While the highest-scoring groups have seen little change over the past week, we have seen a notable change in the directional ranking of the ACGS system.

The top end of the Asset Class Group Scores page has remained largely similar over the past week, with equity leadership still coming from those groups that have pushed much of the market higher throughout the recent rally. This includes the technology and healthcare-related sector groups, as well as the growth-oriented size classifications that have been a continued point of focus over the past few weeks. China also continues to score well on the international front, with its group score retreating slightly over the past week, but still maintaining a relatively strong score of 4.63. The Money Market Percentile Rank also continues to remain in low field position, with a recent reading of 14.79% returning the indicator toward its previous rally-low of 14.08% in June.

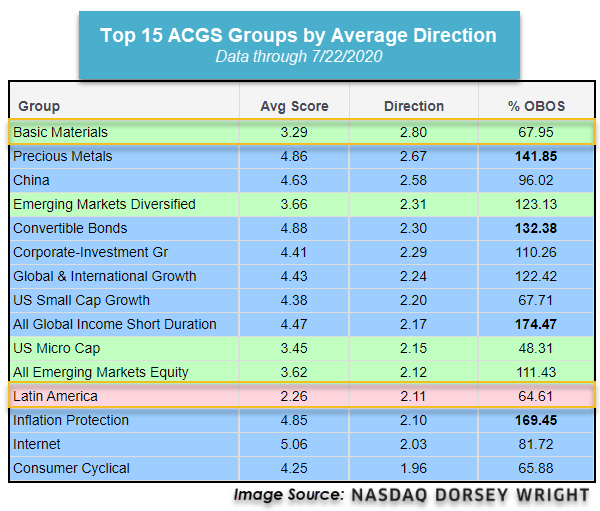

While the highest-scoring groups have seen little change over the past week, we have seen a notable change in the directional ranking of the ACGS system, which can be viewed by simply clicking on the “Direction” column header to the right of the average group score. This view resorts the page by the average score direction of each group, which takes the score change from either a high or low over the past six months for each of the representatives housed in a group and provides the average directional move for the group as a whole. Sorting the page by the highest average direction displays those groups that have shown the most recent score improvement, without regard to the ranking of the group itself. In this view, we can see some variations in the ranking of domestic equity-related areas, as the basic materials group currently possesses the highest average direction of any group on the ACGS system. We can also see that while China still has the highest average direction of any international group, Latin America has shown a somewhat surprising improvement in its average score as well.

