We provide a review of the U.S. Dollar's impact on sector returns in rising and falling dollar environments.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 286.79 | 2.06 | Positive | O | 4.19 | 263.13 | +6W | |

| EEM | iShares MSCI Emerging Markets ETF | 45.30 | 1.97 | Positive | Sell | O | 5.02 | 40.91 | -4W |

| EFA | iShares MSCI EAFE ETF | 65.05 | 2.51 | Positive | Sell | O | 2.86 | 62.58 | +1W |

| FM | iShares MSCI Frontier 100 ETF | 25.84 | 3.07 | Negative | Sell | O | 0.91 | 25.73 | +3W |

| IJH | iShares S&P MidCap 400 Index Fund | 193.99 | 1.66 | Positive | Buy | O | 3.08 | 182.50 | -1W |

| IJR | iShares S&P SmallCap 600 Index Fund | 74.82 | 1.58 | Positive | Buy | O | 2.64 | 71.54 | +6W |

| QQQ | Invesco QQQ Trust | 299.92 | 0.55 | Positive | Buy | X | 5.91 | 227.52 | +2W |

| RSP | Invesco S&P 500 Equal Weight ETF | 111.97 | 1.92 | Positive | Buy | X | 3.95 | 104.57 | +6W |

| SPY | SPDR S&P 500 ETF Trust | 352.60 | 1.62 | Positive | O | 4.41 | 308.25 | +7W | |

| XLG | Invesco S&P 500 Top 50 ETF | 280.65 | 1.30 | Positive | O | 5.81 | 232.17 | +8W |

Additional Comments:

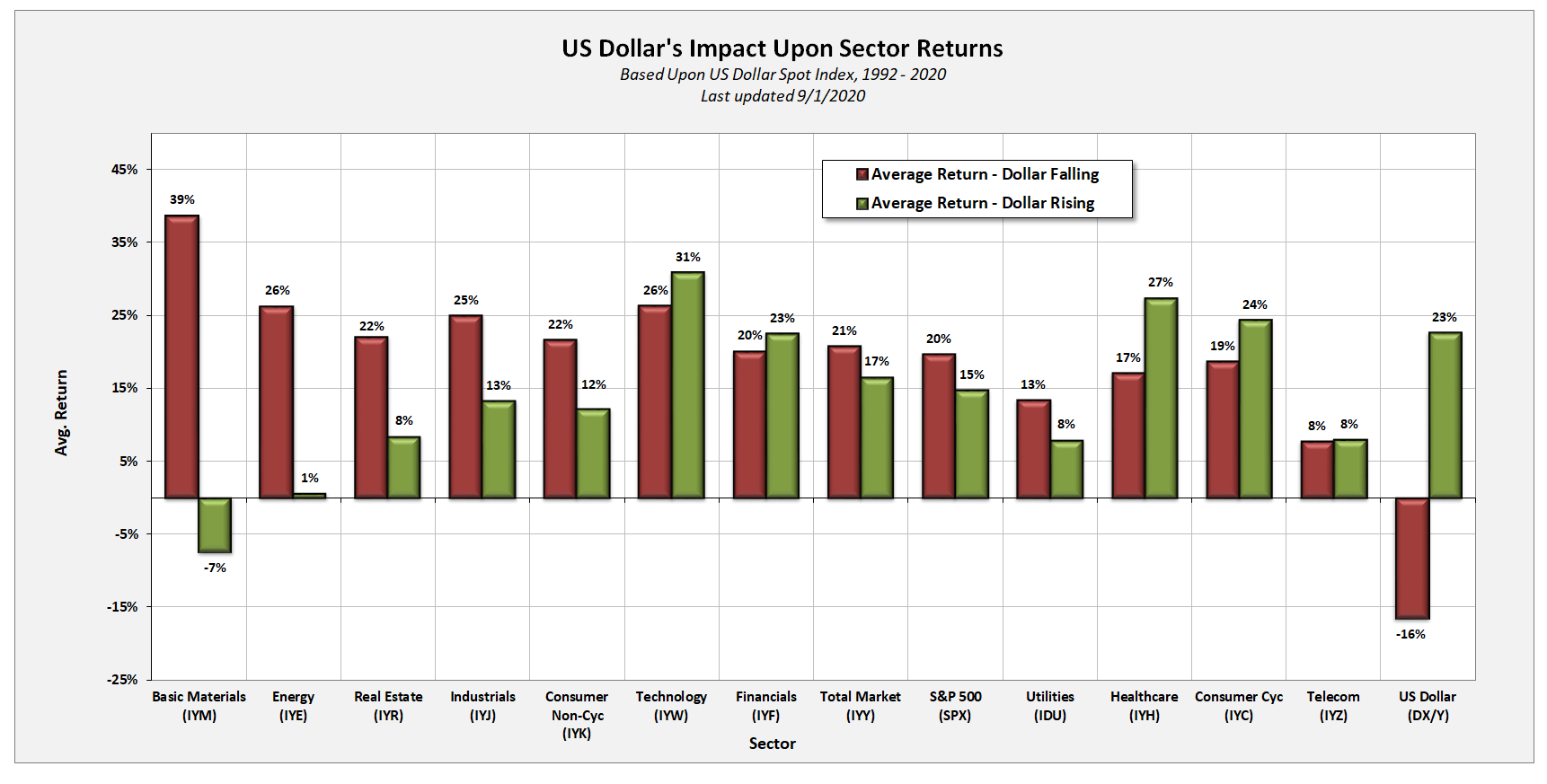

Similar to the asset class study referenced in today’s DALI & US Equity Overview section, we looked at the 11 broad sectors to analyze the U.S. Dollar's impact on the US equity market. Although we had to adjust the time frame of the study a bit based upon data availability, we included sector index data beginning in 1992, affording enough history for a meaningful data sample. Again, our study includes the 11 broad sectors (basic materials, consumer cyclicals, consumer non-cyclicals, energy, financials, healthcare, industrials, technology, telecommunications/comm services, real estate, and utilities). The results of the study are shown below. The red bars represent the average performance during falling dollar markets, while the green bars represent the average performance by that sector during rising dollar markets.

Interestingly, six of the sectors performed better in falling dollar markets, while four performed better in rising dollar markets. Telecom did not see a difference between rising and falling dollar environments, as both produced average returns of 8%. The basic materials sector is the best performing group when the dollar is falling and is also the only sector to post negative absolute returns during rising dollar environments. Energy is the other big beneficiary during a falling dollar market in addition to the industrials sector, which is one of the most improved sectors in our DALI rankings over the last few months. Conversely, when the dollar is rising, technology, financials, consumer cyclical, and healthcare have tended to be the notable winners.