Today we note trades in each of the VictoryShares Models

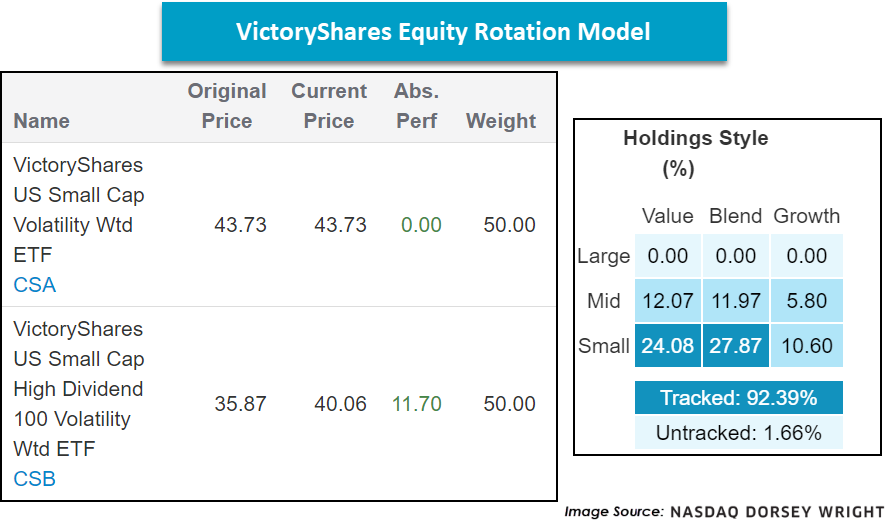

Beginning with the VictoryShares (VS) Equity Rotation Model, the strategy sold the VictoryShares Dividend Accelerator ETF VSDA because it fell out of the top two positions in the model’s relative strength matrix and purchased the VictoryShares US Small Cap Volatility Wtd ETF CSA as it was the next highest ranking fund not currently in the model. We observe a notable tailwind behind small cap equities, present in CSA as well given its acceptable fund score of 3.20 and strongly positive score direction of 2.70. The VS Equity Rotation Model maintains a heavily tilt toward domestic equities yet leans toward small cap value and small cap blend exposure. This marks the model’s fifth trade this year.

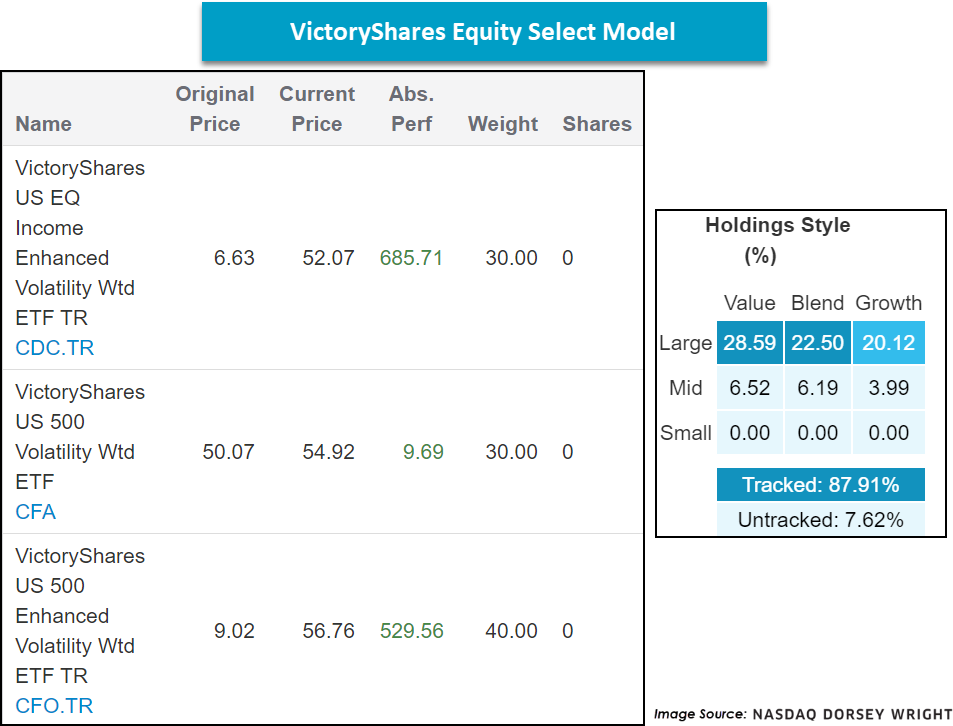

As for the VictoryShares Equity Select Model, we also note a change as the VictoryShares US EQ Income Enhanced Volatility Wtd ETF CDC.TR fell out of the number one ranked position in the matrix, causing it to lose its 40% overweight. As a result, the VictoryShares US 500 Enhanced Volatility Wtd ETF CFO now carries the 40% overweight, with the other two funds each carrying a weighting of 30%. Like the VS Equity Rotation Model, the VS Equity Select Model also maintains a heavy overweight to domestic equities but instead leans toward the large cap space. This is only the second month this year that ushered changes for this strategy.