Daily Summary

Opportunities Using Options in Today's Market

Today, we discuss timely and relevant ways to utilize options in your investment practice with a focused emphasis on the Implied Momentum Bellcurve and the OptionsPlay integration.

Daily Equity Roster

Today's featured stock is Chewy, Inc. Class A (CHWY)

Analyst Observations

ACA, AMGN, CDNS, DIS, ETSY, FIVN, JNJ, NWN, PG, PM & PYPL.

Daily Option Ideas

Call: Amgen (AMGN), Put: Travelers (TRV), Covered Write: Microsoft Corp (MSFT)

- Upcoming Webinar: Technical Market Update featuring Jay Gragnani hosted by First Trust: Tuesday, April 7 at 11:00 am EST - Use the dial-in information in the invite image below.

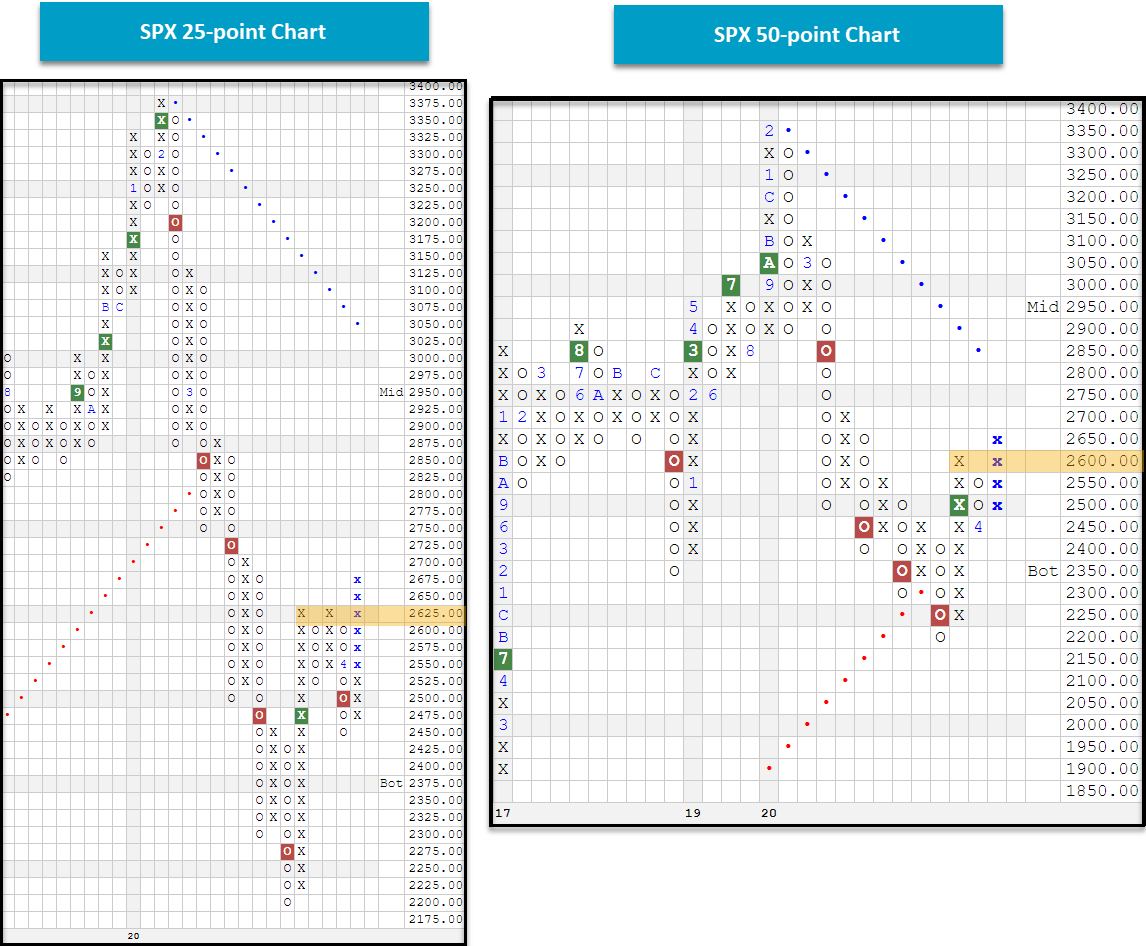

Amid the seemingly ever-present gloom and doom, we note positive action on the charts for major large-cap equity indices today, as each advanced past near-term resistance levels. The S&P 500 SPX and the Nasdaq Composite NASD returned to buy signals on their default point and figure charts today, as the indexes gained 7.03% and 7.33%, respectively, while the Dow Jones Industrial Average DJIA climbed even higher with a daily gain of 7.73%, also returning its default chart to a buy signal.

