A falling dollar environment historically bodes well for commodities

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email james.west@dorseywright.com.

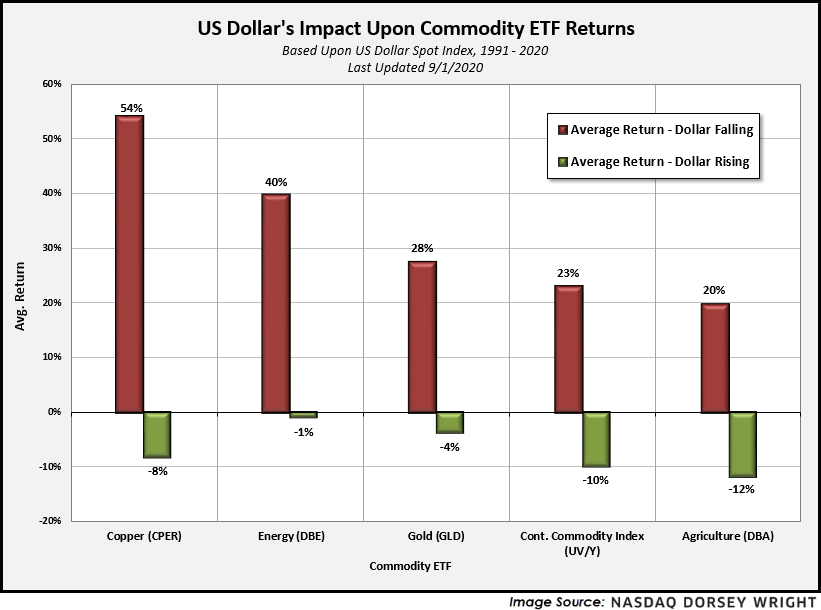

Data represented in the table below is through 9/1/2020:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|

| CL/ | Crude Oil Continuous | 42.93 | Positive | Buy | X | 41.67 | -9W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 283.45 | Negative | Sell | O | 276.47 | +21W |

| DWACOMMOD | DWA Continuous Commodity Index | 524.83 | Positive | Buy | O | 463.56 | -186W |

| GC/ | Gold Continuous | 1976.40 | Positive | Buy | X | 1686.99 | -2W |

| HG/ | Copper Continuous | 3.00 | Positive | Buy | X | 2.62 | -5W |

| ZG/ | Corn (Electronic Day Session) Continuous | 349.25 | Negative | Buy | O | 348.06 | +2W |

Continuing our discussion of a falling dollar’s impact on asset classes, we will now pivot to the alternative assets/commodities space.

It is academically and empirically accepted that commodities tend to perform well in a falling/weakening dollar environment. In fact, according to data beginning in 1985, the average return for a broad basket of commodities in a rising dollar environment is -8% compared to a return of 17% in a falling period. A number of variables are noted to affect commodity prices, many of which are fundamentally tied to potential changes in supply or demand; however, a few qualitative tailwinds behind this finding also stem from commodities being denominated in the U.S. currency. Said more directly, with a falling dollar, commodities become less expensive for overseas buyers, theoretically bolstering demand (Source: wsj.com).

In going a step further, within the broad commodities framework we find areas such as Copper CPER and Energy DBE to perform especially well. According to data beginning in 1991, we note the average return for Copper, the topic of Friday’s (9/4) upcoming feature, to be around 54% in a falling dollar environment compared to -8% in a rising dollar period. In fact, each of the five groups shown below demonstrates slightly negative returns in rising dollar environments and significantly higher returns in the opposite, providing additional confirmation for the already developing technical story as demand for commodities has been rather loud throughout the year.