There are changes to two iShares models this week.

There are changes to two iShares models this week. The iShares Tactical Model ISHRTACTICAL removed the iShares NASDAQ Biotech ETF IBB and added the iShares Silver Trust SLV. The iShares Sector Rotation Model also sold the iShares NASDAQ Biotech ETF IBB.

IBB was removed from ISHRTACTICAL because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the portfolio. In its place the model added SLV as it was the highest-ranking fund in the model matrix that was not already a holding in the portfolio. This is the eighth change to the model this year. SLV currently has a strong 5.10 fund score a positive 3.09 score direction. On its default chart, SLV has given four consecutive buy signals, most recently breaking a double top at $26. SLV has most recently found support at three levels between $21.50 and $24.

In addition to SLV, the model now has exposure to software, consumer services, oil & gas exploration, oil equipment & services, medical devices, home construction, and semiconductors. Year-to-date (through 8/26) ISHRTACTICAL is up 14.79% vs. the S&P 500 SPX which has gained 7.67%.

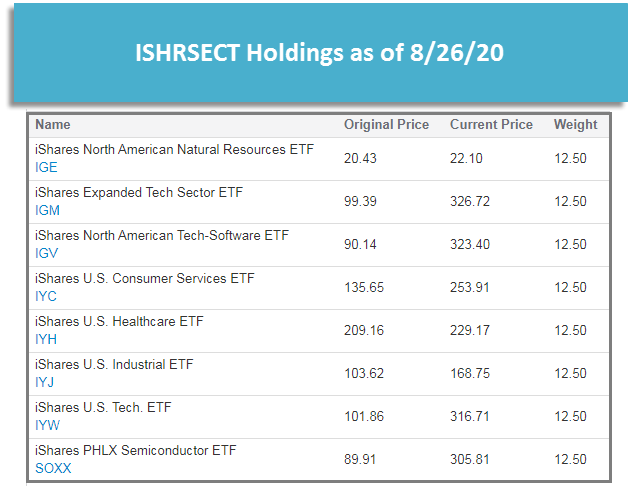

ISHRSECT utilizes a relative strength versus benchmark methodology which compares each of the funds in the model universe against the iShares Dow Jones US ETF IYY. Those funds showing near-term relative strength against the benchmark (i.e. are in a column of Xs) are included in the portfolio and are removed only when they show weakness relative to the benchmark. When an addition or deletion is made, the portfolio is rebalanced so each position is equally weighted. IBB was removed from the portfolio because it reversed down into a column of Os on its relative strength chart against IYY, demonstrating short-term relative weakness. Year-to-date, ISHRSECT has gained 9.83%. The full model holdings can be seen below.