As evident on the default charts for the major large-cap equity indices and many individual charts for that matter, increased levels of volatility can muddy the relationship between supply and demand at first glance with large daily price fluctuations; and due to such, reviewing charts on alternative scales can prove beneficial. For example, when reviewing SPX on a 50-point (long-term) chart we note today’s action resulting in a second consecutive buy signal and inevitable higher bottom. When reviewing SPX on a slightly more sensitive 25-point chart, we find the index returning to a buy signal with a triple top break at 2,650. Note how each of these scales suggested resistance in the 2,600 – 2,650 range, adding further significance to the move today. If looking at NASD on a 100-point chart we also see a notable level of resistance breached with a move to 7,900 today, returning the index to a buy signal, while the 200-point chart for the DJIA also broke a triple top at 22,600.

Remember that a scale is considered appropriate when signals lead to consecutive signals, and changes in the trend are indicative of longer-term movements in price. While the weight of the evidence still suggests a defensive posture toward equities in aggregate, the movement today is notable in that it indicates near-term strength/improvement across various scales.

With equity markets experiencing continued turbulence amid the advance of the COVID-19 outbreak, an awareness of potential tools available to investors is more essential than ever. The use of options in your investment practice can offer flexibility in the form of taking directional bets with limited capital exposure, generating income, or hedging existing positions. Although most of you undoubtedly have your hands full with client calls, quarterly adjustments, and tactical posturing, understanding your “options” can provide you with alternative ways to play this rapidly-changing market and potentially earn new business during this trying time.

As a refresher, Options are financial instruments that are derivatives based on the value of underlying securities, such as stocks or ETFs. There are two types of options: calls and puts. Call buyers seek to participate in the upside price movement of an underlying security and have the right to purchase said security if the option moves “in the money.” Call sellers take the opposite side of the trade, generally betting that the price of the underlying security will stay below the strike price of the option at expiration and generating premiums for selling the obligation to deliver the shares should they move “in the money.” Put buyers, on the other hand, benefit when the price of the underlying security moves lower, as they own the right to sell shares at the option’s strike price. Put sellers take the opposite side of the trade and collect premiums for the obligation to be “put to” the shares should the underlying price be hit. Simply put: investors buy options when they want the right to participate in a security’s directional move and may do so for capital appreciation or to hedge a long or short position by taking the opposite directional trade (ie. buy a call to hedge a short position, buy a put to hedge a long position). It is also important to remember that one option contract provides a right or obligation to 100 shares of the underlying security, meaning that when you purchase an option contract or contracts, you must account for the number of shares represented by the number of contracts bought or sold. For example, if you bought 3 Microsoft MSFT call options for $1, your total out-of-pocket cost would be 3 x $1 x 100, or $300. Today, we are going to show you a few timely and relevant ways to utilize these instruments in the current market environment.

