Today, we discuss the basics of Bitcoin ($BTC) and review a few ways to gain exposure to this alternative space. Additionally, we walk users through accessing crypto-asset trend charts on the NDW Research Platform.

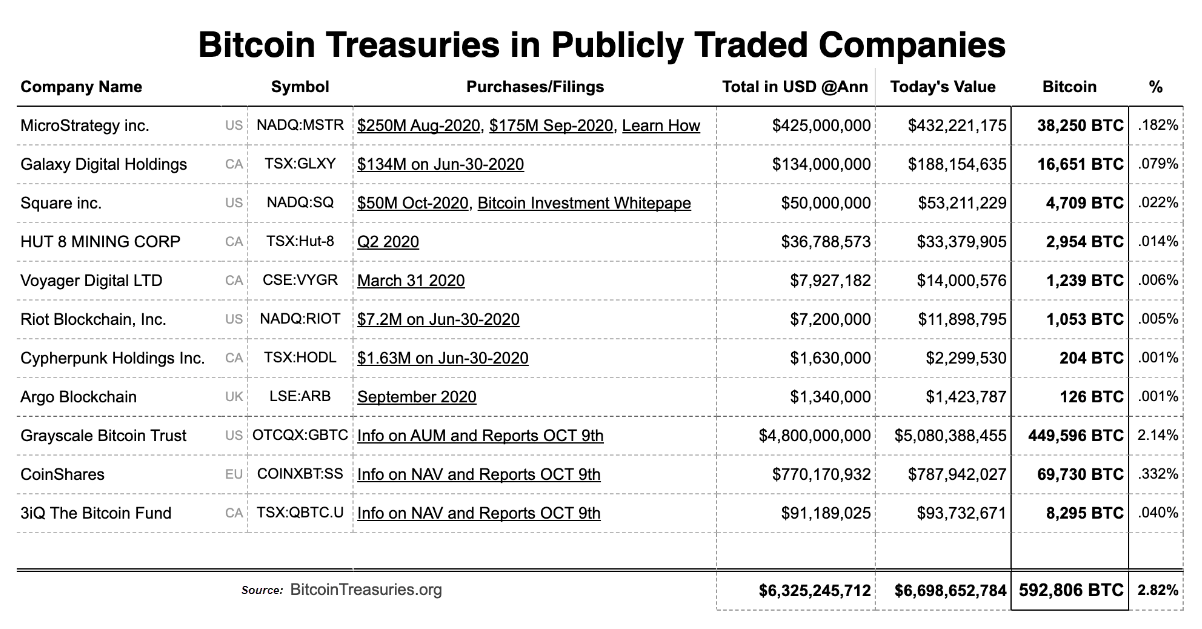

On October 8, Square SQ, the payments company helmed by Twitter CEO Jack Dorsey, announced that it purchased 4,709 bitcoins, a $50 million investment, representing 1% of the firm’s total asset. As a result, Square became the second technology firm to go long on bitcoin in recent months after MicroStrategy MSTR, a business intelligence firm, crowned the crypto as its treasury reserve asset of choice. SQ’s investment announcement not only injected fresh confidence into the crypto market but also caused $BTC to jump 2.5% in one day. As a result, $BTC finished the week up 6.6%, marking its strongest single week rise since the end of July. Due to the renewed interest we’ve seen in the crypto market and recent conversations we’ve had with advisors, today, we will discuss the basics of Bitcoin ($BTC). Additionally, we’ll review a few ways to gain exposure to this alternative space and walk users through accessing crypto-asset trend charts on the NDW Research Platform.

What is Bitcoin?

