Upcoming events with OppenheimerFunds as well as a change in the DWA Yield Model

Upcoming Events with OppenheimerFunds

Please join OppenheimerFunds and Nasdaq Dorsey Wright for an engaging discussion on portfolio construction best practices using technical analysis. We will focus the discussion on Relative Strength investing and how it can be applied to a portfolio, revenue weighting and why it matters as well as implementing these processes in a model portfolio. This will be a great opportunity to hear from one of our industry’s leaders in the field of investment research and technical analysis.

- Wednesday, November 28th – Clearwater, FL - 12 pm @ Bascom’s Chop House (3665 Ulmerton Road, Clearwater, FL 33762) – Click here to RSVP or call 212-323-0704

- Wednesday, November 28th – Tampa, FL - 5:30 pm @ Fleming’s Prime Steakhouse (4322 W Boy Scout Blvd, Tampa, FL 33607) – Click here to RSVP or call 212-323-0704

- Thursday, November 29th – Boca Raton, FL - 12 pm @ Abe & Louie’s (2200 West Glades Road, Boca Raton FL 33431) – Click here to RSVP or call 212-323-4610

- Thursday, December 13th – Charlotte, NC – 12 pm @ Del Frisco’s (4725 Piedmont Row Dr. Suite 170, Charlotte, NC 28210) – Click here to RSVP or call 704-770-6184

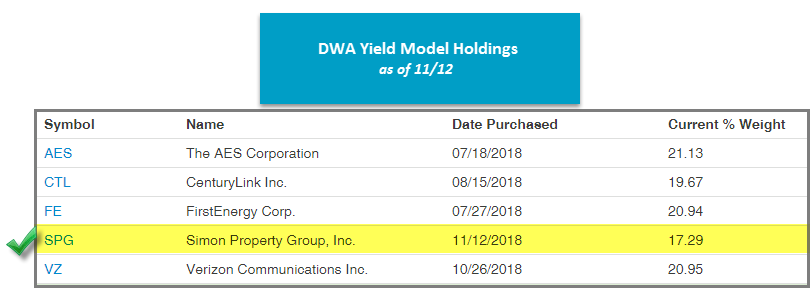

There was a change to DWA Yield Portfolio SPX500YLD: Sell – QUALCOMM Incorporated QCOM, Buy – Simon Property Group, Inc. SPG. Recall that the DWA Yield Portfolio is designed to provide a turn-key U.S. equity income solution within client accounts, while also taking advantage of a relative strength-based strategy that has the potential for capital appreciation. SPX500YLD is designed to hold approximately five positions, and in order for a stock to be considered as an addition to the model, it must rank in the top 10 of the model’s relative strength matrix, have a minimum of 3 positive technical attributes in its favor, and the trend chart must be on a Point & Figure buy signal. All of the positions will be held until one of the following occurs: the stock falls below the 20th position in the matrix, technical attributes fall below 3, or the stock gives two consecutive sell signals. As a result of yesterday’s market action, QCOM fell to the 25th position in the model matrix, warranting its removal from the model. In its place, SPG has been added as it is the highest ranked stock in the model matrix that is on a Point & Figure buy signal with 4 technical attributes in its favor at this time. SPG offers a yield of 4.28%. Note: to see this model, you must have the matrix tool as apart of your subscription.