Using and Interpreting the Implied Momentum Bellcurve

The Implied Momentum tool, which can be found under Asset Allocation > Distribution Curves > Implied Momentum Bellcurve is built around the "Zone Concept," developed and pioneered by the late Jim Yates. Jim Yates developed the "Zone Concept" using a "bell-curve" distribution but applied to the investment world. Jim's zonal tool was so simple that it was basically "Normal Distributions for Dummies". What Jim had created was an elegant way of viewing the market in terms of that bell curve distribution, such that anyone between the ages of 8 and 80 could understand it. He did so by creating an implied volatility calculation for stocks based upon their option premiums. He took an at-the-money option, worked backward through the Black & Scholes model, and ultimately determined the volatility of the underlying stock needed to warrant that option price the market had agreed upon. He simply used the market to provide a volatility measurement to him for all optionable securities. The net result was a way of placing each stock on its own bell curve, based upon where its current price was within the natural volatility range that the market had agreed upon through the options pricing. Jim organized the market into "zones" by simply placing each stock (by symbol) on a big bell curve based upon where they resided on their individual distribution (shown in the image below), ultimately providing a beautiful visual of the market. There were 6 "Zones," equal in size to one another, and we know from statistics 101 class that 66% of our occurrences will appear in the "middle" of that curve for normally distributed data. Whether we are referring to the height of men around the world, or blood pressures across developed countries, 66% of the data points should reside within +/- one "Zone" (or standard deviation) above or below trend (or mean rather). We consider trend to be an intermediate-term moving average for the stock. The Zones then add perspective to how far above or below "normal" a stock, or the market as a whole, have become. If 66% of the time the market is middling then the right strategy for an investor is a relatively neutral strategy 2/3rds of the time. The Covered Write, for instance, is a "right answer" for most stocks in most markets, as shown below, and in extreme conditions like today's market, more extreme postures are validated.

The Implied Momentum Bell Curve for S&P 100 Index OEX constituents (shown below) shows how the 100 OEX stocks, which are typically the most well-known and widely-owned U.S. stocks, are skewed to the oversold side of the curve, as most stocks are located between Zones 1-3, with a particular emphasis on Zone 1. The curve has shifted to left significantly since late February when large-cap domestic equity indices were trading near all-time highs. At that point in time, the curve resembled a more evenly-distributed bell curve with the majority of constituents residing in Zones 3-5.

Buying Calls

Stocks in Zone 1 can be examined for potential long call ideas, especially for those looking for securities that might offer "mean reversion" opportunities following the recent market sell-off. Many of the stocks in Zone 1 are typically short-term laggards and are often the types of stocks that you try not to get married to. In some cases, they may have experienced a short-term pullback and other times they are going through long term corrections. Additionally, Zone 1 stocks are good candidates for short-term trading purposes since you have a pre-determined amount of risk -- the price of the option. When purchasing calls, we use a couple of general guidelines. We want to go out several months, usually about three to six months, to give the option time to work. We also recommend buying in-the-money calls. Finally, we recommend you only buy as many calls as you have an appetite for round lots of the stock (especially if you are using the calls as stock substitutes). If you are normally a 500 share buyer of a $30 stock, only buy 5 calls.

The list below represents is a shortlist of stocks that appear in Zone 1, are on a PnF buy signal, and have a Technical Attribute rating of 3, 4, or 5. Be sure to consult the listed strike and stop-loss points before you purchase, and more importantly, make sure you review the Point & Figure charts for the securities, as they may have changed during this writing. Again, if you go the call route, be sure to buy in-the-money and give yourself some time.

| Symbol | Name | Price | Tech Attrib/Score | DWA Sector | Overbought/Oversold | ||

|---|---|---|---|---|---|---|---|

| AAPL | Apple Inc. | 241.41 |

5

|

Computers |

|

||

| ALL | The Allstate Corporation | 85.96 |

4

|

Insurance |

|

||

| BAC | Bank of America | 20.03 |

3

|

Banks |

|

||

| CMCSA | Comcast Corporation | 33.95 |

5

|

Media |

|

||

| COP | ConocoPhillips | 32.91 |

3

|

Oil |

|

||

| DIS | The Walt Disney Company | 93.88 |

3

|

Media |

|

||

| MA | Mastercard Inc. | 237.03 |

4

|

Finance |

|

||

| SO | The Southern Company | 50.27 |

3

|

Utilities/Electricity |

|

Covered Calls via Overwrites and Covered Writes:

The Implied Momentum Curve can also help you identify potential overwrite candidates. Recall that overwriting is the sale of calls against stock that you already own, turning the position into a covered write. Doing this will give you cash right now in the form of option premium which can act as a hedge in the portfolio. The cash will give you some downside protection in case the stock declines and it will generate above-average returns should the market move sideways. In overwriting, you sell the calls at a later date, after the stock has been previously purchased and ideally has rallied. On the other hand, covered writing, which we frequently discuss in this report, is when you buy the stock and simultaneously sell calls against the position. The benefit of an overwrite versus a protective put is that the overwrite brings cash into the account, providing the "downside protection".

