We review the best and worst-performing ETFs within international equities during the second quarter of 2020

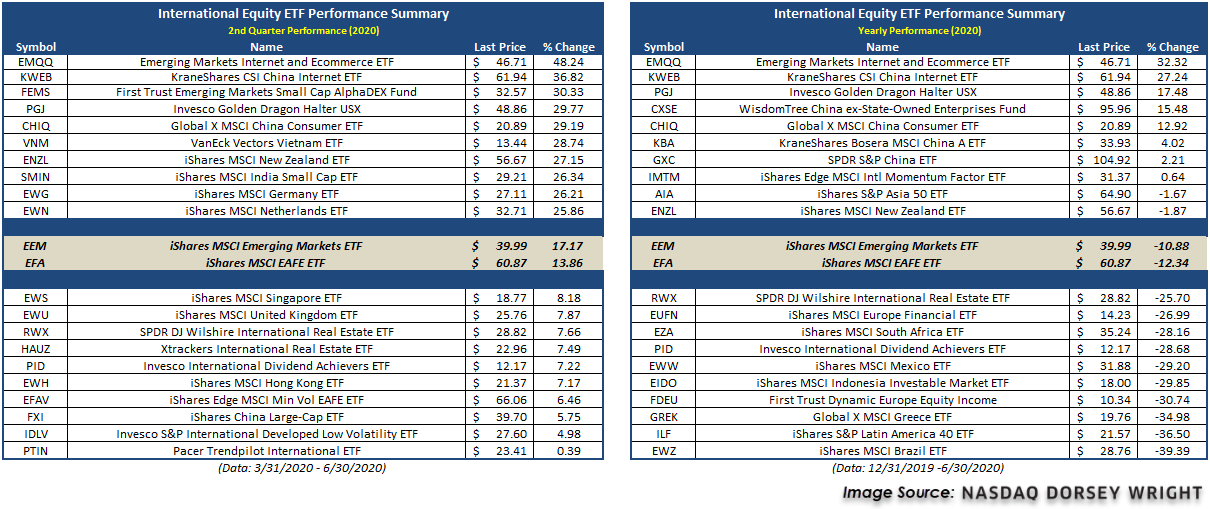

The second quarter of 2020 saw most global equity markets rally significantly after a dreadful first quarter, with international equities showing notable improvement across the board. The broad iShares MSCI Emerging Markets ETF EEM and iShares MSCI EAFE ETF EFA each posted double-digit returns over the past three months, gaining 17.17% and 13.86%, respectively. Furthermore, each international equity fund in our examination was in the black in Q2, a sharp turnaround from the first quarter that saw no international equity representatives post positive returns. China continues to lead the way for most foreign equity markets, with additional participation coming from other countries in Asia. We have highlighted some noteworthy observations from our quarterly performance review below, looking first at the best/worst performers over the past three months, followed by an update on where we sit on a year-to-date basis.

Second Quarter Returns

- Almost all of the top 10 performing international funds stem from emerging markets, with China showing 3 representatives.

- Emerging market internet and e-commerce showed significant strength, with EMQQ posting the best return over the past three months at a gain of 48.24%.

- Some European representatives also showed significant improvement, with Germany EWG and the Netherlands EWN each advancing by more than 25%.

- Low volatility and dividend-oriented funds made up the bulk of the worst-performing international funds.

- International real estate also had multiple funds represented in the bottom 10 performers.

Year-to-date Returns

- Chinese equities make up 6 out of the top 10 performing international equity funds over the first six months of the year.

- Emerging market internet and e-commerce is also the best performing fund on a year-to-date basis, with a gain of 32.32%

- Brazil EWZ and broader Latin America ILF were the worst-performing international areas in the first half of the year, down -39.39% and -36.50%, respectively.

- International dividend achievers PID and international real estate RWX have shown significant underperformance on the year thus far, each posting losses worse than -25%.