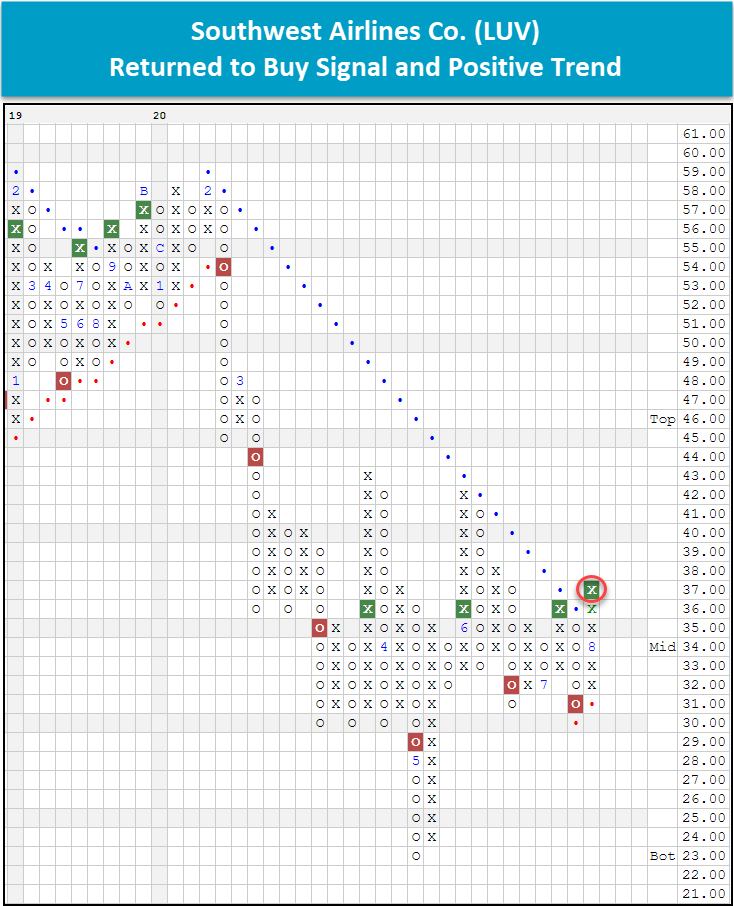

Southwest Airlines (LUV) Reenters a Positive Trend

Upcoming KKM webinar: Join KKM on Wednesday, August 19th at 3 pm ET for a webinar focusing on models powered by Nasdaq Dorsey Wright methodology. The topic will be on "Dynamic & Active: Time to revisit two investment themes (powered by Nasdaq Dorsey Wright) for 2020", which is hosted by KKM and sponsored by Adhesion Wealth. Click here to register.

The pandemic has no doubt changed everyday life for people across the globe, which certainly applies to the way we travel. As many continue to stay at home and restrict their travels to only essential needs, we have seen the airline industry taking a significant hit during this difficult time. While many airline stocks continue to struggle having hit multi-year lows and trade in a negative trend, one stock that caught our attention is Southwest Airlines Co. LUV. The stock hit an intraday high on 8/11 at $37.44 putting the chart on a buy signal. That was also enough to push the stock into positive trend territory for the first time since February of this year, and as a result of that movement, its technical attribute moved from a 0 to a 1. Additionally, its weekly momentum is positive for the first week after having been negative for the last five weeks. While it is too early to make any judgement on the stock or the industry, it is worth keeping an eye on this particular chart for any future improvement that could potentially cause this to become a technically sound candidate.