With the second quarter coming to a close earlier this week today we will review some of the best and worst performing ETFs last quarter as well as over the previous six months.

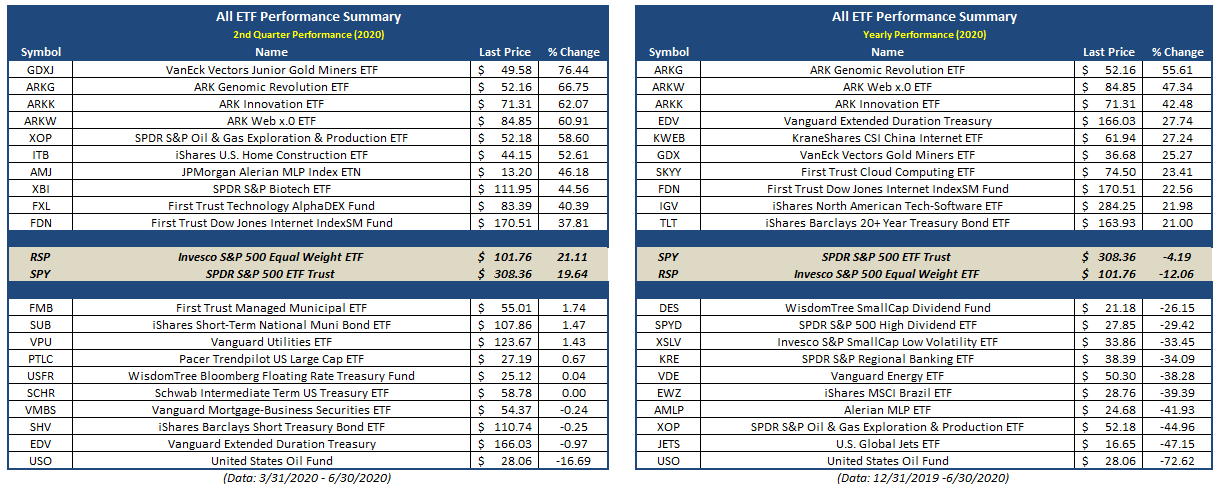

With the second quarter coming to a close earlier this week today we will review some of the best and worst performing ETFs last quarter as well as over the previous six months. Starting with Q2 2020 performance, the VanEck Vectors Junior Gold Minors ETF GDXJ takes the prize as the best performing ETF in Q2 (excluding leveraged and inverse) with a return of 76%. Other notable names at the top of the list include a few from ARK like Genomic Revolution ARKG, Innovation ARKK, and Web x.0 ARKW all produced gains in excess of 60% for the quarter. Some of the other themes among the top performing names in the second quarter were energy, technology, and biotech. One the other hand, those ETFs at the bottom of the list were mostly fixed income related ETFs while the United State Oil Fund USO continued it’s volatile ways ultimately posting a return of -16.69% for the second quarter.

On a year-to-date basis, many of the themes we saw in the second quarter performance have been consistent with performance this year, overall. The ARK Genomic Revolution ETF ARKG is the best performer on the year with a return of 55.61% followed by a number of other thematic growth ETFs like the aforementioned ARK products, cloud computing, internet and software. Interestingly, China Internet KWEB also made an appearance in the top ten along with a couple long-term US Treasury ETFs. Not too surprisingly, USO is the worst performing ETF on the year drop more than 72% thru the end of June while the US Global JETS ETF JETS is down more than 47%.

Unless otherwise stated (or denoted by “.TR”), performance returns for equities, ETFs, indexes do not reflect dividends and are based on the last sale for the date requested. Returns do not reflect all potential transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

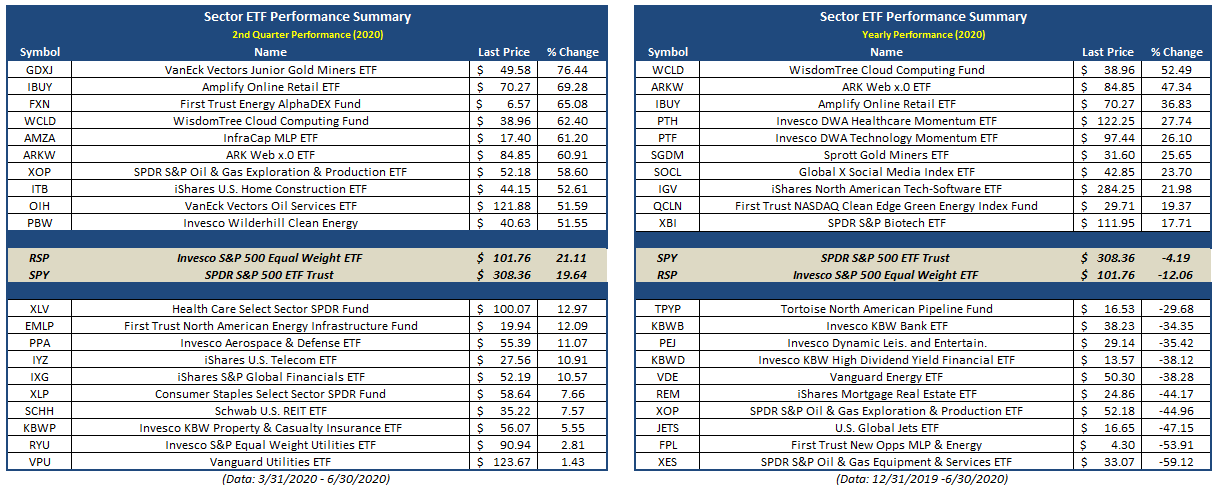

From a sector perspective Junior Gold Miners GDXJ was at the top on the list followed by Online Retail IBUY, First Trust Energy FXN, Cloud Computing WCLD, MLPs AMZA, and ARK Web x.0 ARKW all of which were up more than 60% in the second quarter. Utilities and insurance ETFs were among the laggards in the second quarter as the Vanguard Utilities ETF VPU was only up 1.43% while the S&P 500 ETF SPY was up nearly 20%.

Thematic technology ETFs remain a top of the list of best performers for the year as well as Healthcare Momentum PXH and Technology Momentum PTF which are up 28% and 26% respectively. On the other hand, it’s not too surprising to see a number of energy-related ETFs within the bottom performers as well as the JETS ETF and Leisure/Entertainment PEJ.

Unless otherwise stated (or denoted by “.TR”), performance returns for equities, ETFs, indexes do not reflect dividends and are based on the last sale for the date requested. Returns do not reflect all potential transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.