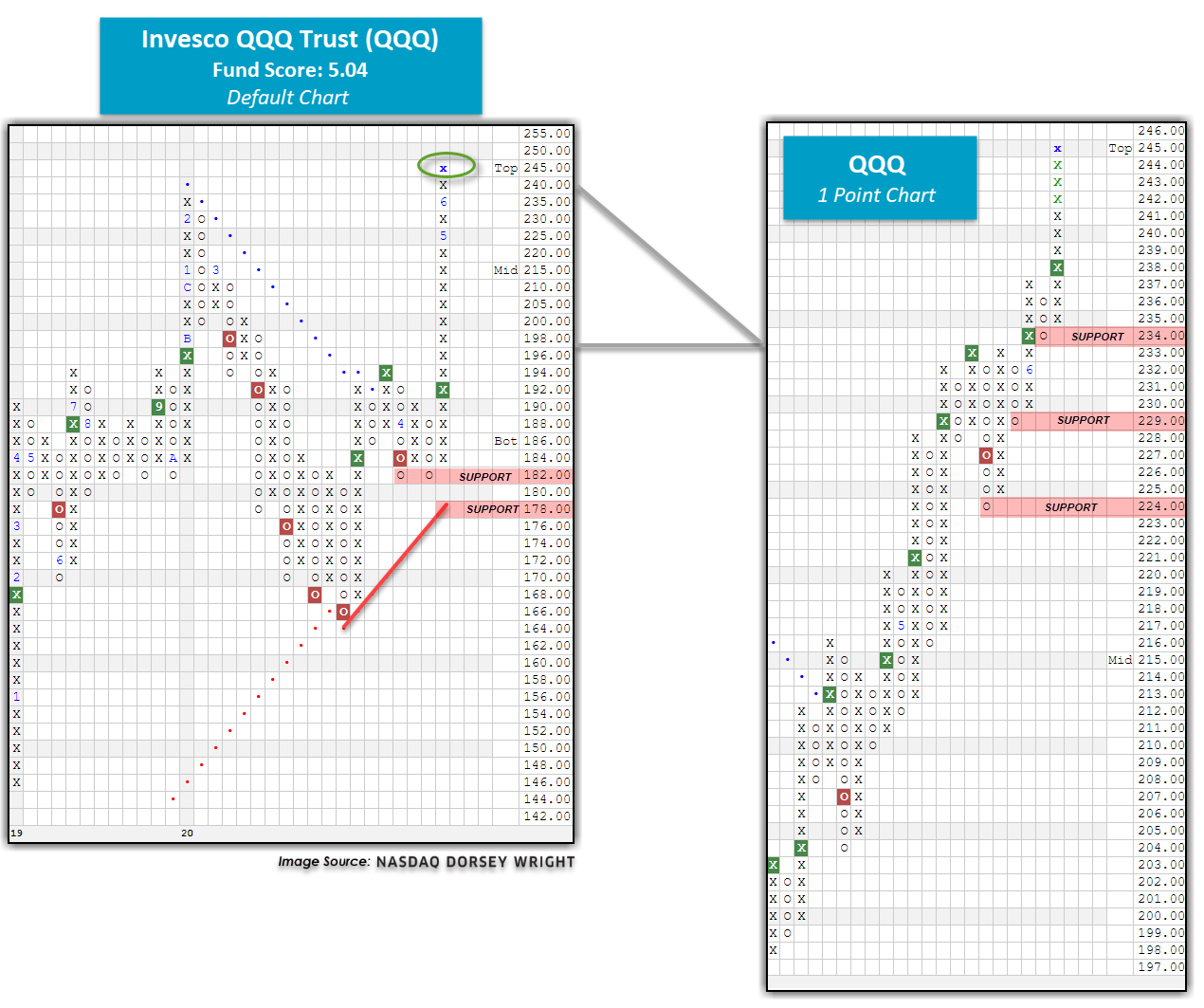

Today, the Invesco QQQ Trust (QQQ) printed a new all-time high at $245.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 273.38 | 2.15 | Positive | X | 3.78 | 263.30 | +9W | |

| EEM | iShares MSCI Emerging Markets ETF | 40.89 | 2.38 | Positive | Sell | O | 2.30 | 40.56 | +9W |

| EFA | iShares MSCI EAFE ETF | 63.81 | 3.37 | Positive | Sell | O | 1.58 | 63.28 | +9W |

| FM | iShares MSCI Frontier 100 ETF | 24.60 | 3.85 | Negative | Sell | O | 0.31 | 26.93 | +9W |

