There are changes to two iShares models this week. The iShares Tactical Model ISHRTACTICAL removed the iShares NASDAQ Biotech ETF IBB and added the iShares Silver Trust SLV. The iShares Sector Rotation Model also sold the iShares NASDAQ Biotech ETF IBB.

IBB was removed from ISHRTACTICAL because its rank in the model’s relative strength matrix fell below the threshold to remain a holding in the portfolio. In its place the model added SLV as it was the highest-ranking fund in the model matrix that was not already a holding in the portfolio. This is the eighth change to the model this year. SLV currently has a strong 5.10 fund score a positive 3.09 score direction. On its default chart, SLV has given four consecutive buy signals, most recently breaking a double top at $26. SLV has most recently found support at three levels between $21.50 and $24.

In addition to SLV, the model now has exposure to software, consumer services, oil & gas exploration, oil equipment & services, medical devices, home construction, and semiconductors. Year-to-date (through 8/26) ISHRTACTICAL is up 14.79% vs. the S&P 500 SPX which has gained 7.67%.

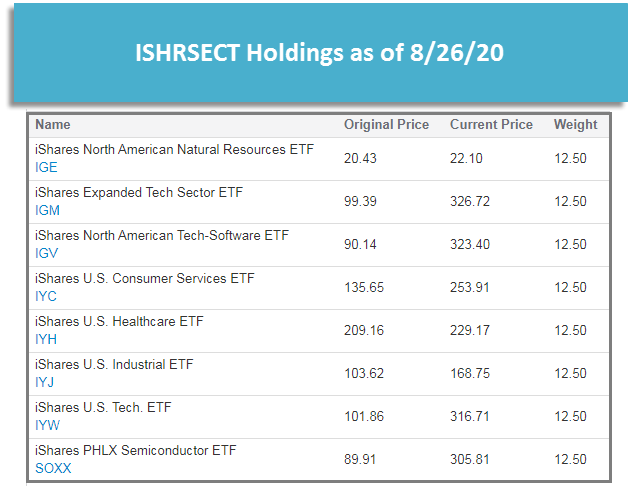

ISHRSECT utilizes a relative strength versus benchmark methodology which compares each of the funds in the model universe against the iShares Dow Jones US ETF IYY. Those funds showing near-term relative strength against the benchmark (i.e. are in a column of Xs) are included in the portfolio and are removed only when they show weakness relative to the benchmark. When an addition or deletion is made, the portfolio is rebalanced so each position is equally weighted. IBB was removed from the portfolio because it reversed down into a column of Os on its relative strength chart against IYY, demonstrating short-term relative weakness. Year-to-date, ISHRSECT has gained 9.83%. The full model holdings can be seen below.

This section of the report categorizes select iShares Fixed Income and Currency ETPs by their respective fund groups. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those iShares ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

