There are no changes to be made within either of the Dorsey Wright Invesco Models this week, as each of the current holdings continues to maintain positive relative strength within their respective universes. Today we review Q2 2018 performance of the Invesco funds as well as the Invesco Models.

There are no changes to be made within either of the Dorsey Wright Invesco Models this week, as each of the current holdings continues to maintain positive relative strength within the respective universes.

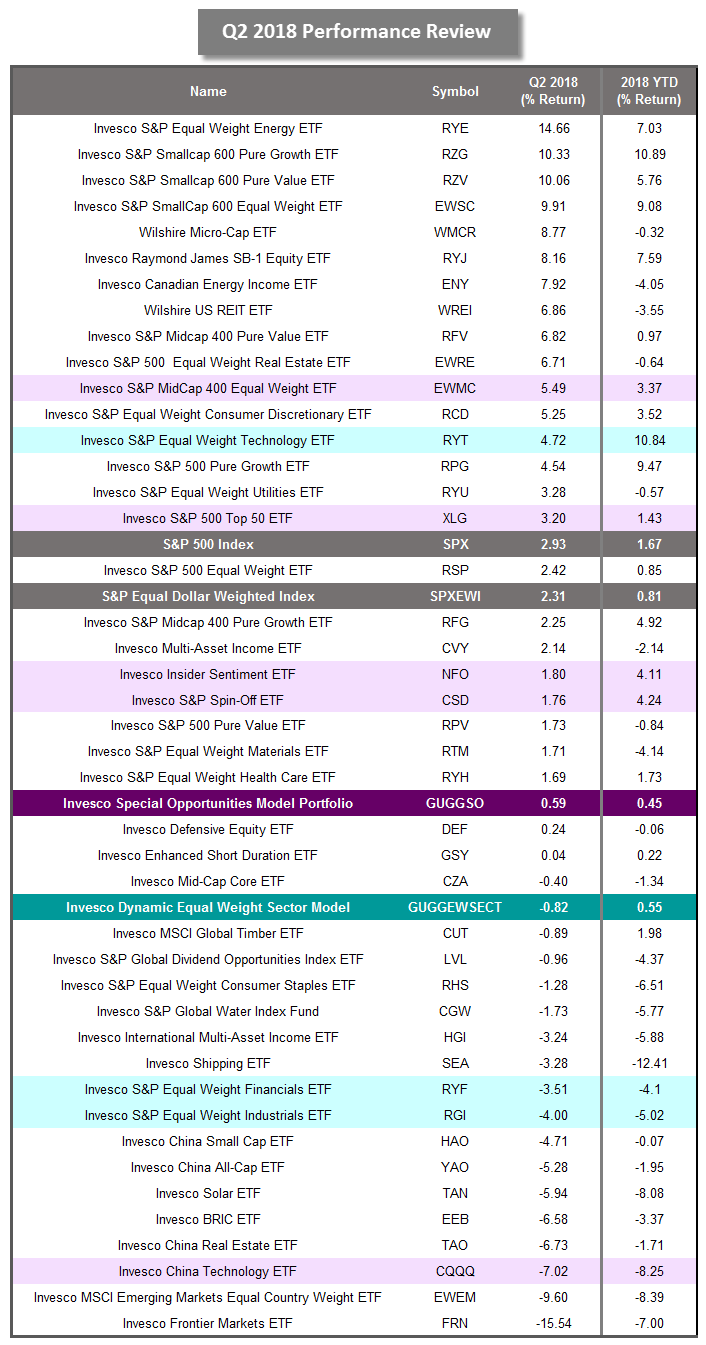

The second quarter of 2018 has come to an end and as is customary, we wanted to review how the Invesco line-up of funds performed, as well as recap how the Invesco Special Opportunities Model GUGGSO and the Invesco Dynamic Equal Weight Sector Model GUGGEWSECT fared over the second quarter of the year. In the image below, we have provided a snapshot of the Q2 2018 performance for the Invesco ETF lineup (excluding the BulletShares products). We have highlighted the Invesco Dynamic Equal Weight Sector Model GUGGEWSECT and its current holdings in teal, the Invesco Special Opportunities Model GUGGSO and its current holdings in purple, and the S&P 500 Index SPX benchmarks in gray.

Although there were a lot of negative headlines paired with market choppiness over the past three months, the second quarter proved to be an overall strong one for US equities. When all was said and done, the S&P 500 Index SPX posted a gain of 2.93% while the S&P Equal Dollar Weighted Index SPXEWI finished up 2.31%. The Invesco Special Opportunities Model GUGGSO finished the quarter flat with a gain of 0.59%. This model did not see any changes over the second quarter as each of the model holdings continued to maintain positive relative strength. The biggest contributor over the second quarter was the Invesco S&P MidCap 400 Equal Weight EWMC which posted a gain of 5.49%. The Invesco China Technology CQQQ lagged the portfolio over Q2, posting a loss of -7.02%.

The Invesco Dynamic Equal Weight Sector Model GUGGEWSECT was down slightly with a loss of -0.82%. This model did not see any changes over the second quarter as each of the model holdings continued to maintain positive relative strength. The best performing of the current holdings for Q2 was once again the Invesco S&P Equal Weight Technology ETF RYT which was up 4.72%. The Invesco S&P Equal Weight Industrials ETF RGI dragged the portfolio, posting a loss of -4.00% over Q2.