No changes this week. In October 2018, Invesco announced the acquisition of OppenheimerFunds. As a result, the Oppenheimer US Revenue Model is now the Invesco US Revenue Model with the same NDW symbol ([OPPREV]). Effective August 1st, the OPPREV model will be maintained in the Invesco ETF Report, which is published each Monday morning at 9:30 am. The model rules will remain the same. If you have any questions, please call our research team at 804-320-8511.

*No changes this week. The next evaluation will occur on Thursday, August 1st.

**In October 2018, Invesco announced the acquisition of OppenheimerFunds. As a result, the Oppenheimer US Revenue Model is now the Invesco US Revenue Model with the same NDW symbol (OPPREV). Effective August 1st, the OPPREV model will be maintained in the Invesco ETF Report, which is published each Monday morning at 9:30 am. The model rules will remain the same. If you have any questions, please call our research team at 804-320-8511.

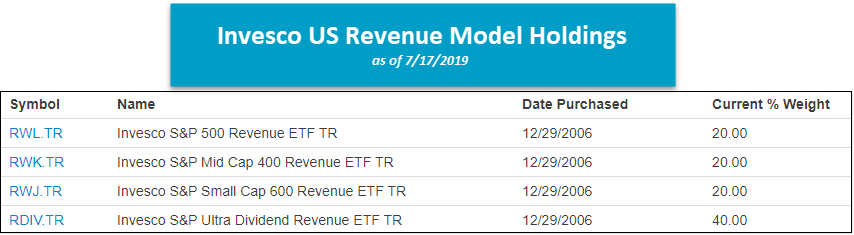

Invesco US Revenue Model Overview

The Invesco US Revenue Model OPPREV seeks to provide overweight exposure to the strongest fund within an inventory of four members of Invesco's revenue line-up that each provide broad exposure to one of the three capitalization categories, as well as a dividend-focused inventory, but do so with a weighting scheme based on top-line revenue, as opposed to market capitalization. For example, the Invesco Large Cap Revenue ETF RWL provides broad exposure to the S&P 500 universe but does so by providing greater exposure to lower valuation companies than the market-cap benchmark.

Model Inventory

- Invesco Large Cap Revenue ETF RWL.TR

- Invesco Mid Cap Revenue ETF RWK.TR

- Invesco Small Cap Revenue ETF RWJ.TR

- Invesco Ultra Dividend Revenue ETF RDIV.TR

Systematic Model Rules

- The model is evaluated on a monthly basis and remains 100% invested at all times.

- The members of the four fund inventory are compared to one another on a relative strength basis, using a Relative Strength Matrix.

- The model inventory is ranked from strongest to weakest based on each fund’s “buy rank.”

- The top position is overweighted at 40%, and the remaining three members of the inventory are weighted at 20% each.

- Upon the monthly evaluation, if the top-ranked fund has fallen below the top two positions in the matrix, that fund loses its overweight allocation and the highest-ranked ETF in the matrix is then overweighted at 40%.

- Upon each change, the model is rebalanced.

Current Model Holdings and Suggested Weights