Inflation Protection Bonds

Symbol

Name

Score

Average Group Score: 4.8

TIP

iShares Barclays US Treasury Inflation Protected Securities

5.19

STIP

iShares Barclays 0-5 Year TIPS Bond ETF

3.85

Municipal Bonds

Symbol

Name

Score

Average Group Score: 4.2

SUB

iShares Short-Term National Muni Bond ETF

4.51

NYF

iShares New York Muni Bond ETF

3.42

MUB

iShares National Municipal Bond ETF

2.61

CMF

iShares California Municipal Bond ETF

2.51

Global Fixed Income

Symbol

Name

Score

Average Group Score: 4.0

ISHG

iShares S&P Citigroup 1-3 Year Intl. Treas. Bond ETF

5.22

IGOV

iShares S&P Citigroup International Treasury Bond ETF

5.17

EMB

iShares JP Morgan USD Emerging Markets Bond ETF

4.73

IPFF

iShares S&P International Preferred Stock ETF

2.90

Corporate Bonds

Symbol

Name

Score

Average Group Score: 4.0

LQD

iShares iBoxx $ Investment Grade Corp. Bond ETF

4.14

FLOT

iShares Floating Rate Note ETF

3.81

Agency Bonds

Symbol

Name

Score

Average Group Score: 4.0

AGZ

iShares Barclays Agency Bond ETF

3.77

Treasury Bonds

Symbol

Name

Score

Average Group Score: 4.0

GBF

iShares Barclays Government Credit Bond ETF

5.10

GVI

iShares Barclays Intermediate Government/Credit Bond ETF

4.87

IEI

iShares Barclays 3-7 Year Treasury Bond ETF

3.91

TLH

iShares Barclays 10-20 Year Treasury Bond ETF

3.80

SHV

iShares Barclays Short Treasury Bond ETF

3.80

IEF

iShares Barclays 7-10 Year Tres. Bond ETF

3.65

SHY

iShares Barclays 1-3 Year Tres. Bond ETF

3.48

TLT

iShares Barclays 20+ Year Treasury Bond ETF

3.03

Broad Fixed Income

Symbol

Name

Score

Average Group Score: 4.0

IGIB

iShares Intermediate-Term Corporate Bond ETF

5.30

AGG

iShares US Core Bond ETF

4.58

MBB

iShares Barclays MBS Fixed-Rate Bond ETF

4.38

IGLB

iShares Long-Term Corporate Bond ETF

4.13

USIG

iShares Broad USD Investment Grade Corporate Bond ETF

3.87

High Yield

Symbol

Name

Score

Average Group Score: 4.0

HYG

iShares iBoxx $ High Yield Corporate Bond ETF

3.66

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time with an "average level" to give us a general picture of whether the iShare ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong market ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness.

Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell. The Distribution Curve below displays those ETFs with positive RS in uppercase letters and those ETFs with poor RS versus the market in lowercase letters. As well, those ETFs that are on a Point & Figure Buy signal appear in Green letters, while those on Sell signals can appear in Red letters. Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

Average Level

46.50

| <--100 | -100--80 | -80--60 | -60--40 | -40--20 | -20-0 | 0-20 | 20-40 | 40-60 | 60-80 | 80-100 | 100-> | |||

|

||||||||||||||

This section of the report categorizes select iShares ETFs by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those iShares ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.9 | IWY | iShares Russell Top 200 Growth ETF | 5.86 |

| IVW | iShares S&P 500 Growth ETF | 5.76 | |

| OEF | iShares S&P 100 ETF | 5.71 | |

| IWL | iShares Russell Top 200 ETF | 4.67 | |

| IYY | iShares Dow Jones U.S. ETF | 4.65 | |

| IWB | iShares Russell 1000 ETF | 4.53 | |

| IVV | iShares S&P 500 Index | 4.36 | |

| IWX | iShares Russell Top 200 Value ETF | 2.43 | |

| IWD | iShares Russell 1000 Value ETF | 2.42 | |

| IVE | iShares S&P 500 Value ETF | 2.40 |

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.5 | IWO | iShares Russell 2000 Growth ETF | 5.37 |

| IJT | iShares S&P SmallCap 600 Growth ETF | 4.99 | |

| IWM | iShares Russell 2000 ETF | 3.12 | |

| IJR | iShares S&P SmallCap 600 Index Fund | 2.66 | |

| IJS | iShares S&P SmallCap 600 Value ETF | 2.29 | |

| IWN | iShares Russell 2000 Value ETF | 2.26 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.5 | EEM | iShares MSCI Emerging Markets ETF | 5.16 |

| BKF | iShares MSCI BRIC ETF | 4.66 | |

| JPXN | iShares JPX-Nikkei 400 ETF | 3.01 | |

| EFA | iShares MSCI EAFE ETF | 2.99 | |

| IEV | iShares Europe ETF | 2.83 | |

| EPP | iShares MSCI Pacific ex-Japan Index Fund | 2.53 | |

| ILF | iShares S&P Latin America 40 ETF | 0.79 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.4 | IWP | iShares Russell Midcap Growth ETF | 5.53 |

| IJK | iShares S&P MidCap 400 Growth ETF | 5.14 | |

| IWR | iShares Russell Midcap ETF | 4.36 | |

| IJH | iShares S&P MidCap 400 Index Fund | 3.09 | |

| IWS | iShares Russell Midcap Value ETF | 2.53 | |

| IJJ | iShares S&P MidCap 400 Value ETF | 2.16 |

| Sector Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.3 | ITB | iShares U.S. Home Construction ETF | 5.90 |

| IYW | iShares U.S. Tech. ETF | 5.86 | |

| SOXX | iShares PHLX Semiconductor ETF | 5.73 | |

| IGV | iShares North American Tech-Software ETF | 5.72 | |

| IHI | iShares U.S. Medical Devices ETF | 5.29 | |

| IYC | iShares U.S. Consumer Services ETF | 5.24 | |

| IYK | iShares U.S. Consumer Goods ETF | 4.80 | |

| IYT | iShares U.S. Transportation ETF | 4.50 | |

| IYM | iShares U.S. Basic Materials ETF | 4.50 | |

| IHF | iShares U.S. Healthcare Providers ETF | 4.26 | |

| IYJ | iShares U.S. Industrial ETF | 4.20 | |

| IBB | iShares NASDAQ Biotech ETF | 4.20 | |

| IYH | iShares U.S. Healthcare ETF | 4.15 | |

| IGN | iShares North American Tech-Multimedia Networking ETF | 3.71 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 3.65 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 3.65 | |

