*No changes this week. The next evaluation will occur on Thursday, August 1st.

**In October 2018, Invesco announced the acquisition of OppenheimerFunds. As a result, the Oppenheimer US Revenue Model is now the Invesco US Revenue Model with the same NDW symbol (OPPREV). Effective August 1st, the OPPREV model will be maintained in the Invesco ETF Report, which is published each Monday morning at 9:30 am. The model rules will remain the same. If you have any questions, please call our research team at 804-320-8511.

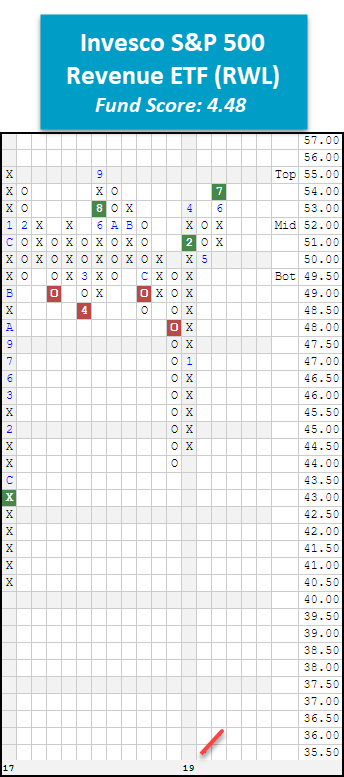

Today we want to direct your attention to the Invesco S&P 500 Revenue ETF RWL, one of the four funds in the Invesco US Revenue Model OPPREV inventory. Earlier this month, RWL broke a spread triple top at $54, marking the second consecutive buy signal on the chart. At current levels, RWL is just one box away from testing significant resistance at $55 and is just two boxes away from a new all-time high. At this time, RWL has the strongest fund score out of the four ETFs in the OPPREV inventory at 4.48 with a 1.76 score direction. Although the technical weight of the evidence is positive, OPPREV is in overbought territory here with an OBOS% reading of 70%. From current levels, initial support is offered at $50. Note RWL offers a yield of 1.84%.

| Ticker | Name | Report |

|---|---|---|

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Buy Signal Report |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Daily Breakout Report |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Trend Changes |

| REEM | Oppenheimer Emerging Markets Revenue ETF | Stocks Whose Price Has Crossed Below The 150 Day Moving Average |

| RWJ | Invesco S&P Small Cap 600 Revenue ETF | Stocks Whose Price Has Crossed Above The 50 Day Moving Average |

| RDIV | Invesco S&P Ultra Dividend Revenue ETF | Stocks Whose Group Risk Has Changed |

| RWW | Oppenheimer S&P Financials Revenue ETF | Stocks Whose Group Risk Has Changed |

| OMFS | Oppenheimer Russell 2000 Dynamic Multifactor ETF | Daily Momentum Changes |

| OSIZ | Oppenheimer Russell 1000 Size Factor ETF | Daily Momentum Changes |

| OYLD | Oppenheimer Russell 1000 Yield Factor ETF | Daily Momentum Changes |

| RDIV | Invesco S&P Ultra Dividend Revenue ETF | Daily Momentum Changes |

| RWJ | Invesco S&P Small Cap 600 Revenue ETF | Daily Momentum Changes |

| RWW | Oppenheimer S&P Financials Revenue ETF | Daily Momentum Changes |

| ESGF | Oppenheimer Global ESG Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| ESGL | Oppenheimer ESG Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OMFS | Oppenheimer Russell 2000 Dynamic Multifactor ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OQAL | Oppenheimer Russell 1000 Quality Factor ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OSIZ | Oppenheimer Russell 1000 Size Factor ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OYLD | Oppenheimer Russell 1000 Yield Factor ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RDIV | Invesco S&P Ultra Dividend Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RGLB | Oppenheimer Global Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RWJ | Invesco S&P Small Cap 600 Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RWK | Invesco S&P Mid Cap 400 Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RWL | Invesco S&P 500 Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| RWW | Oppenheimer S&P Financials Revenue ETF | Stocks Whose Daily Momentum Has Changed From Negative To Positive |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Change In Trend Report |

| REEM | Oppenheimer Emerging Markets Revenue ETF | Moving Average Report |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | Stocks Whose Trend Has Changed From Negative To Positive |

| REEM | Oppenheimer Emerging Markets Revenue ETF | Stocks 50 Day MAvg Crossed Above 200 Day MAvg |

