While the domestic equity improvement has been the major focus of most of our research over the past few weeks, there are certainly other risk-on assets showing near-term improvement, such as commodities.

The domestic equity market has continued to push higher over the past week, with most major indexes either printing or nearing new all-time highs. This has led to further improvement from the US equity core percentile rank (CorePR), which has risen to a recent level of 92.96%, as those large cap names which make up the representative for this reading have outpaced most other investible areas of the market. This continued strength from risk-on assets has led to a further dampening of the money market percentile rank (MMPR), which comes in at a recent posting of 6.34%.

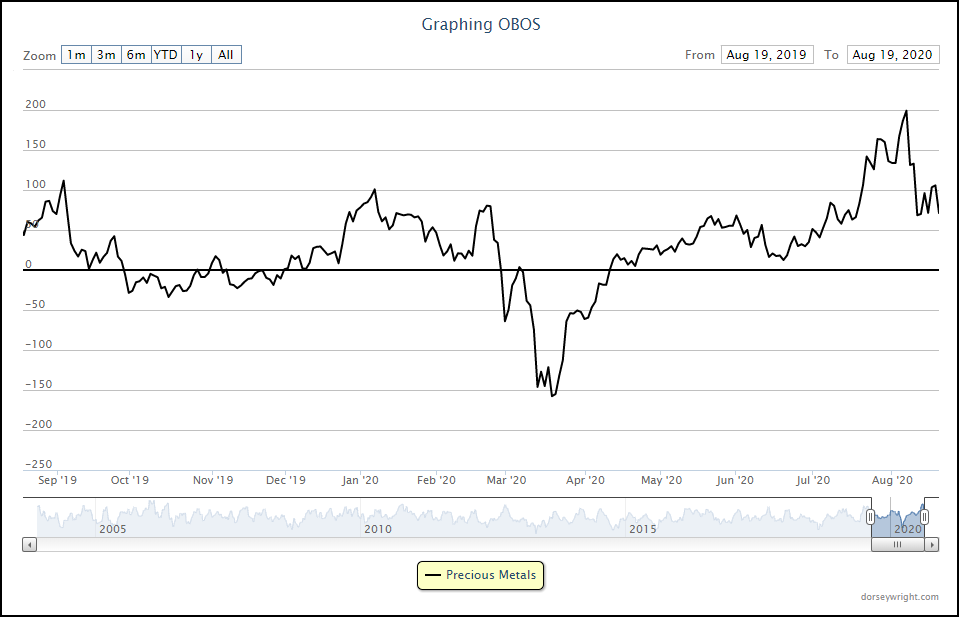

While the domestic equity improvement has been the major focus of most of our research over the past few weeks, there are certainly other risk-on assets showing near-term improvement, such as commodities. The commodities conversation has been largely centered around precious metals throughout most of the market rally, and rightfully so, as the precious metals group on the Asset Class Group Scores (ACGS) page remains in elevated score territory with a recent average score of 4.45. While this is not as high as the 5.12 score that the group posted earlier this month, the space has continued to maintain strength among the top 20 groups on the entire ACGS system. This slight downtick in score also led to normalization of the average overbought/oversold (OBOS) reading for the precious metals group, which climbed as high as 199% on August 6 before dropping to current levels at 71%, potentially providing a more opportune entry point for those looking to gain exposure to the space.

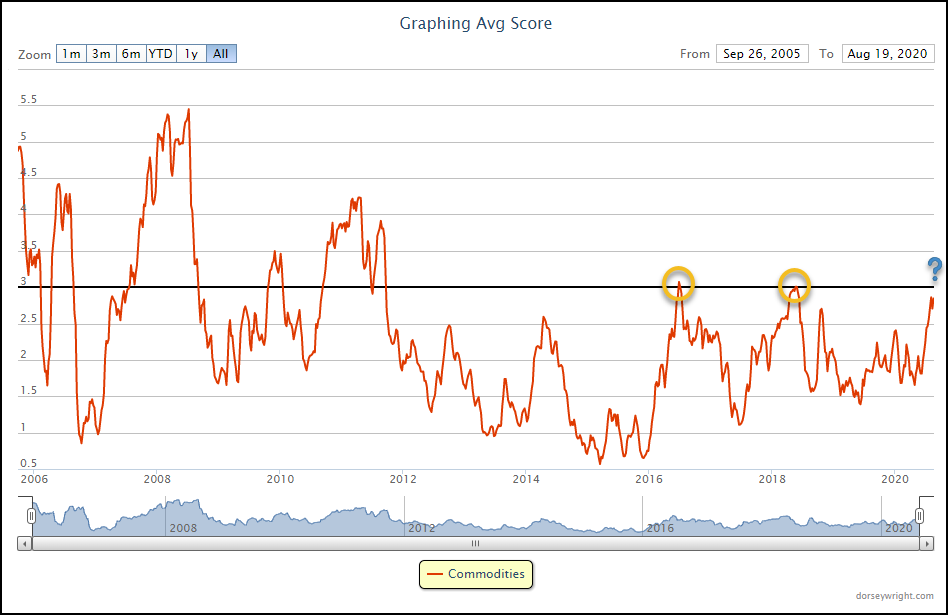

The continued strength of precious metals has led to further improvement from the broader commodities group, which is nearing the sought after 3.00 score threshold with an average score of 2.87. In looking at the score history of this group, we can see that commodities have had difficulty remaining above an average score of 3.00 since 2011. The group saw two occasions since that time where the score did move above 3.00, in July of 2016 and May of 2018, however, the group was unable to maintain a score above 3.00 for more than a couple of days in each instance. While we will see if this recent rise in score plays out differently, the near-term strength demonstrated by various areas within the commodities space certainly paints a positive picture for further improvement.

One of the other areas within commodities that have shown recent progress is agriculture. While this space has yet to move into favorable score territory with an average score of 2.11, we can see through the Group Score Report page that this group is the second most improved group on the entire ACGS page over the past 30 days, moving higher by 0.71 score points (through 8/20). Agriculture has some work left to do in order to reach its year-to-date score high of 2.45 and will be a place to monitor for more upside that has the potential to push the broader commodities space higher.