| IYF | iShares U.S. Financial ETF | 3.24 | |

| IHE | iShares U.S. Pharmaceuticals ETF | 3.20 | |

| IYZ | iShares U.S. Telecom ETF | 2.63 | |

| IDU | iShares U.S. Utilities ETF | 1.81 | |

| ITA | iShares U.S. Aerospace & Defense ETF | 1.81 | |

| IEZ | iShares U.S. Oil Equip. & Svcs. ETF | 1.52 | |

| IAK | iShares U.S. Insurance ETF | 1.13 | |

| IAT | iShares U.S. Regional Banks ETF | 1.04 | |

| ICF | iShares Cohen & Steers Realty ETF | 0.84 | |

| IGE | iShares North American Natural Resources ETF | 0.78 | |

| IYE | iShares U.S. Energy ETF | 0.69 | |

| IEO | iShares U.S. Oil & Gas Exploration & Production ETF | 0.49 |

Weekly Updates: The iShares Tactical Model ISHRTACTICAL removed the iShares NASDAQ Biotech ETF IBB and added the iShares Silver Trust SLV. The iShares Sector Rotation Model also sold the iShares NASDAQ Biotech ETF IBB.

iShares Sector Rotation Model ISHRSECT

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares North American Natural Resources ETF | IGE | 12.500% | 6.3990 | 05/06/2020 |

| iShares Expanded Tech Sector ETF | IGM | 12.500% | 0.3920 | 03/04/2009 |

| iShares North American Tech-Software ETF | IGV | 12.500% | 0.3830 | 11/07/2007 |

| iShares U.S. Consumer Services ETF | IYC | 12.500% | 0.8150 | 04/28/2010 |

| iShares U.S. Healthcare ETF | IYH | 12.500% | 1.1400 | 04/22/2020 |

| iShares U.S. Industrial ETF | IYJ | 12.500% | 1.2230 | 02/09/2011 |

| iShares U.S. Tech. ETF | IYW | 12.500% | 0.6240 | 03/04/2009 |

| iShares PHLX Semiconductor ETF | SOXX | 12.500% | 1.0070 | 06/18/2014 |

iShares Tactical Model ISHRTACTICAL

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares North American Tech-Software ETF | IGV | 12.500% | 0.3830 | 01/27/2016 |

| iShares U.S. Consumer Services ETF | IYC | 12.500% | 0.8150 | 04/29/2010 |

| iShares U.S. Oil & Gas Exploration & Production ETF | IEO | 12.500% | 3.2770 | 06/10/2020 |

| iShares U.S. Oil Equip. & Svcs. ETF | IEZ | 12.500% | 4.3040 | 05/27/2020 |

| iShares U.S. Medical Devices ETF | IHI | 12.500% | 0.2810 | 01/20/2016 |

| iShares U.S. Home Construction ETF | ITB | 12.500% | 0.4210 | 05/20/2020 |

| iShares PHLX Semiconductor ETF | SOXX | 12.500% | 1.0070 | 08/28/2019 |

| iShares Silver Trust | SLV | 12.500% | 0.0000 | 08/26/2020 |

iShares International Model ISHRINTL

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares MSCI Switzerland ETF | EWL | 20.000% | 1.4790 | 03/11/2020 |

| iShares MSCI Netherlands ETF | EWN | 20.000% | 0.9120 | 03/04/2020 |

| iShares MSCI Taiwan ETF | EWT | 20.000% | 2.2600 | 12/04/2019 |

| iShares MSCI New Zealand ETF | ENZL | 20.000% | 2.6135 | 05/22/2019 |

| iShares Dow Jones U.S. ETF | IYY | 20.000% | 1.4600 | 08/29/2018 |

iShares Fixed Income Model ISHRFIXED

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

iShares Long-Term Corporate Bond ETF

IGLB

20.000%

3.4240

07/22/2020

iShares International High Yield Bond ETF

HYXU

20.000%

1.1560

07/29/2020

IShares Emerging Markets High Yield Bond ETF

EMHY

20.000%

5.7900

05/27/2020

iShares iBoxx $ Investment Grade Corp. Bond ETF

LQD

20.000%

2.9160

07/01/2020

iShares Preferred & Income Securities ETF

PFF

20.000%

5.4681

04/15/2020