Selling calls against an existing long position is not always the right answer, but when a stock has performed well and reached a point at which partial profit-taking is being considered, overwriting the position can create a more productive outcome. Overwriting is only suggested with stocks that are A.) generally positive on a technical basis, and B.) willing to be sold by the investor, as selling calls obligates the overwriter to so do at the specified strike price. We typically suggest overwriting stocks in Zone 5, however, in today's market, investors can be a bit more flexible. Below is a list of stocks in the OEX that are in Zones 2-5 that are trading on a PnF buy signal and have TA ratings of 3, 4, or 5.

Points to Remember on Overwriting:

- By definition overwriting is selling calls against a position you already own. Covered writing is simultaneously buying the stock and selling the call.

- This strategy can help make the sell decision easier -- the stock is above the strike price on the expiration date, you are obligated to deliver the stock.

- The strategy provides a hedge on the downside by the premium you are taking in from selling the option.

- You must be willing to have the stock called away at the strike price otherwise you are a Closet Naked Writer.

- Overwriting is a good strategy to consider when the stock is overall still bullish but the short term indicators like momentum and trading bands suggest a pullback or consolidation phase.

| Symbol | Name | Price | Tech Attrib/Score | DWA Sector | Overbought/Oversold | ||

|---|---|---|---|---|---|---|---|

| ABBV | AbbVie Inc. | 73.37 |

3

|

Drugs |

|

||

| ABT | Abbott Laboratories | 79.45 |

4

|

Drugs |

|

||

| AGN | Allergan plc | 175.71 |

5

|

Drugs |

|

||

| AMGN | Amgen Inc. | 205.41 |

4

|

Biomedics/Genetics |

|

||

| AMZN | Amazon.com Inc. | 1906.59 |

5

|

Internet |

|

||

| BIIB | Biogen Inc. | 300.51 |

3

|

Biomedics/Genetics |

|

||

| BMY | Bristol-Myers Squibb Company | 55.53 |

3

|

Drugs |

|

||

| CHTR | Charter Communications, Inc. | 433.80 |

5

|

Media |

|

||

| COST | Costco Wholesale Corporation | 288.65 |

4

|

Retailing |

|

||

| CSCO | Cisco Systems, Inc. | 39.06 |

4

|

Computers |

|

||

| DHR | Danaher Corporation | 135.15 |

4

|

Machinery and Tools |

|

||

| GILD | Gilead Sciences, Inc. | 78.21 |

4

|

Biomedics/Genetics |

|

||

| INTC | Intel Corporation | 54.13 |

4

|

Semiconductors |

|

||

| LLY | Eli Lilly and Company | 139.66 |

4

|

Drugs |

|

||

| LMT | Lockheed Martin Corporation | 350.50 |

4

|

Aerospace Airline |

|

||

| MDLZ | Mondelez International Inc. | 50.79 |

4

|

Food Beverages/Soap |

|

||

| MRK | Merck & Co., Inc. | 76.25 |

4

|

Drugs |

|

||

| MSFT | Microsoft Corporation | 153.83 |

5

|

Software |

|

||

| NEE | NextEra Energy, Inc. | 221.64 |

4

|

Utilities/Electricity |

|

||

| NFLX | NetFlix Inc. | 361.76 |

5

|

Internet |

|

||

| ORCL | Oracle Corporation | 49.40 |

5

|

Software |

|

||

| PEP | PepsiCo, Inc. | 124.59 |

3

|

Food Beverages/Soap |

|

||

| PG | The Procter & Gamble Company | 115.08 |

3

|

Food Beverages/Soap |

|

||

| PM | Philip Morris International Inc. | 73.46 |

3

|

Food Beverages/Soap |

|

||

| VZ | Verizon Communications Inc. | 54.70 |

3

|

Telephone |

|

||

| WMT | Walmart Inc. | 119.48 |

5

|

Retailing |

|

Using OptionsPlay Integration with Nasdaq Dorsey Wright Platform

