With the recent deterioration, we wanted to provide a broad update on the technical picture of the U.S. Dollar and also discuss the Dollar’s impact on the broad asset classes.

Throughout the second half of 2020, a deterioration within the U.S. Dollar has been among the primary themes in focus, and understanding the Dollar’s impact on the positions in our portfolios is important. Coming into 2020, investors found themselves within a rising dollar environment, as the NYCE U.S. Dollar Spot Index DX/Y had reached a multi-year high. The greenback has since weakened over the last four months, so today we will provide a broad update on the technical picture of the U.S. Dollar and also discuss the Dollar’s impact on the broad asset classes.

What is the US Dollar Index (DX/Y)?

To begin we should first explain that the US Dollar Index DX/Y is priced in terms of a weighted basket of major foreign currencies. When we refer to moves in "the dollar," it is this index to which we are referring. The US Dollar Index is a geometrically-averaged calculation of six currencies weighted against the US dollar, which has been in existence since 1973. Futures Contracts were listed on the Index back in 1985 and only one major reconstitution of the Index has taken place since that time, a move to include the Euro.

Today the US Dollar Index contains six component currencies, which are "trade-weighted": the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona, and Swiss Franc. Prior to the formation of the Euro FX, the US Dollar Index contained ten currencies, including as well the West German Mark, French Franc, Italian Lira, Dutch Guilder, and Belgium Franc. Today the currency weights contributing to the pricing of this Index are as follows:

Currency Weights (source: theice.com):

- Euro = 57.6%

- Canadian Dollar = 9.1%

- Japanese Yen = 13.6%

- Sweden Krona = 4.2%

- British Pound = 11.9%

- Swiss Franc = 3.6%

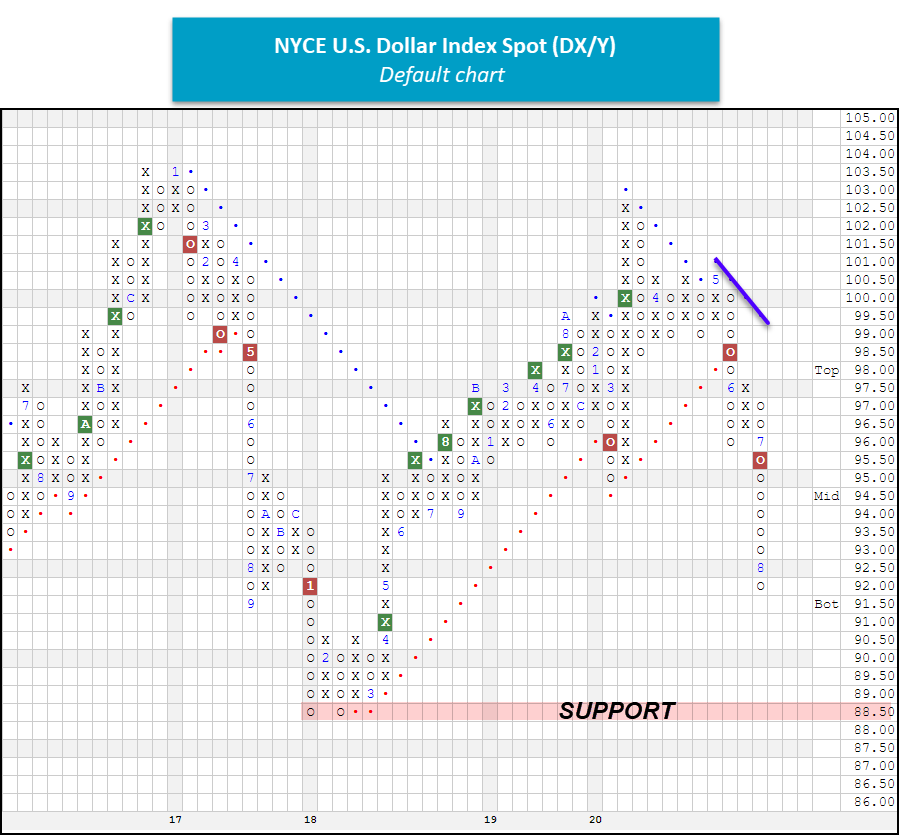

At the end of August, the NYCE U.S. Dollar Spot Index DX/Y was sitting at the $92 level, which is more than 10% off of the chart high at $102.50. As a result, we are now effectively in a falling dollar environment. Prior to this transition, the U.S. Dollar had been in a rising dollar environment since February 16, 2018. While there have been support levels violated along the way, the January/February 2018 low at $88.50 is still intact on the chart. All of this is to say that the potential for a bounce is possible, and investors should not necessarily make big shifts in their allocations based on just the 10% correction alone. As we’ll discuss in the U.S. Dollar Study below certain asset classes fair better than others during falling dollar environments, while others aren’t impacted to a significant degree.

