The US Treasury 10YR and 30YR Yield Indices gave buy signals for the first time since June, each had given multiple consecutive sell signals prior to Wednesday's action.

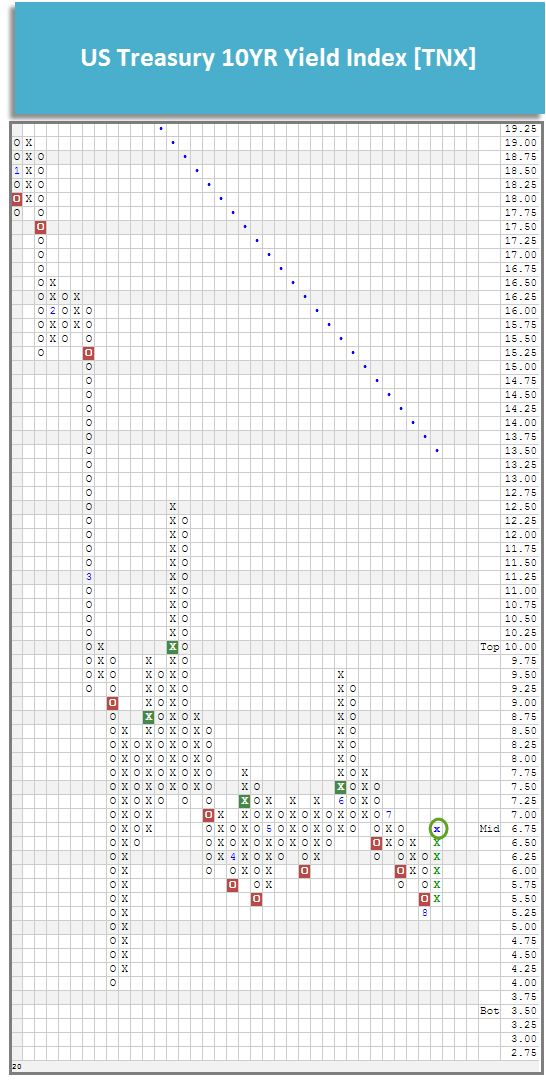

The US Treasury 10YR Yield Index TNX completed a bearish signal reversal in Wednesday’s trading. Prior to Wednesday’s buy signal, TNX had given three consecutive sell signals, and hit its lowest point since March when it fell to 0.525% on its default chart earlier this month. The rise in yields was cited as one factor leading to the sell-off of gold GC/ and silver SI/ which had both been on strong upward trajectories in recent weeks.

There was similar action further out on the yield curve as the US Treasury 30YR Yield Index TYX also returned to a buy signal in Wednesday’s trading when it hit 1.375%. TYX had also given three consecutive sell signals prior to Wednesday.

The buy signals given by TNX and TYX are first sign of potentially rising interest rates that we have seen since June, when both yield indexes rallied to the highest points since February before reversing course and finding a series of lower tops and lower bottoms.

Despite the upward action movement in rates, which contributed to funds like the iShares Barclays 20+ Year Treasury Bond ETF TLT and iShares US Core Bond Fund AGG reversing down into Os on their default charts, the iShares Barclays US Treasury Inflation Protected Securities ETF TIP remains at an all-time high on its default chart as Producer Price Index and Consumer Price Index showed higher than expected inflation this week. Within the Asset Class Group Scores (ACGS) System, the inflation protection group now has an average group score of 4.87 placing it second amongst fixed income groups after convertible bonds.