Invesco US Revenue Model

| Group | Symbol | Percent | |

|---|---|---|---|

| Cash | CASH$ | 0.00% | |

| Invesco S&P Mid Cap 400 Revenue ETF TR | All US Mid Cap | RWK.TR | 19.99% |

| Invesco S&P Small Cap 600 Revenue ETF TR | All US Small Cap | RWJ.TR | 20.01% |

| Invesco S&P 500 Revenue ETF TR | Growth-Domestic | RWL.TR | 19.99% |

| Invesco S&P Ultra Dividend Revenue ETF TR | Growth & Income | RDIV.TR | 40.01% |

| Symbol | Name | Price | Fund Score | Month Score Change | PnF Signal | RS Col. | PnF Trend | Weekly Mom |

|---|---|---|---|---|---|---|---|---|

| ESGF | Oppenheimer Global ESG Revenue ETF | 29.80 | 1.50 | -0.02 | Sell | O | Negative | +6W |

| ESGL | Oppenheimer ESG Revenue ETF | 32.29 | 4.67 | 0.50 | Buy | X | Positive | +6W |

| OMFL | Oppenheimer Russell 1000 Dynamic Multifactor ETF | 30.43 | 3.90 | -0.08 | Buy | O | Positive | -1W |

| OMFS | Oppenheimer Russell 2000 Dynamic Multifactor ETF | 27.07 | 3.66 | 0.08 | Sell | O | Negative | +5W |

| OMOM | Oppenheimer Russell 1000 Momentum Factor ETF | 29.25 | 3.81 | 0.38 | Buy | O | Positive | +6W |

| OQAL | Oppenheimer Russell 1000 Quality Factor ETF | 29.73 | 4.34 | 1.37 | Buy | O | Positive | +6W |

| OSIZ | Oppenheimer Russell 1000 Size Factor ETF | 28.86 | 3.70 | 1.36 | Buy | O | Positive | +6W |

| OVLU | Oppenheimer Russell 1000 Value Factor ETF | 27.69 | 4.07 | 1.62 | Buy | O | Positive | +6W |

| OVOL | Oppenheimer Russell 1000 Low Volatility Factor ETF | 29.61 | 5.58 | 0.03 | Buy | O | Positive | -1W |

| OYLD | Oppenheimer Russell 1000 Yield Factor ETF | 27.40 | 4.26 | 0.17 | Buy | O | Positive | -1W |

| RDIV | Invesco S&P Ultra Dividend Revenue ETF | 37.80 | 2.38 | -0.38 | Buy | O | Positive | +6W |

| REEM | Oppenheimer Emerging Markets Revenue ETF | 25.14 | 1.30 | -0.22 | O | +6W | ||

| REFA | Oppenheimer International Revenue ETF | 24.79 | 0.77 | 0.17 | Sell | O | Negative | -1W |

| RGLB | Oppenheimer Global Revenue ETF | 26.36 | 1.36 | -0.03 | Sell | O | Negative | +6W |

| RWJ | Invesco S&P Small Cap 600 Revenue ETF | 62.45 | 0.26 | 0.13 | Sell | O | Negative | +5W |

| RWK | Invesco S&P Mid Cap 400 Revenue ETF | 61.63 | 2.58 | 0.10 | Sell | O | Positive | +6W |

| RWL | Invesco S&P 500 Revenue ETF | 54.82 | 4.48 | 0.70 | Buy | O | Positive | +6W |

| RWW | Oppenheimer S&P Financials Revenue ETF | 69.91 | 4.53 | 0.15 | Buy | X | Positive | +5W |

Score change monthly period began 06/25/2019