There are no changes to any of the iShares alternatives models this week. With yields rising, we discuss how the iShares iBonds suite of target maturity ETFs can be utilized to reduce interest rate exposure. There are upcoming changes to the iShares model lineup.

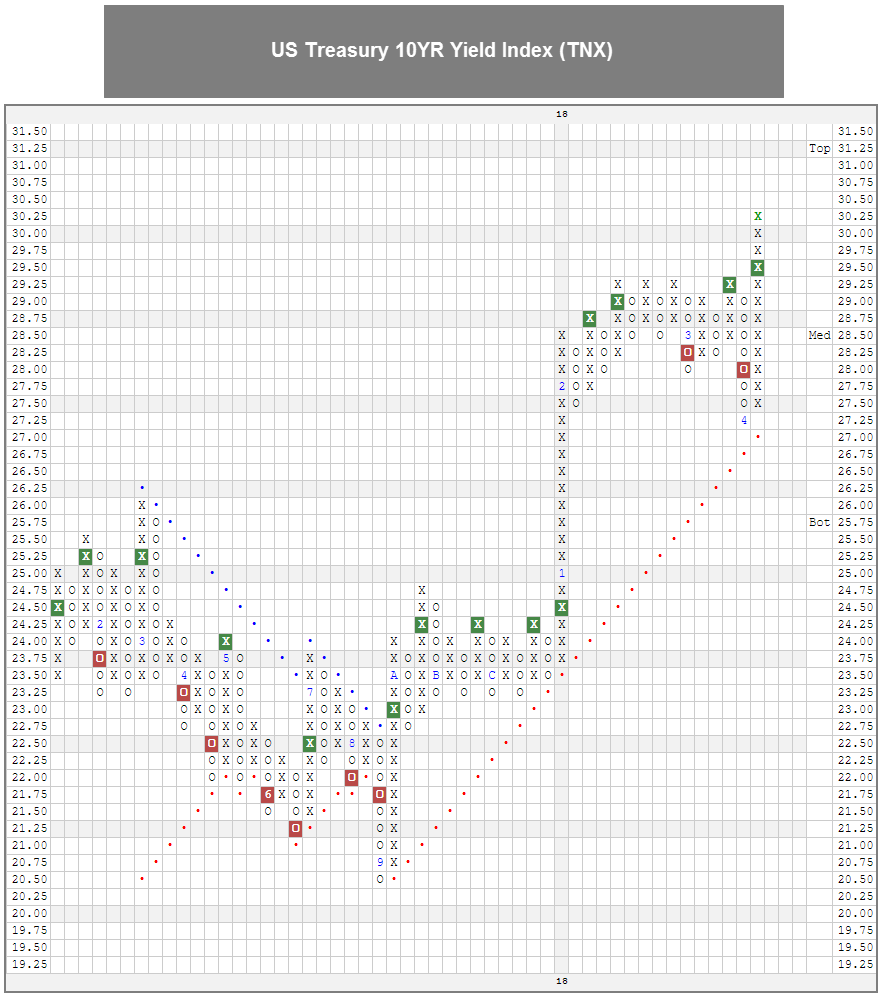

There are no changes to any of the iShares Alternatives models this week. As we discussed in yesterday's fixed income piece, the US Treasury 10YR Yield Index TNX recently reached 3.0% and continued higher, reaching levels we have not seen since 2011. We have also seen notable deterioration in the average score for many fixed income groups - currently the only fixed income groups with a score above 3.0 are the Floating Rate, Inverse-Fixed Income, and Convertible Bonds groups.

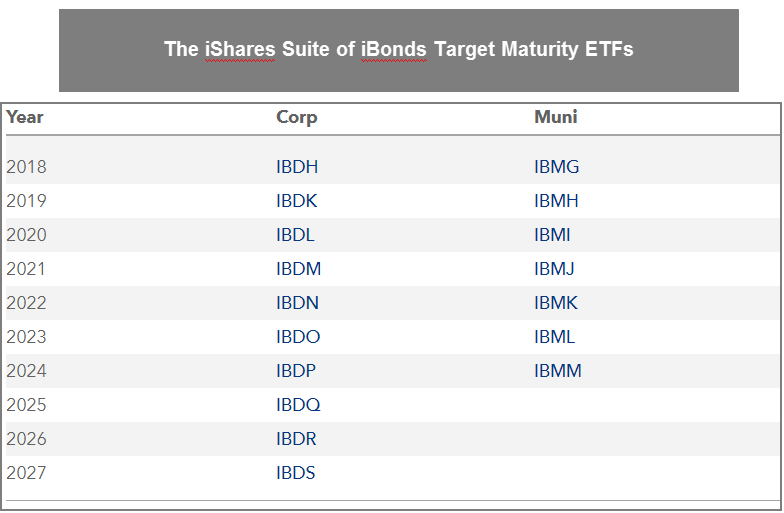

If you are concerned about how your clients' fixed income allocation may hold up in a rising rate environment, you may want to consider incorporating a laddered, held-to-maturity portfolio using the iShares iBonds Suite of products. The iBonds offer a series of target maturity corporate and municipal bond ETFs.

Unlike traditional fixed income ETFs, target maturity ETFs hold individual bonds that each mature or are expected to be called in the same year. As the underlying bonds mature, the cash or cash equivalent holdings of the fund increases and upon the fund reaching maturity the proceeds are distributed to shareholders. Because these funds have a target maturity, they can be used to create a held-to-maturity portfolio to protect against capital losses due to rising interest rates.Targeted maturity ETFs can also be used to create laddered portfolios. A laddered portfolio is one with allocations spread across several different maturities, e.g. 20% each to 1 to 5 year maturity bonds. A laddered portfolio provides liquidity and can help minimize interest rate risk.