| IJH | iShares S&P MidCap 400 Index Fund | 190.44 | 1.81 | Positive | Buy | O | 2.90 | 184.97 | +9W |

| IJR | iShares S&P SmallCap 600 Index Fund | 73.71 | 1.63 | Positive | Buy | O | 2.53 | 73.75 | +9W |

| QQQ | Invesco QQQ Trust | 243.30 | 0.68 | Positive | Buy | X | 5.04 | 206.68 | +9W |

| RSP | Invesco S&P 500 Equal Weight ETF | 110.26 | 2.00 | Positive | Buy | X | 3.91 | 105.13 | +9W |

| SPY | SPDR S&P 500 ETF Trust | 320.79 | 1.80 | Positive | O | 3.91 | 300.66 | +9W | |

| XLG | Invesco S&P 500 Top 50 ETF | 241.94 | 1.53 | Positive | O | 4.39 | 221.26 | +9W |

Additional Comments:

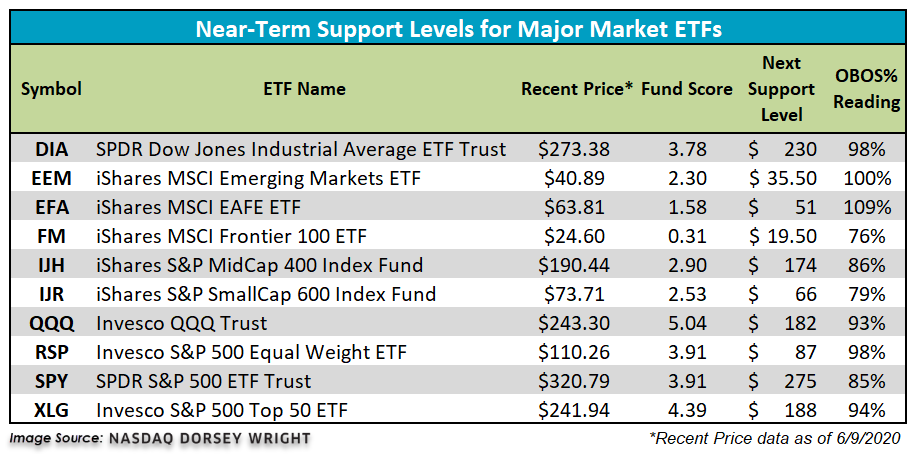

It was another exceptionally strong week for the 10 major market funds covered in this report as each managed to finish in positive territory. The top-performing fund over the last seven days was the iShares S&P SmallCap 600 Index Fund IJR, up a notable 8.99%. Conversely, the iShares MSCI Frontier 100 ETF FM lagged the pack despite finishing in positive territory with a gain of 2.80%. Two of the 10 major market funds currently sit in positive territory on the year, the Invesco QQQ Trust QQQ and the Invesco S&P Top 50 ETF XLG, with respective gains of 14.43% and 3.66% (through 6/9). In fact, with today’s (6/10) market action, the tech-heavy QQQ has rallied to new all-time highs, which we’ll discuss below. We have also updated initial support levels for all 10 major market funds covered in this report using today’s intraday action (note: all technical data is through 6/9).

As previously mentioned, the QQQ has reached a new all-time high at $245 with today’s market action as large-cap growth stocks continue to drive major US indexes higher. Recall that QQQ was the first major market fund to move back into positive territory for the year following the COVID-19 selloff and continues to lead the #2 performer, XLG, by a whopping 10.67%. To read more on the divergence between the QQQ and XLG, click here for the Major Market ETF Update published on May 20th. In early April, the QQQ returned to a buy signal with a spread triple top at $192 and has continued to rally in a single column of Xs without a pullback ever since. As a result, QQQ is nearing the very top of its 10-week trading band with an OBOS% reading of 93% overbought. Additionally, monthly momentum has been positive for two months, suggesting the potential for higher prices for the QQQ. From a fund score perspective, the QQQ has a solid score of 5.04, outscoring the average growth-domestic fund by 1.26 score points, the average all US fund by 1.82 score points, as well as the average US large-cap growth fund by 0.84 score points. The weight of the technical evidence is overwhelmingly positive, and demand is in control. As previously mentioned, QQQ is trading in technically overbought territory so those looking to initiate new long positions may wish to scale in or enter on a pullback and/or normalization of the trading band. An initial support level on the default chart sits at $182, with additional support offered with a test of the bullish support line at $178. For those looking for tighter support levels, we find viable support at $234 and $229 on the QQQ’s more sensitive 1 point per box chart.