Upcoming webinars and events and a change in the CURRSHARES model.

Market Update Webinar Replay: Missed Monday's webcast? Click the link(s) below for a recap.

Mid -Year Market Review: Join the Nasdaq Dorsey Wright team on Wednesday, July 29 at 1 pm EST as we discuss the volatile market movement through the first six months of the year and what to monitor in the second half of 2020. Click here to register.

Speakers include:

- Jay Gragnani, Head of Research and Client Engagement

- John Lewis, CMT, Senior Portfolio Manager

- Jamie West, CFA, Senior Analyst

- Chuck Fuller, Senior Vice President, Applied Research

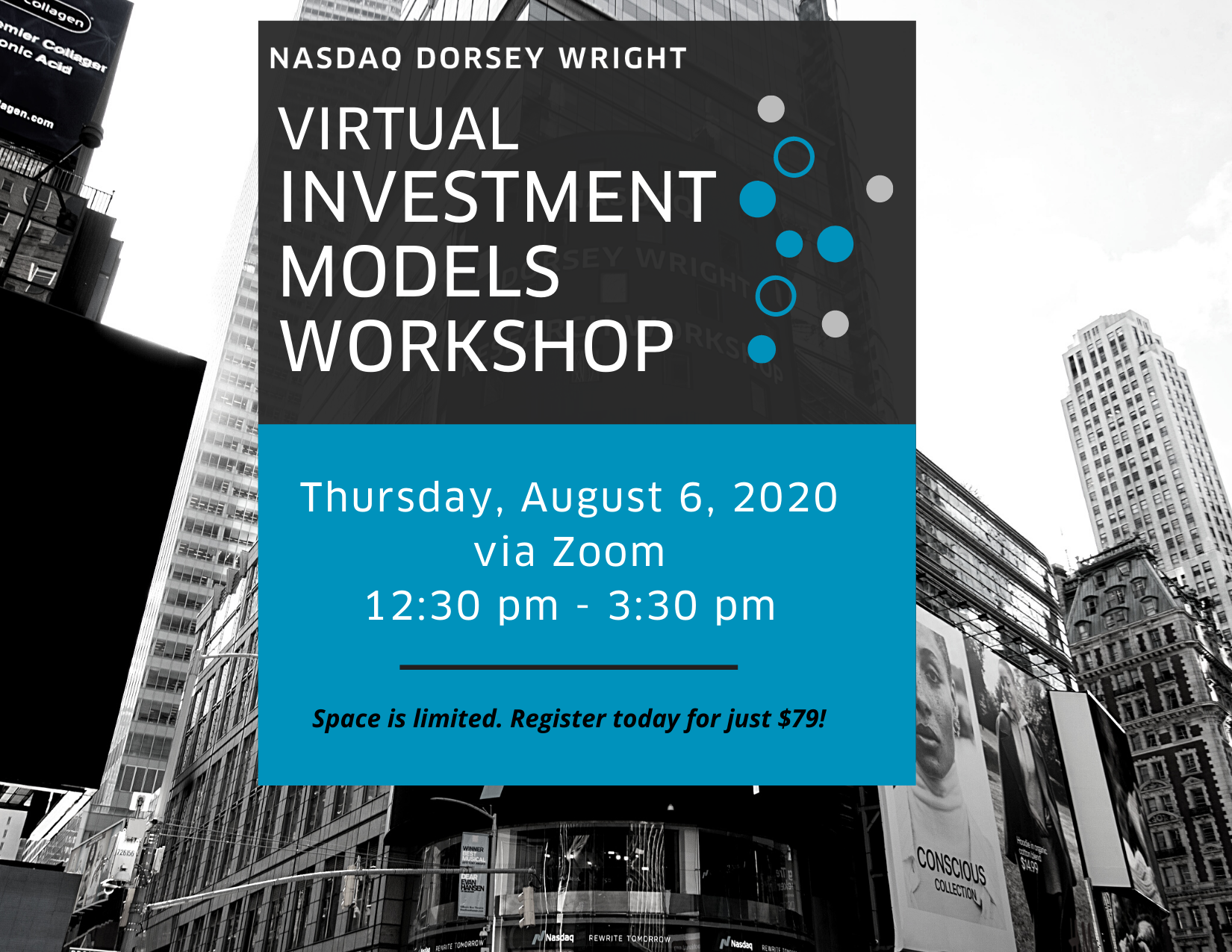

Virtual Investment Models Workshop: The Investment Models Workshop is designed specifically for financial professionals looking to incorporate Nasdaq Dorsey Wright's (NDW) turnkey model solutions into their investment practice, as well as those who would just like to learn more. This three-hour virtual course will not only give you the chance to engage with experts from NDW, but will also expose you to new strategies, investment frameworks, and best practices for utilizing the NDW Research Platform to help you manage your business with more confidence, efficiency, and greater scale. Investments & Wealth Institute® has accepted the Nasdaq Dorsey Wright Investment Models Workshop for 3 hours of CE credit towards the CIMA®, CPWA®, CIMC®, and RMA certifications. The workshop will take place on Thursday, August 6 from 12:30 pm - 3:30 pm EST. Click here for more information.