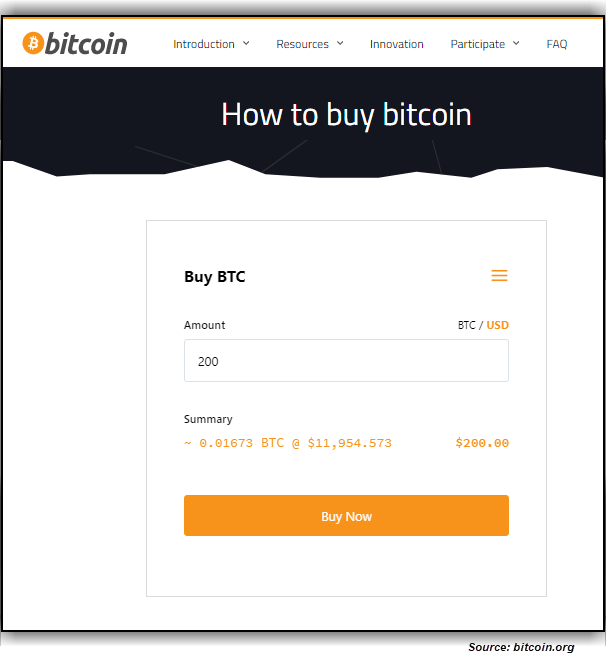

Launched in 2009, Bitcoin is the world's largest cryptocurrency by market cap which currently sits at around $200 billion. Per the Bitcoin Wiki, Bitcoin is a decentralized digital currency that enables instant payments to anyone, anywhere in the world. Bitcoin uses peer-to-peer technology to operate with no central authority: transaction management and money issuance are carried out collectively by the network. Bitcoin uses public-key cryptography, peer-to-peer networking, and proof-of-work to process and verify payments. Bitcoins are sent (or signed over) from one address to another with each user potentially having many, many addresses. Each payment transaction is broadcast to the network and included in the blockchain so that the included bitcoins cannot be spent twice. After an hour or two, each transaction is locked in time by the massive amount of processing power that continues to extend the blockchain. Using these techniques, Bitcoin provides a fast and extremely reliable payment network that anyone can use. For more information on bitcoin, be sure to visit www.bitcoin.org.