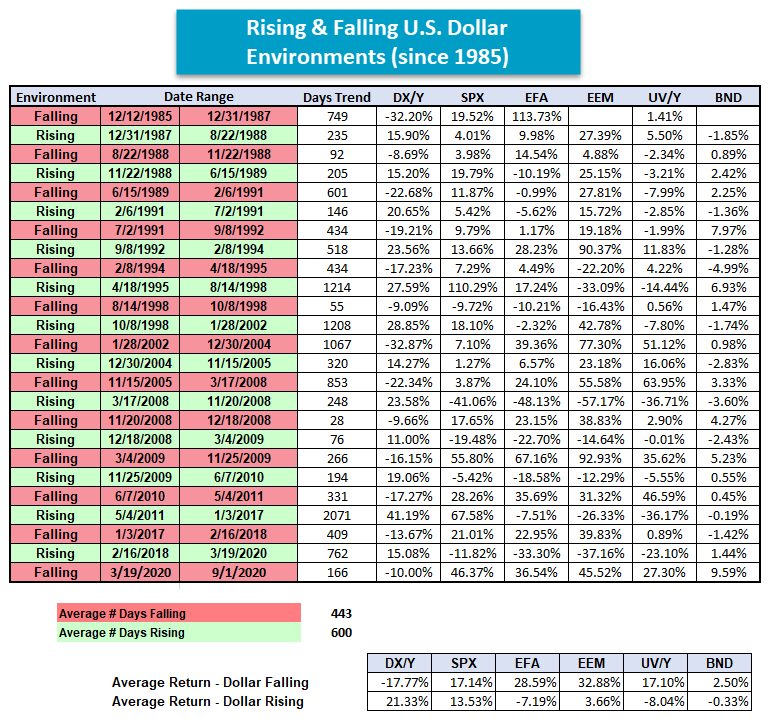

Our data on this NYCE U.S. Dollar Spot Index goes back to the point in time when a liquid market was created for this calculation of the Dollar with the inception of futures contracts on the U.S. Dollar Index (in 1985). Since that time we have seen many significant moves for the Dollar, and we would like to focus on identifying any meaningful correlation between other major asset classes and moves in the underlying currency markets. In other words, do some assets perform better with consistency in a rising dollar market, and vice versa?

Traditional measures of correlation would look at daily or monthly returns of some security, the Dollar for example, and then match up the returns of something else (a bond index perhaps) in the same manner. If bonds were generally up during the same sessions that the Dollar posted gains, they would be considered positively correlated. If bonds were generally down during days (or months) when the Dollar was up, they would be considered inversely correlated. Such data is available elsewhere and didn't truly provide the type of research we wanted to provide to you. Before we began to study this we set out a definition for a "rising dollar market", versus a "falling dollar market."

Study Parameters:

- Rising Dollar Market: Any move of at least 10% from a low constitutes a new "rising dollar market." The beginning of this trend is established at the low watermark and the trend remains in force until a correction of at least 10% occurs, at which point the peak of that rally then marks the end of the rising trend in the dollar. This represents a "trough to peak" move in the dollar, and that time period is what we use to qualify a rising dollar market.

- Falling Dollar Market: Any decline of at least 10% in the dollar index from a peak begins a "falling dollar market". The beginning of this trend is established at the high watermark and the trend remains in force until a rally of at least 10% occurs off a low, at which point the trough of that decline marks the end of the falling trend in the dollar. This represents a "peak to trough" move in the dollar, and the time period within is what we used to qualify a falling dollar market.

Over the last 35 years, there have been a total of 12 rising dollar markets and 12 falling dollar markets (including the recent "rising" stint, which began on February 16, 2018, and ended on March 19, 2020) using our basic criteria. The average duration of a (rising or falling) cycle is 522 days, and results in average moves of about +/- 20% in each direction (keep in mind that the manner in which these trends were calculated means that no trend could have resulted in a move materially less than 10% in either direction). With this most recent rising dollar period that lasted 762 days, the average number of days for a rising dollar environment pushed up to 600. The return for DX/Y during this particular rising environment was +15.08% (2/16/18 to 3/19/20), which is a little less than the +21% historical average. Below we offer you a recap of all the historical rising and falling dollar environments, and associated returns for DX/Y, in addition to other pertinent benchmarks.