Last year, we partnered with OptionsPlay to provide integration with the Nasdaq Dorsey Wright platform that scores potential options strategies by risk and potential reward. The tool, which is accessible by clicking the blue and green OptionsPlay logo next to a chart title, details bullish, bearish, and income-based strategies including covered write and put writes for individual stocks and ETFs. Additionally, subscribers with the add-on also have the ability to screen existing portfolios for OptionsPlay covered call recommendations, as indicated by the colored icon column header or a highlighted OptionsPlay tab on top of the portfolio. In the example below, we used the OptionsPlay integration to screen for income-generating ideas among a portfolio of 30 blue-chip mega-cap stocks. By using a medium timeframe and optimal risk tolerance (both defaults found under Income Settings), the OptionsPlay recommendation for a covered call on Microsoft MSFT is to sell the May 1st, 2020 $175 strike for $2.19 per share in premium. Using hypothetical ownership of 300 shares, or 3 contracts, the play generates $657 in premium, which results in a 19.35% annualized return and has a 71.57% chance of expiring worthless. Recall that a covered call will expire worthless when the stock remains “out of the money”, or below the strike price, at expiration. This strategy sweetens the deal for current shareholders already receiving a 1.26% dividend yield for owning the stock. Additionally, OptionsPlay provides recommendations for potential put-write scenarios, as shown below.

The previously-mentioned process can be replicated using an optionable inventory of ETFs, as well. Additionally, OptionsPlay can help provide guidance regarding directional options strategies and multi-leg income-producing trades. For more information regarding OptionsPlay, check out our Educational videos here.

Average Level

-59.13

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| HRL | Hormel Foods Corporation | Food Beverages/Soap | $48.38 | mid-to-upper 40s | 65 | 39 | 5 for 5'er, top 10% of FOOD sector matrix, all-time high, pos monthly mom flip, LT pos trend and RS, 1.9% yield. |

| AMZN | Amazon.com Inc. | Internet | $1906.59 | mid-1800s - low-2000s | 2272 | 1600 | 5 for 5'er, top 20% of INET sector matrix, LT pos trend and pos mkt RS Earnings 4/23 |

| DEA | Easterly Government Properties Inc | Real Estate | $25.26 | 21 - 24 | 34.50 | 18.50 | 4 for 5'er, #5 of 155 names in REAL sector matrix, 4.8% yield, R-R>4.0 |

| PETS | PetMed Express, Inc. | Retailing | $28.29 | 25 - 28 | 41 | 21 | 5 for 5'er, #3 of 87 names in RETA sector matrix, 4% yield, pot. cov write, R-R>2.0 |

| VRTX | Vertex Pharmaceuticals Incorporated | Biomedics/Genetics | $238.31 | low 220s - hi 230s | 300 | 188 | 5 for 5'er, #8 of 109 names in BIOM sector matrix, LT mkt RS buy signal, triple top, pot. covered write Earnings 4/28 |

| CTXS | Citrix Systems, Inc. | Software | $141.33 | low $140s to high $150s | $214 | $114 | 4 for 5'er, pullback from AT high, consec buy signals, #1 in fav DWASOFT, pos weekly mom Earnings 4/22 |

| QDEL | Quidel Corporation | Healthcare | $95.00 | $90s | 161 | 78 | 5 for 5'er, #4 of 110 names in HEAL sector matrix, LT mkt RS buy signal, pot. covered write, R-R>3.0 |

| CHWY | Chewy, Inc. Class A | Retailing | $33.37 | low/mid 30s to low 40s | $60 | $28 | 3 for 5'er, consec buy signals, pullback from AT high, pos mon mom |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|

Follow-Up Comments

| Comment | |||||||

|---|---|---|---|---|---|---|---|

|

|

|||||||

DWA Spotlight Stock

CHWY Chewy, Inc. Class A R ($33.59) - Retailing - CHWY is a 3 for 5’er that ranks #1 in the retailing sector RS matrix. This stock moved into a positive trend last month and has given two consecutive buy signals. In March. CHWY printed an all-time high at $39 before pulling back to $32. With today’s action, CHWY has reversed up into Xs to $35. In addition, monthly momentum has been positive for three months. New positions are welcome in the low to mid 30s to low 40s. We will set our initial stop at $28, which is the bullish support line. We will use CHWY’s bullish price objective of $60 as our near-term price target.

