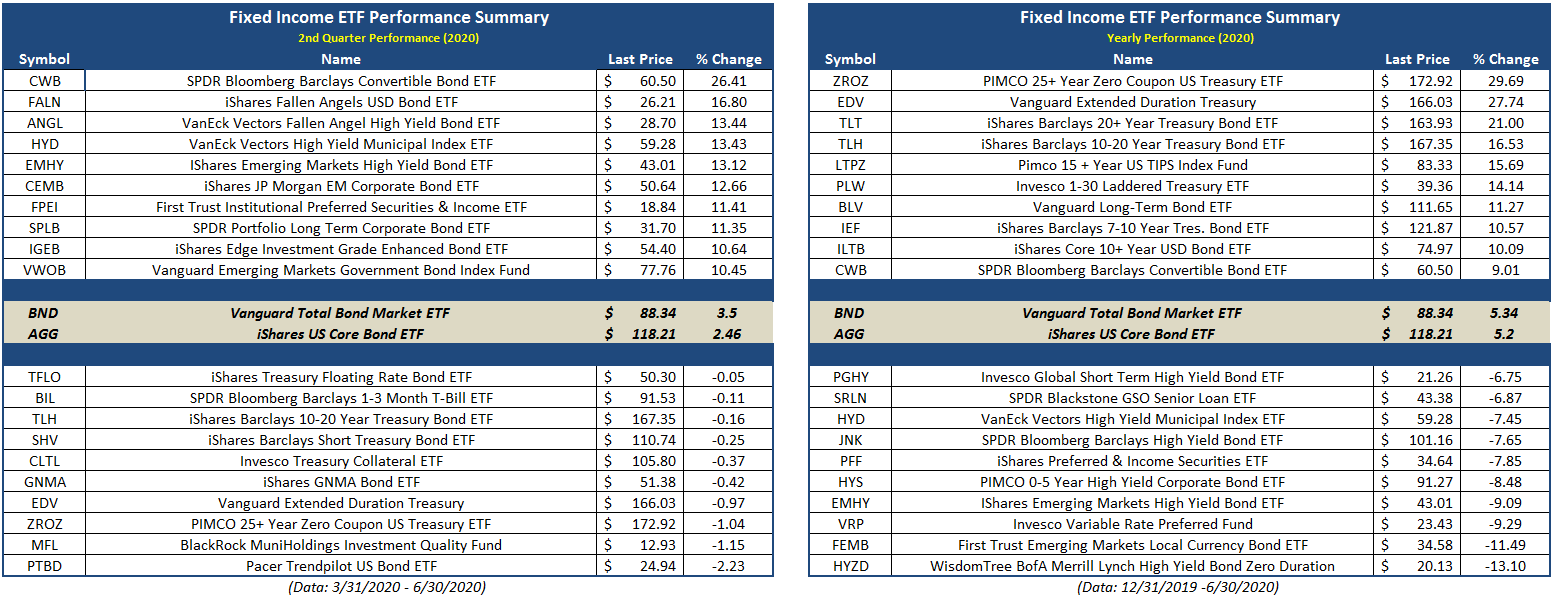

As we do each quarter, we review the performance of the fixed income ETF universe.

As we do each quarter, we review the performance of the fixed income ETF universe. The rankings of best- and worst-performing ETFs is below, followed by commentary.

- Convertible bonds were the best performing fixed income segment in Q2, lifted by the strong rebound of the US equity market.

- High yield bonds were also top performers as high yield spreads, which had blown out during the Q1 sell-off, rebounded in Q2 as markets stabilized. However, high yield funds were among the worst performers year-to-date as, despite narrowing in Q2, spreads remain well above late 2019 levels.

- Foreign bonds also had a strong Q1 showing, aided by the decline of the US dollar late in the quarter.

- Long duration bonds were among the worst performers for the quarter as rates rose slightly from their Q1 lows. However, long duration funds still dominated on a year-to-date performance basis as rates remain well below where they were at the beginning of the year.

- Floating rate and short-term bonds were also among the worst Q2 performers. However, this is more a reflection of the tailwinds for many other areas of the fixed income market than is of weakness in these groups.