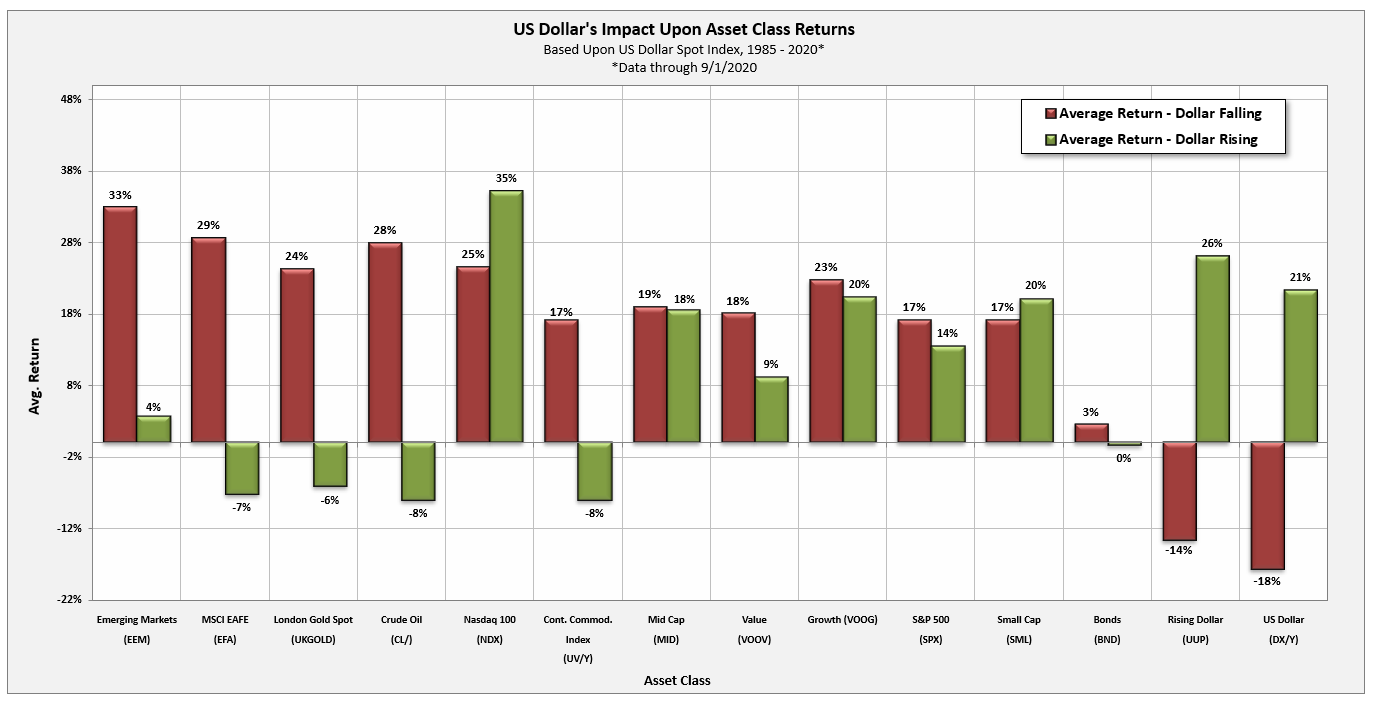

Having identified "rising dollar" and "falling dollar" environments going back to 1985, the next step was to look at various asset classes and their respective performance during these markets. To accomplish this we chose investment vehicles representing US equities, international equities, emerging markets, domestic fixed income, various equity styles (large, mid, small, value, and growth), and commodities. The results were interesting as many assets did show meaningful performance biases during either rising or falling dollar markets. The red bars in the graphics below represent the average performance during all falling dollar markets, while the green bars represent the average performance by that same asset class during all rising dollar markets. For some assets, we did not have data going back to 1985, so returns reflect the average since the time at which we had data (those dates are denoted). In the bullet points below, we have highlighted the notable takeaways about falling dollar environments.

Observations:

- The S&P 500 Index SPX has performed well in both rising dollar and falling dollar markets, with returns of 14% (rising) and 17% (falling).

- Growth stocks tend to perform better than value stocks on average during falling dollar environments – 23% compared to 18%.

- In falling dollar environments international equities tend to outperform US equities. Emerging markets EEM had an average return of 33% during falling dollar periods, followed closely by developed (international) markets EFA, which gained 29%.

- Strong asset classes during falling dollar periods include international equities and commodity indices.

So what does the information in the study mean for our portfolios today? At this point, we would consider it less of a call to action and more of a cause for attention. The US equities asset class is showing superior relative strength over all other asset classes while international equities remains ranked dead last in DALI at #6 with 124 tally signals in its favor. Additionally, while commodities and currencies do fair well, on average, in falling dollar environments, the RS trends don't corroborate that story at this time as both rank in the bottom half of DALI.