We review the mechanics of target maturity ETFs.

The US Treasury 10YR Yield Index TNX gave a third consecutive buy signal in Wednesday’s trading when it broke a spread triple top at 0.80%. This is the highest level the index has reached since June when it hit 0.95%.

The US Treasury 30YR Yield Index TYX also gave a fresh buy signal on Wednesday when it broke a double top at 1.625%. Like TNX, TYX also remains below the levels it reached in June.

As discussed in last Thursday’s report, we recently added the NDW Tactical + Ladders Fixed Income Model LADDERS to our suite of guided models. The model combines the State Street Fixed Income Model SSFIXED.TR with two “ladders” composed of BulletShares target maturity ETFs, one investment-grade CORPLADDER, the other high yield HYLADDER.

Therefore, we thought today would be an opportune time to review how target maturity funds work.

Unlike traditional fixed income ETFs, target maturity ETFs hold individual bonds that each mature or are expected to be called in the same year. As the underlying bonds mature, the cash or cash equivalent holdings of the fund increase and upon the fund reaching maturity the proceeds are distributed to shareholders. Because these funds have a target maturity, they can be used to create a held-to-maturity portfolio to protect against capital losses due to rising interest rates.

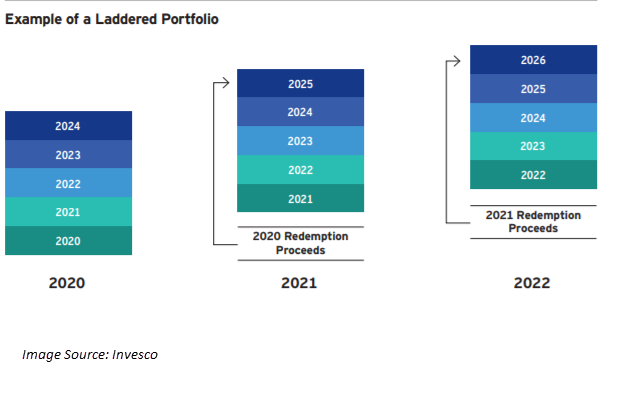

As in the LADDERS model, target maturity ETFs can also be used to create laddered portfolios. A laddered portfolio is one with allocations spread across several different maturities, e.g. 20% each to 1 to 5-year maturity bonds. A laddered portfolio provides liquidity and can help minimize interest rate risk.

Even though the underlying bonds in a target maturity ETF are expected to be held until maturity, they are exchange-traded, and therefore the market value and NAV of the fund will still be affected by interest rate movement. Therefore it is important to understand that ultimately, as the bonds near maturity, the NAV of the fund should move toward the par value of its holdings and the fund will receive par value for its bonds (excepting any potential defaults), which will, in turn, be distributed to the funds’ investors.

It is important to note that the movement of NAV towards the underlying par value does not mean that bonds purchased at a premium will result in a capital loss nor that bonds purchased at a discount will result in a capital gain. This is due to how the amortization of premiums and discounts is handled. If a fund purchases its bonds at a discount to par, the discount is amortized over time and may result in the fund distributing more income than would be expected based on the average weighted coupon. The reverse is true if bonds are purchased at a premium.