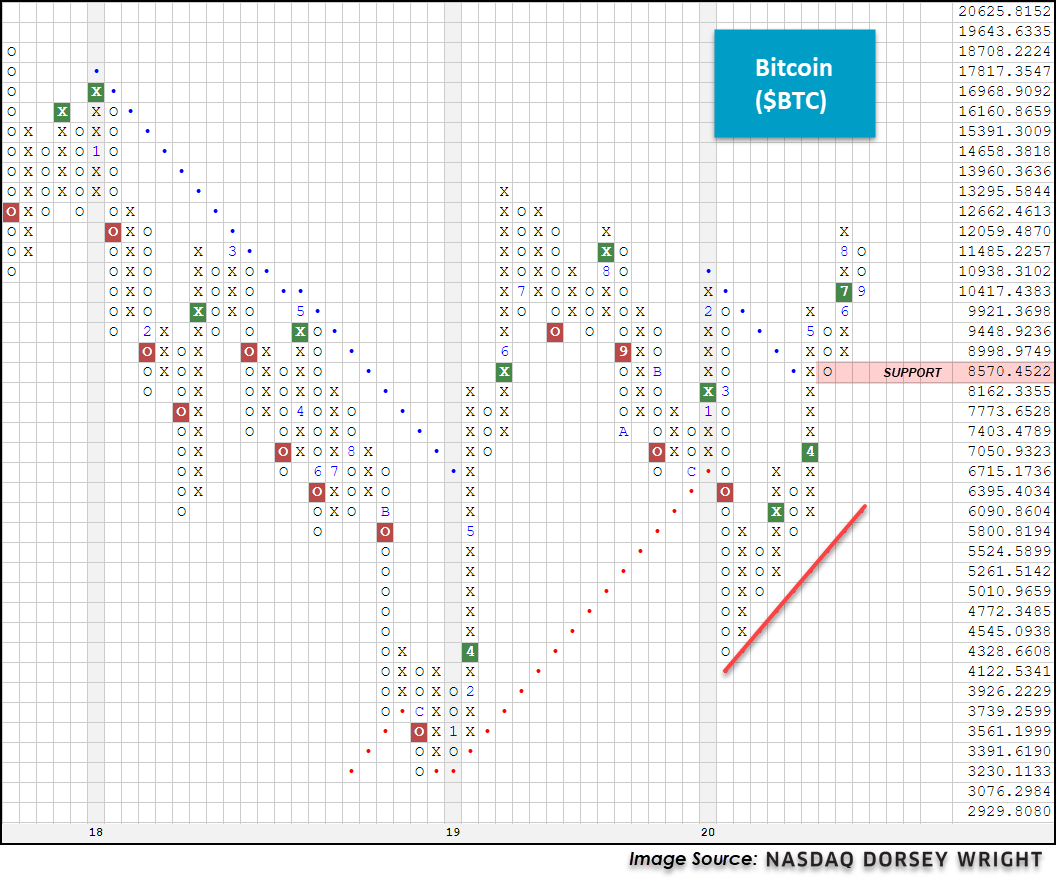

After a significant rally starting in 2015, the price of $BTC peaked at $19,643.63 in Q4 2017 before falling more than -84% to around $3,100 in December 2018. While $BTC remains below its high watermark, we have seen signs of technical improvement, undoubtedly aided by the recent investment announcement from SQ. Back in September, $BTC hit the $11,200 level, however, demand was unable to move the price any higher, triggering a four-day sell-off to $10,200. $BTC’s 6.6% rally over the last week enabled it to break through and close above resistance that had built up over the last month around the $11,000 level. Today, $BTC is trading around $11,500. Because of its strengthening correlation to the S&P 500 Index which has some in the industry calling $BTC the “Digital S&P” instead of “Digital Gold”, analysts suggest that macro-factors, such as the upcoming US election, stimulus talks, and the coronavirus pandemic, will play a strong role in determining the direction of $BTC from here. (Source: coinbase.com)

How can I invest in Bitcoin?

There are a few different ways to invest in $BTC at this time. Two of the options include purchasing $BTC on crypto trading platforms such as Coinbase, Robinhood, or Cash App SQ or by purchasing shares of the Grayscale Bitcoin Investment Trust GBTC. If you plan on purchasing $BTC outright, be sure to do your research and have a place to store them. This can be an online digital wallet attached to the account where you buy and sell, a program on your computer, or a physical device you plug into your computer. For more information on trading bitcoin, click here.

For those looking to gain exposure without buying bitcoins, there is the option to purchase shares of the GBTC. This digital currency investment product is the closest thing available to a bitcoin ETF in the U.S. as it owns bitcoins on behalf of investors and allows them to trade in shares of the trust, replicating some aspects of an ETF. Grayscale Investments calls it a traditional investment vehicle with shares titled in the investor's name. Although the Trust is not an ETF itself, Grayscale says it's modeled on popular commodity investment products like the SPDR Gold Trust GLD, a physically-backed ETF. Shares of Grayscale Bitcoin Trust are eligible to be held in certain IRA, Roth IRA, and other brokerage and investor accounts.

On January 21, 2020, GBTC became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. This allows accredited investors who purchased shares in the Trust’s private placement to have an earlier liquidity opportunity, as the statutory holding period of private placement shares would be reduced from 12 months to 6 months, according to SEC rules. The trust requires a minimum investment of $50,000 and charges an annual fee of 2.0 percent, which accrues daily, for accredited investors who wish to subscribe to the Trust as a private placement. On the other hand, investors are eligible to purchase as little as one share of the GBTC public quotation.

Grayscale lists the benefits of investing in GBTC on its website, including that it provides Titled, auditable ownership through a traditional investment vehicle, is eligible for tax-advantaged accounts, is publicly quoted on the OTCQX, is supported by a network of trusted service providers, and its assets are securely stored in “cold”/offline storage with Coinbase Custody Trust Company, LLC, as Custodian.

