According to results compiled by AAII, the bias in investor sentiment is neutral looking into the next 6 months.

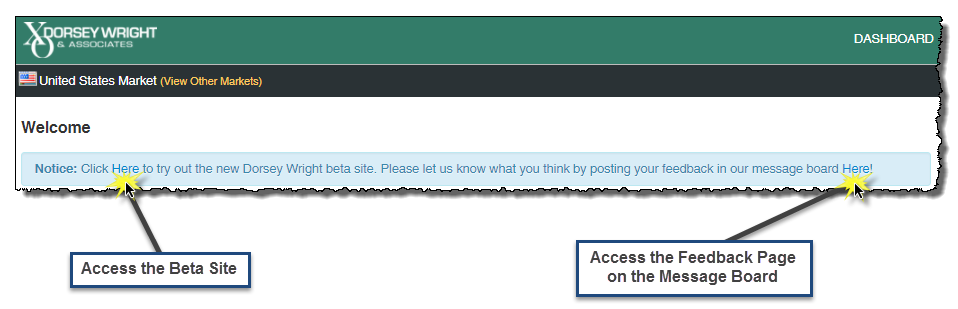

The Beta Site for the Dorsey Wright Platform is live! Current DWA subscribers have the ability to access the beta site by clicking on the link in the upper left hand corner of either your custom Dashboard or the Welcome page. The beta site currently reflects phase one of our website redesign, and we are looking for feedback in order to help better the Platform. In addition to the link that transfers user to the beta site, we have also provided a link to the message board where feedback can be provided. Click here to learn more about the beta site.

The American Association of Individual Investors compiles the results of a weekly survey to determine investors' sentiment toward the market. Investors designate whether they feel the market will be higher (Bullish Sentiment), lower (Bearish Sentiment), or remain unchanged (Neutral Sentiment) over the next 6 months. From time to time, we like to bring the results to your attention, as we feel it can often offer interesting perspective. In the image below, we have charted the results of the weekly sentiment survey against the price of the S&P 500 Index SPX to see how investors' feelings may have shifted with market changes through 2017 thus far.

As you can see below, the bias coming in to the year was bullish with nearly half (46.70%) expecting higher prices in the coming months. In fact, bullish sentiment was at the highest level it had been since early 2015 at the beginning of the year. So far, that sentiment has been accurate, with the SPX moving to new highs breaking above $2410 on Thursday. What is interesting to note, however, is that despite these current highs, bullish sentiment has declined substantially from where it began the year, falling to a low of 25% just a month ago. Notice that this change in sentiment hasn't necessarily mapped over to the bearish side, but instead has gone more towards neutral, which recently peaked around 40%.

It is not unusual to see bullish sentiment track the price movement of the major market indexes, while bearish sentiment moves oppositely. That is to say, bullish sentiment increases along with the market, while bearish sentiment increases at market lows; thus serving as a contrarian indicator of sorts. With that in mind, we would not be surprised to see bullish sentiment increase, but as we head into the holiday weekend sentiment remains relatively neutral at these levels.