We review broad asset classes using ETF constituents to provide a Q2 2020 performance update

Market Update Webinar Replay - Missed Monday's webcast? Click the link below for a recap:

Market Fact: Since 1987, the 1st of July has produced positive returns for the S&P 500 Index SPX approximately 85% of the time (including today's positive return). This is the best rate of success relative to all 11 other months.

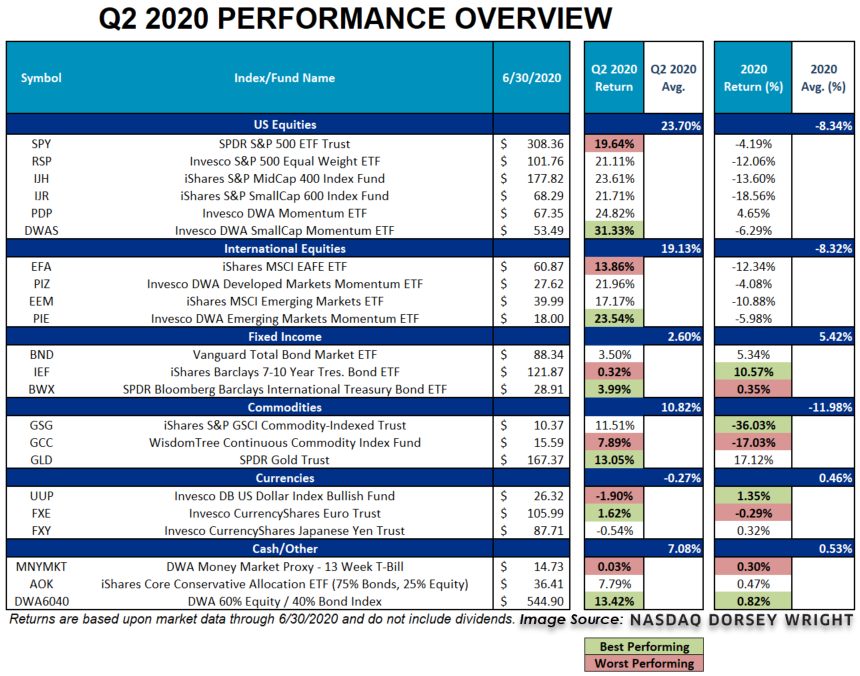

Q2 2020 Performance Update: With the end of Tuesday’s trading session, we closed out Q2 2020. As we do each quarter, we wanted to take this opportunity to summarize the performance of various asset classes using ETF proxies.

The second quarter of 2020 diverged sharply from the prior quarter, with all broad asset classes except currencies advancing. Fixed income remains, far and away, the broad asset class leader on the year after notching additional gains on the quarter. However, equities grabbed headlines over the past three months as both domestic and international asset class fund constituents contributed strong double-digit gains on average. In fact, the S&P 500 Index and in consequence, the SPDR S&P 500 ETF Trust SPY, posted its best quarterly gain since 1998. Despite the recent turnaround across risk assets including equities and to a lesser extent, commodities, all three asset classes remain in the red on the year.

The returns above are price returns and do not include dividends or all potential transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss. MNYMKT is internally maintained and calculated by Dorsey Wright and represents the performance of the 13 week T-bill. DWA6040 is internally maintained and calculated by Dorsey Wright and represents a 60/40 split between SPX and BND, rebalanced daily.