Amid the seemingly ever-present gloom and doom, we note positive action on the charts for major large-cap equity indices today, each advancing past near-term resistance levels.

- Upcoming Webinar: Technical Market Update featuring Jay Gragnani hosted by First Trust: Tuesday, April 7 at 11:00 am EST - Use the dial-in information in the invite image below.

Amid the seemingly ever-present gloom and doom, we note positive action on the charts for major large-cap equity indices today, as each advanced past near-term resistance levels. The S&P 500 SPX and the Nasdaq Composite NASD returned to buy signals on their default point and figure charts today, as the indexes gained 7.03% and 7.33%, respectively, while the Dow Jones Industrial Average DJIA climbed even higher with a daily gain of 7.73%, also returning its default chart to a buy signal.

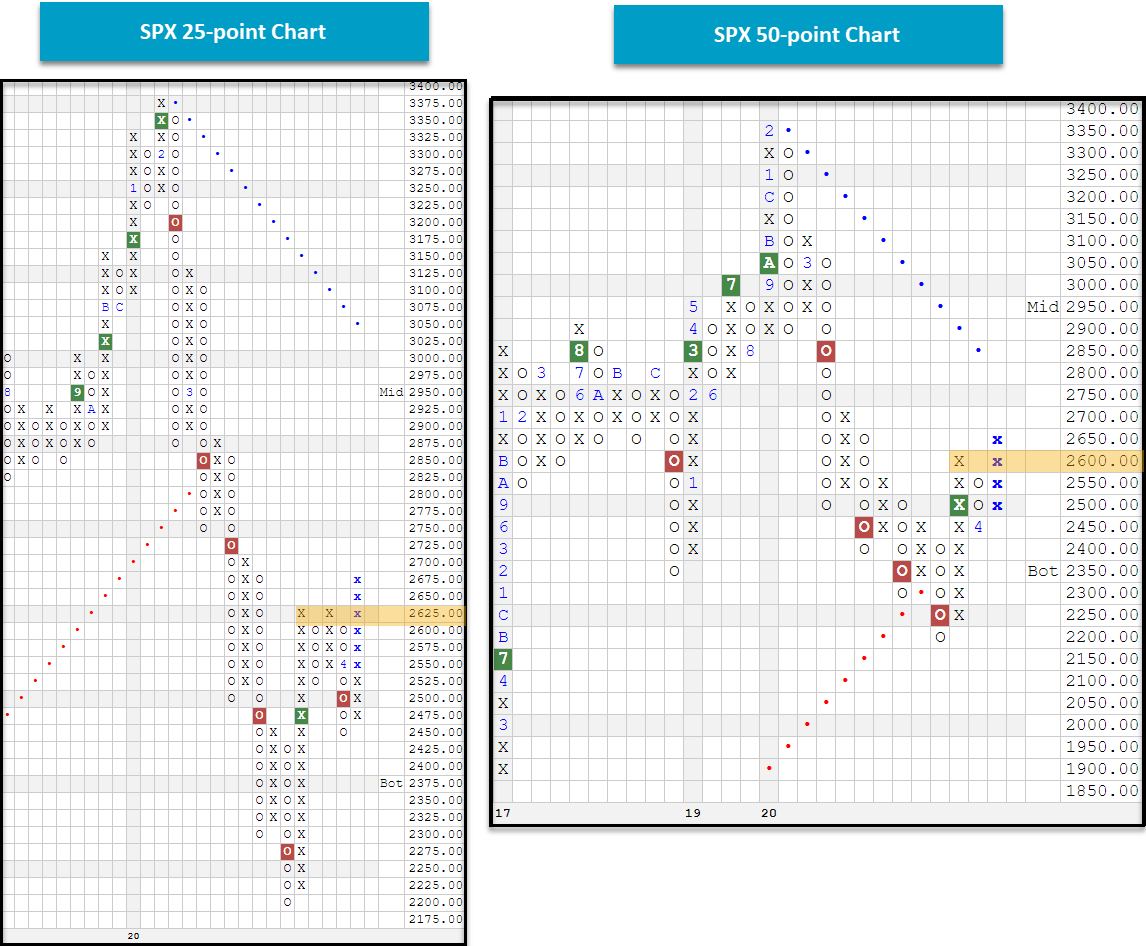

As evident on the default charts for the major large-cap equity indices and many individual charts for that matter, increased levels of volatility can muddy the relationship between supply and demand at first glance with large daily price fluctuations; and due to such, reviewing charts on alternative scales can prove beneficial. For example, when reviewing SPX on a 50-point (long-term) chart we note today’s action resulting in a second consecutive buy signal and inevitable higher bottom. When reviewing SPX on a slightly more sensitive 25-point chart, we find the index returning to a buy signal with a triple top break at 2,650. Note how each of these scales suggested resistance in the 2,600 – 2,650 range, adding further significance to the move today. If looking at NASD on a 100-point chart we also see a notable level of resistance breached with a move to 7,900 today, returning the index to a buy signal, while the 200-point chart for the DJIA also broke a triple top at 22,600.

Remember that a scale is considered appropriate when signals lead to consecutive signals, and changes in the trend are indicative of longer-term movements in price. While the weight of the evidence still suggests a defensive posture toward equities in aggregate, the movement today is notable in that it indicates near-term strength/improvement across various scales.