| 19 | 20 | |||||||||||||||||||||||||||

| 39.00 | X | 39.00 | ||||||||||||||||||||||||||

| 38.00 | • | X | O | 38.00 | ||||||||||||||||||||||||

| 37.00 | 6 | • | X | O | 37.00 | |||||||||||||||||||||||

| 36.00 | X | O | • | • | • | X | 4 | 36.00 | ||||||||||||||||||||

| 35.00 | O | X | O | X | • | X | • | X | • | • | X | X | O | x | 35.00 | |||||||||||||

| 34.00 | O | • | O | X | O | X | O | X | O | 9 | • | X | O | X | X | O | x | 34.00 | ||||||||||

| 33.00 | • | O | X | O | X | O | X | O | X | O | • | • | X | O | X | O | X | O | x | 33.00 | ||||||||

| 32.00 | O | X | 7 | X | 8 | O | X | O | • | • | X | • | X | O | X | O | X | O | 32.00 | |||||||||

| 31.00 | O | O | X | O | X | O | X | • | X | O | • | X | O | X | O | 31.00 | ||||||||||||

| 30.00 | O | O | O | 1 | O | 2 | O | • | X | O | Mid | 30.00 | ||||||||||||||||

| 29.00 | O | X | O | X | O | X | 29.00 | |||||||||||||||||||||

| 28.00 | O | X | X | O | X | 3 | X | • | 28.00 | |||||||||||||||||||

| 27.00 | O | X | O | X | O | O | X | • | 27.00 | |||||||||||||||||||

| 26.00 | O | X | O | X | O | X | X | • | 26.00 | |||||||||||||||||||

| 25.00 | O | X | O | C | O | X | O | X | • | 25.00 | ||||||||||||||||||

| 24.00 | A | X | B | X | • | O | X | O | X | • | 24.00 | |||||||||||||||||

| 23.00 | O | O | X | • | O | X | O | • | 23.00 | |||||||||||||||||||

| 22.00 | O | • | O | X | • | 22.00 | ||||||||||||||||||||||

| 21.00 | • | O | • | 21.00 | ||||||||||||||||||||||||

| 19 | 20 |

| ACA Arcosa Inc ($39.97) - Transports/Non Air - ACA broke a triple top at $40 on Monday, a move that also broke through the stock’s bearish resistance line. As a result, ACA is now a 4 for 5’er within the transports/non air sector. From here, support is offered at $36. |

| AMGN Amgen Inc. ($209.40) - Biomedics/Genetics - AMGN moved higher Monday to break a spread triple top break at $212, marking its second consecutive buy signal. This 4 for 5'er moved to a positive trend at the end of March and has maintained an RS buy signal against the market since October of 2014. The stock also had weekly momentum recently flip positive, suggesting the potential for further upside from here. The overall technical picture continues to improve. Initial support can be found at $196 with further support at $192. AMGN carries a 3.06% yield and has earnings expected on 4/28. |

| CDNS Cadence Design Systems, Inc. ($68.91) - Software - CDNS reversed back up into a column of Xs Monday and broke a quadruple top at $68 before advancing to $69 intraday. This also moved the stock back to an overall positive trend, giving it 5 out of the 5 possible technical attributes. CDNS had weekly momentum just flip positive, indicating the potential for additional price appreciation. The technical picture is strong here. Initial support can be found at $64 with further support offered at $63 and $62. Earnings are expected on 4/20. |

| DIS The Walt Disney Company ($98.15) - Media - DIS gave a second consecutive buy signal when it broke a double top at $98 in Monday's trading. DIS is a 3 for 5'er and ranks in the top half of the media sector matrix. Although it remains in a negative trend, the technical picture for the stock is improving and it has it recently found good support at $93. Overhear resistance sits at $102 and $106, while its bearish resistance line now sits at $118. DIS comes with a 1.79% yield. |

| ETSY Etsy Inc ($46.33) - Retailing - ETSY returned to a buy signal in Monday's trading when it broke a double top at $41 and continued higher to exceed another level of resistance at $45. ETSY is a 3 for 5'er and ranks in the top half of the retailing sector matrix. The next level of overhead resistance sits at $49, while ETSY's bearish resistance line sits at $54. The nearest level of support sits at $34. |

