With no changes to any of the Invesco models this week, we turn our attention to future movements in interest rates and how the Invesco BulletShares suite can help you minimize interest rate risk.

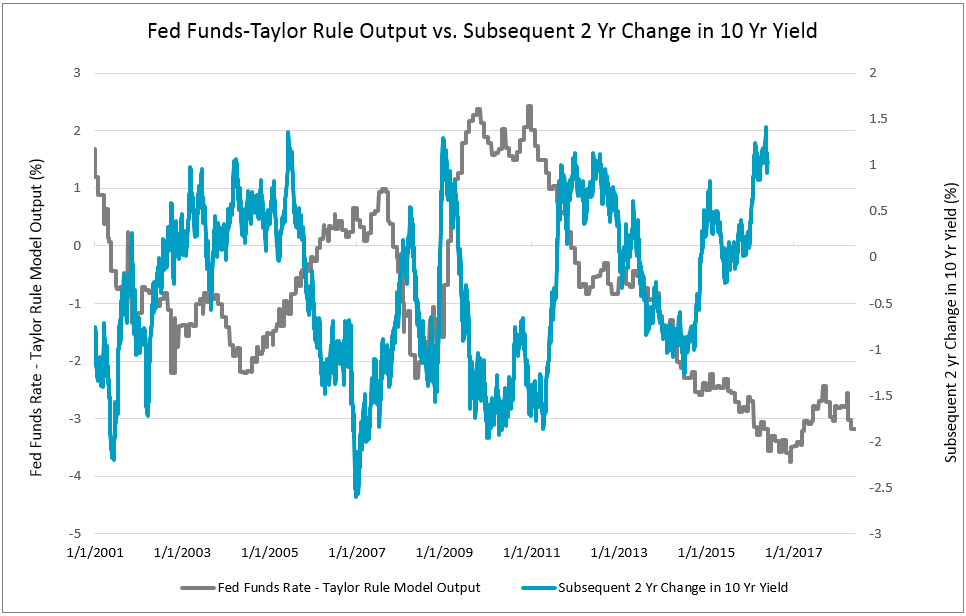

There are no changes to any of the Invesco models this week. The Fed’s increase of the federal funds rate earlier this month was consistent with the telegraphed message on shorter-term rates. What about the longer end of the curve? Can we expect the dynamics that drive the Fed’s short-term rate decisions to effect durations that drive returns in long-term client portfolios? One of the most famous models that drives short-term fed rate decisions is the Taylor Rule Model. This model shows how short-term rates should respond to changes in inflation and GDP. Below we show a chart of the difference between the Fed Funds Rate and the Taylor Rule Model output, side-by-side with the forward 2 year change in the 10 year Treasury Yield. As you can clearly see, as the actual fed funds rate trades markedly above the Taylor Rule Model output, we subsequently see intermediate-term treasury yields decrease. Inversely, and the current situation we find ourselves in, as the fed funds rate trades markedly below the Taylor Rule Model output, we subsequently see intermediate-term treasury yields increase. Specifically, this model currently calls for a 100bps rise in the 10-year yield over the next two years, consistent with our broad view of rising intermediate-term rates over the next few years.

If future changes in 10-year US Treasury yields are in-line with the model predictions, then over the next two years, we would expect to see fixed income securities with low and/or positive correlations to intermediate-term yields outperform more rate sensitive (and negatively correlated) instruments, e.g. Treasuries and investment grade corporates. The model output suggests an environment in which investors are likely to be rewarded for reducing interest rate risk (i.e. duration) and potentially for increasing credit risk, as rising intermediate- and long-term Treasury yields are usually a byproduct of an expansionary domestic economy.

One method by which you can protect your clients’ fixed income portfolios is by utilizing target maturity ETFs, like the suite of Invesco BulletShares products,. The BulletShares products offer a simple to solution for constructing a portfolio which can be held-to-maturity and therefore minimize interest rate risk. Unlike traditional fixed income ETFs, target maturity ETFs hold individual bonds that each mature or are expected to be called in the same year. As the underlying bonds mature, the cash or cash equivalent holdings of the fund increases and upon the fund reaching maturity the proceeds are distributed to shareholders. Because these funds have a target maturity, they can be used to create a held-to-maturity portfolio to protect against capital losses due to rising interest rates.

BulletShares ETFs can also be used to create laddered portfolios. A laddered portfolio is one with allocations spread across several different maturities, e.g. 20% each to 1 to 5 year maturity bonds. A laddered portfolio provides liquidity and can help minimize interest rate risk. Invesco currently offers 10 investment grade corporate BulletShares ETFs with target maturities ranging from 2018 to 2027 and eight high yield corporate BulletShares ETFs with target maturities ranging from 2018 to 2025. According to the bond ladder tool at Invesco.com, a five-year, equally-weighted portfolio constructed of investment grade and high yield BulletShares ETFs with target maturities from 2019 to 2023 currently has a 4.5% yield-to-maturity and 2,482 individual underlying bond holdings.

Even though the underlying bonds in the BulletShares ETFs are expected to be held until maturity, they are exchange traded and therefore the market value and NAV of the fund will still be affected by interest rate movement. Therefore it is important to understand that ultimately, as the bonds near maturity, the NAV of the fund should move toward the par value of its holdings and the fund will receive par value for its bonds (excepting any potential defaults), which will in turn be distributed to the funds’ investors. All of the current BulletShares offerings can be seen below.