR Yield Index TNX reversed up into a column of Xs at 0.95% in Wednesday’s trading, but remains below its recent high of 0.975%. The 30-year yield Index TYX also reversed up Wednesday and currently sits at 1.7%; TYX has formed a potential bullish triangle, which would be completed with a breakout at 1.75%.

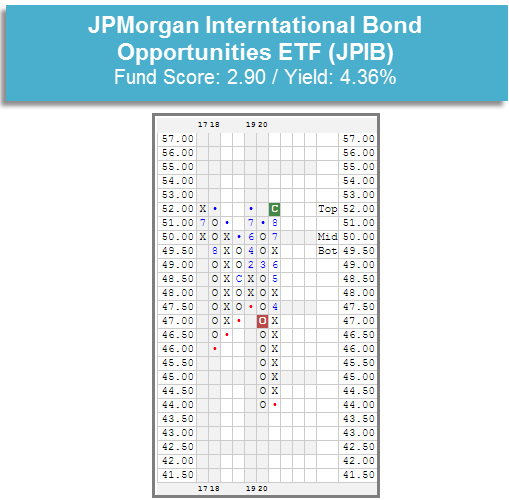

As mentioned last week, the US dollar DX/Y has continued to weaken and currently sits at a multi-year low on its default chart. The weakening dollar is a tailwind foreign bonds and in yesterday’s trading, the JPMorgan International Bond Opportunities ETF JPIB broke a double top at $52, returning it to a buy signal and a positive trend for the first time since March. JPIB currently has a 2.90 fund score and yields 4.36%. The fund currently sits in heavily-overbought territory, so those considering adding exposure may wish to wait for a pullback or for price to normalize at current levels.

As they have for much of the year, convertible bonds continue to lead the fixed income market from a relative strength perspective. The convertibles group currently has a 4.81 average fund score in the Asset Class Group Scores System, placing it first among fixed income group and fifth amongst all 135 groups in the system. Over the last 30 days (12/15), the inverse-fixed income group is the only fixed income group that has had its average score increase, as it has risen 0.06 points. The score of every other fixed income group has declined over this period, in many cases due to rising interest rates. The largest score deteriorations belong to the retirement & income, corp bond-high yield, strategic income, and inflation protection groups, which have all seen their scores decline by at least -0.25 points.