However, there are downsides to consider when purchasing GBTC. Because GBTC is the first of its kind for bitcoin, investors have been paying a high premium. In September 2018, shares of GBTC traded at a high of $7.95, which was around 20% higher than the value of the bitcoin within the trust that each share represented at that time. Although that premium is significant, it’s lower than it has been in the past — GBTC has closed at prices more than two times the value of its underlying bitcoins. The price of GBTC is driven by demand for GBTC shares, not necessarily by the price of bitcoin because unlike a regular ETF, there is no creation-redemption process to keep GBTC's market value in-line with its NAV. (Sources: Grayscale; Investopedia)

With today’s market action, GBTC pushed higher to $12.75, a move that violated the fund’s bearish resistance line. As a result, GBTC is now trading in an overall positive trend with a fund score of 3.19 and a strongly positive 2.37 score direction. From current levels, GBTC faces resistance between $14 and $14.75, the fund’s recent rally high, and remains -67% off of its all-time high of $38.50 from December 2017. Initial support sits at $10. Year-to-date, GBTC is up 43.71% while BTC is up 54.53% (through 10/9).

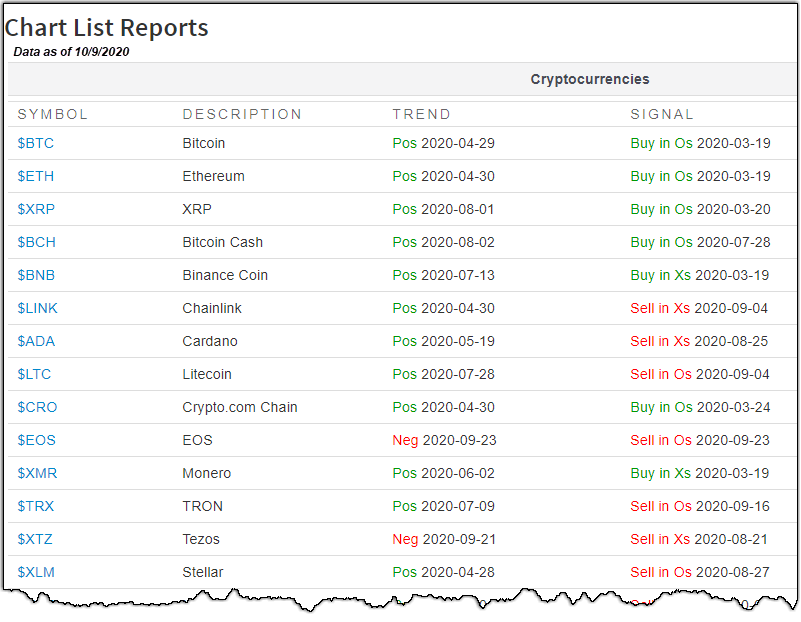

Tracking Cryptoassets on the NDW Research Platform

In 2019, we announced a partnership with Bitwise, a pioneer in the cryptoasset management space. This partnership has enabled us to expand our database, adding over 200 crypto assets and four Bitwise indexes to the NDW Research Platform, including the DWACRYPTO Index, an equal-weighted index comprised of the 10 largest cryptocurrencies as defined by their market caps. You can find a list of all crypto assets that we currently track under Security Selection -> Chart Lists -> Special Reports -> Cryptocurrencies or click here. Please note that cryptocurrency symbols start with the dollar sign $ on the site.

For those looking for additional insight/commentary on the crypto asset space or those who may need some talking points for an upcoming client meeting, we suggest reading Bitwise's Investor Letters, a monthly publication available online at bitwiseinvestments.com. To access this commentary, click here. Note: The views and opinions expressed in this article are those of the authors and do not necessarily reflect those of Nasdaq Dorsey Wright.