| FIVN Five9, Inc. (Five9) ($78.04) - Software - FIVN completed a bullish triangle pattern on Monday with a double top break at $77. This stock is a perfect 5 for 5’er that ranks 2nd out of 108 names in the favored software sector. In addition, weekly momentum just flipped positive, suggesting the potential for higher prices. Demand is in control and the weight of the evidence is positive. From here, support is offered at $73. Note overhead resistance at $81, FIVN’s all-time high from March. Earnings are expected 4/29. |

| JNJ Johnson & Johnson ($138.31) - Drugs - JNJ returned to a buy signal and a positive trend when it broke a double top at $136 in Monday's trading, which will elevate it to a 4 for 5'er. JNJ ranks in the top third of the drugs sector matrix. The stock faces overhead resistance at $142, with additional resistance at $154. Initial support can be found at $126. JNJ comes with a 2.75% yield. Earnings are expected on 4/14. |

| NWN Northwest Natural Gas Corp ($60.72) - Gas Utilities - NWN broke a double top at $59 before moving higher to $60. This stock is a 3 for 5’er that ranks 3rd out of 17 names in the gas utilities sector matrix. From here, initial support is offered at $55 while overhead resistance is at $65. Today’s breakout marks the second consecutive buy signal. NWN offers a yield of 3.15%. |

| PG The Procter & Gamble Company ($116.24) - Food Beverages/Soap - PG broke a double top at $116 on Monday, making the second consecutive buy signal on the chart. PG is a 3 for 5’er that has maintained a positive trend since October 2018. In addition, PG just recently moved to a market RS buy signal. From here, initial support is offered at $108 while the trend line sits at $99. Note PG expects earnings on 4/21 and offers a yield of 2.57%. |

| PM Philip Morris International Inc. ($76.05) - Food Beverages/Soap - PM broke a spread triple top at $76, marking the third consecutive buy signal on the chart. This stock is a 3 for 5’er that is now 1 box away from moving back into a positive trend, which would happen with a move to $77 or higher. From here, initial support is offered at $70. Note PM expects earnings on 4/21 and offers a yield of 6.15%. |

| PYPL Paypal Holdings Inc ($100.91) - Business Products - PYPL returned to a buy signal on Monday with a double top break at $95 before rallying higher to $100. This move flipped PYPL’s trend back to positive, which promotes the stock to a 4 for 5’er that ranks within the top quartile of the business products sector RS matrix. From here, initial support is offered at $90. Earnings are slated for 4/22. |

Daily Option Ideas for April 6, 2020

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Amgen Inc. - $211.58 | AMGN2017G200 | Buy the July 200.00 calls at 24.70 | 190.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Oracle Corporation ( ORCL) | Jun. 42.50 Calls | Raise the option stop loss to 6.95 (CP: 8.95) |

| Electronic Arts Inc. ( EA) | Sep. 95.00 Calls | Raise the option stop loss to 13.35 (CP: 15.35) |

| Walmart Inc. ( WMT) | Jun. 110.00 Calls | Raise the option stop loss to 15.00 (CP: 17.00) |

| Intel Corporation ( INTC) | Jul. 50.00 Calls | Raise the stock price stop loss to 49.00 (CP: 57.76) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| The Travelers Companies, Inc. - $98.98 | TRV2017S105 | Buy the July 105.00 puts at 14.30 | 104.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Cognizant Technology Solutions (CTSH) | May. 50.00 Puts | Stopped at 6.10 (CP: 3.60) |

| Comerica Incorporated (CMA) | Oct. 35.00 Puts | Stopped at 7.55 (CP: 7.40) |

| Consolidated Edison, Inc. (ED) | Aug. 82.50 Puts | Stopped at 82.00 (CP: 81.88) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Microsoft Corporation $153.83 | MSFT2017G170 | Jul. 170.00 | 7.85 | $79,575.60 | 20.68% | 13.76% | 3.70% |

Still Recommended

| Name | Action |

|---|---|

| Newmont Corp (NEM) - 47.15 | Sell the June 50.00 Calls. |

| Sturm Ruger & Company, Inc. (RGR) - 51.42 | Sell the July 52.50 Calls. |

| Oracle Corporation (ORCL) - 49.40 | Sell the September 52.50 Calls. |

| Hill-Rom Holdings, Inc. (HRC) - 105.00 | Sell the September 110.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

| Intel Corporation ( INTC - 54.13 ) | July 55.00 covered write. |