As a result of yesterday’s market action (7/21), the DWA Currency Model CURRSHARES experienced a change, selling its position in our Money Market Proxy using the 13 Week T-Bill MNYMKT as it sufficiently fell out of favor in the matrix. MNYMKT had been a holding in the model since January 2019, and during that time, it posted a gain of 2.34%. Replacing MNYMKT is the Invesco CurrencyShares Australian Dollar Trust FXA as it has moved up to the top of the matrix. The last time FXA was in the model was back in May 2017. In addition to holding FXA, the model also holds the Invesco CurrencyShares Euro Trust FXE and the Invesco CurrencyShares Swiss Franc FXF, at 33% each.

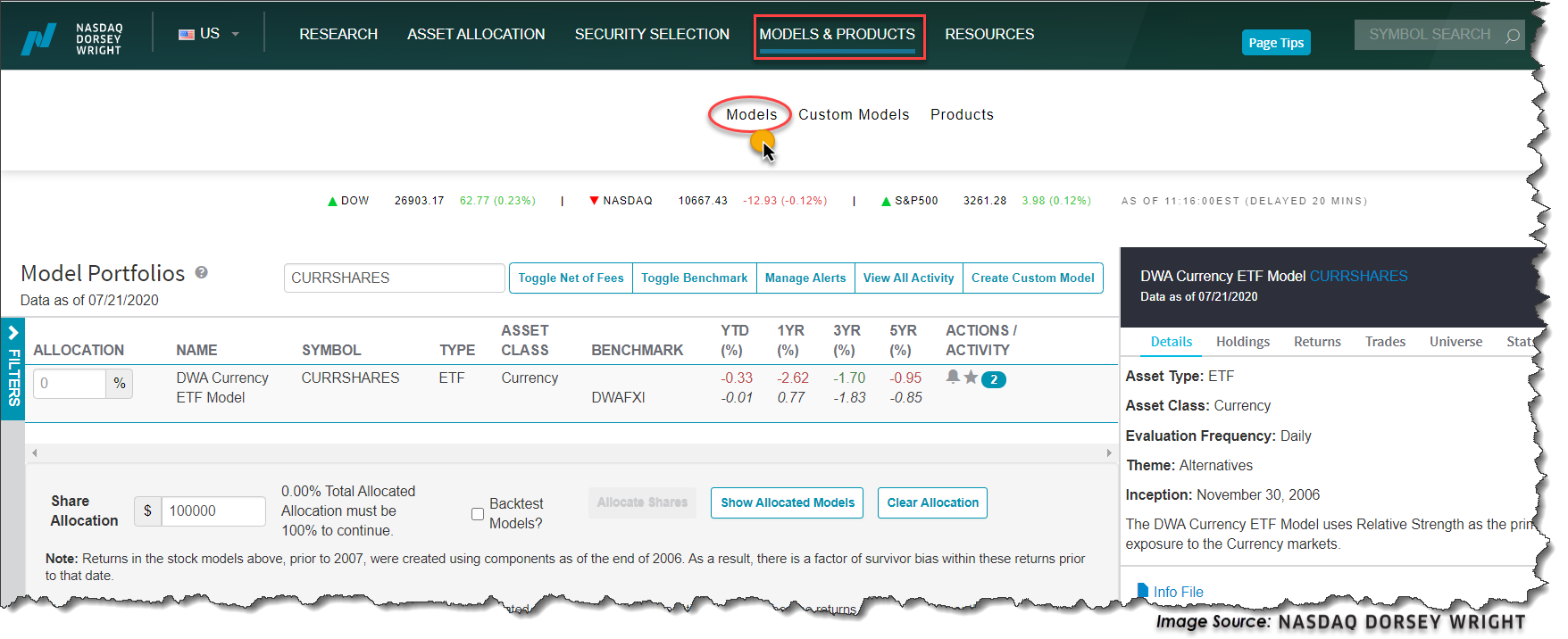

For those unfamiliar with this currency model, it is a provider-agnostic model with 11 currency-based ETFs including cash. It is designed to hold the three strongest positions at all times as demonstrated by relative strength. For more information, visit the Models page located under the Models & Products menu.