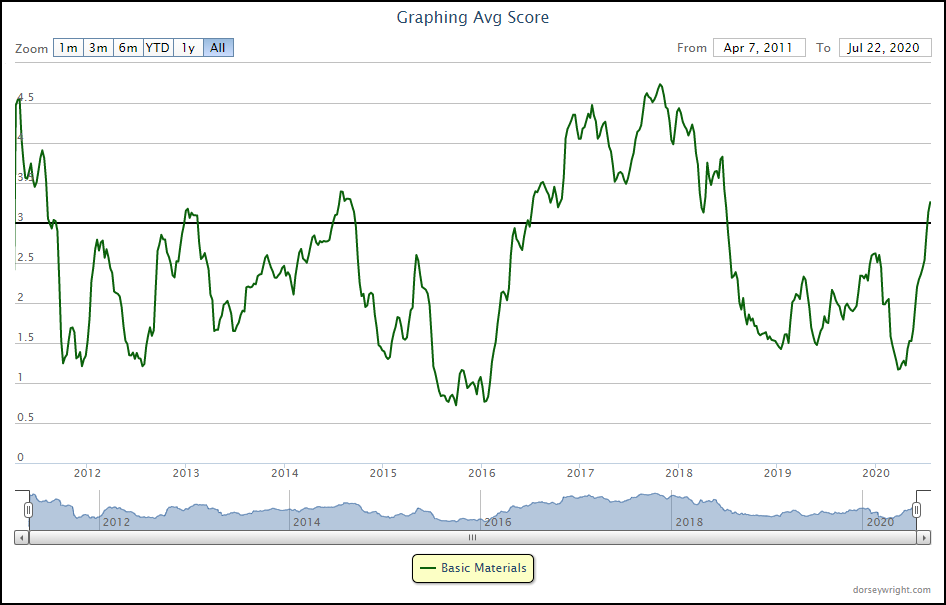

Focusing on basic materials first, we can see that the average direction of 2.80 is actually the highest score direction in the history of the group, dating to April 2011. This has aided the average score of the group to a recent posting of 3.29, marking its highest score in over two years. This group has struggled to maintain a high group score over the years, spending most of its time in low field position with a group score below 3.00. The most recent ascent came from a score low of 1.12 on March 27th, which was the lowest reading the group had seen since February of 2016. While each market environment is certainly different, the last movement higher from this washed-out territory saw the group maintain a score north of 3.00 for almost two years, making the basic materials space a sector to monitor over the next few months. Despite its strong average score direction, the sector is not as heavily overbought as other areas of the domestic equity market, printing a recent average overbought/oversold (OBOS) reading of only 67.95% overbought. For comparative purposes, we can see that the group with the second-highest score direction, precious metals, saw a recent average OBOS reading of 141.85%.

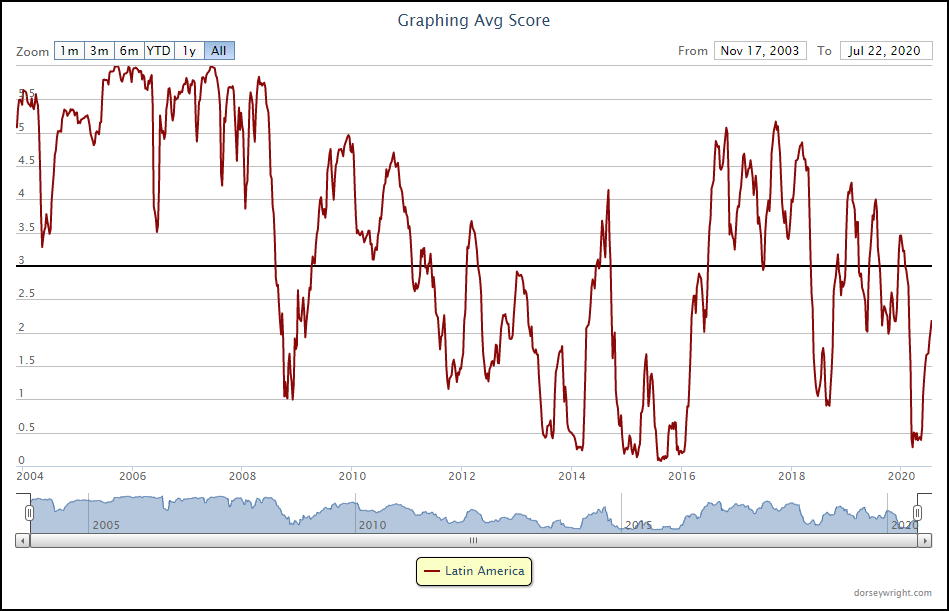

Another group that has shown surprising recent upside movement in score is Latin America, with an average direction of 2.11. Although the group still possesses a less than favorable average score of 2.26, it should be noted that the Latin America group has been no stranger to sharp score movements over its 16+ year group history. Some of these sharp score increases from very low field position have ultimately led to sustained periods of score strength, such as early-2009 through early-2011, and much of mid-2016 through early-2018. It is also important to keep in mind that the sharp movements upwards have also been followed by further score deterioration on several occasions, leading the Latin American space to be reserved for those seeking more aggressive, “bottom-fish” plays in the current market environment. We would ideally like to see further technical improvement, such as an average score reading above 3.00, before looking to gain exposure to the region. Those looking to keep monitor further score movement for the group can utilize the Alerts column to be notified of any further score improvement, or deterioration, on the ACGS page.