Mexico, Colombia, and Peru have all shown relative strength improvement over the past month, continuing themes of strength.

International Equity Weekly Video (3:03)

Latin American representatives have shown increased dispersion over the past month, with relatively smaller representatives accounting for most of the relative strength improvement. This is not visible for those simply following the iShares S&P Latin America 40 ETF ILF. Even though that fund shows a strong 4.22 fund score sitting in a positive trend and on a buy signal, we have not seen the default chart move since January. Even more, the fund is about flat over the past 30 days, posting a return of just 0.07% (through 3/26). Brazil makes up the largest weighting of this fund by far, accounting for over 50% of the underlying exposure, which has not helped the fund over the past month. The iShares MSCI Brazil ETF EWZ has returned -2.60% over the past 30 days, notably underperforming other Latin American countries like Mexico (FLMX) at a gain of 2.90%, Colombia (GXG) 6.65%, and Peru (EPU) at 9.81%. Today, we will highlight the technical pictures of those other representatives as potential opportunities to look toward in the second quarter given their recent improvement and higher rankings in our NDW Country Index Matrix Rankings.

Mexico has been one of the most consistent relative strength names in international equities over the past two years, as it has remained in the top quartile of our NDW RS Country Matrix Rankings since February 2022. That 25-month stint is longer than any other current country inside the top ten, speaking to its resiliency. Of course, having one country sit so high in the rankings for so long begs the question of when this streak will end, as it cannot go on forever. However, it is important to remember that we are in the business of buying winners, and you will be hard-pressed to find a more consistent winner than Mexico. When that changes, so will our rankings, but the current technical picture for our southern neighbor does not suggest any pending declines on the horizon.

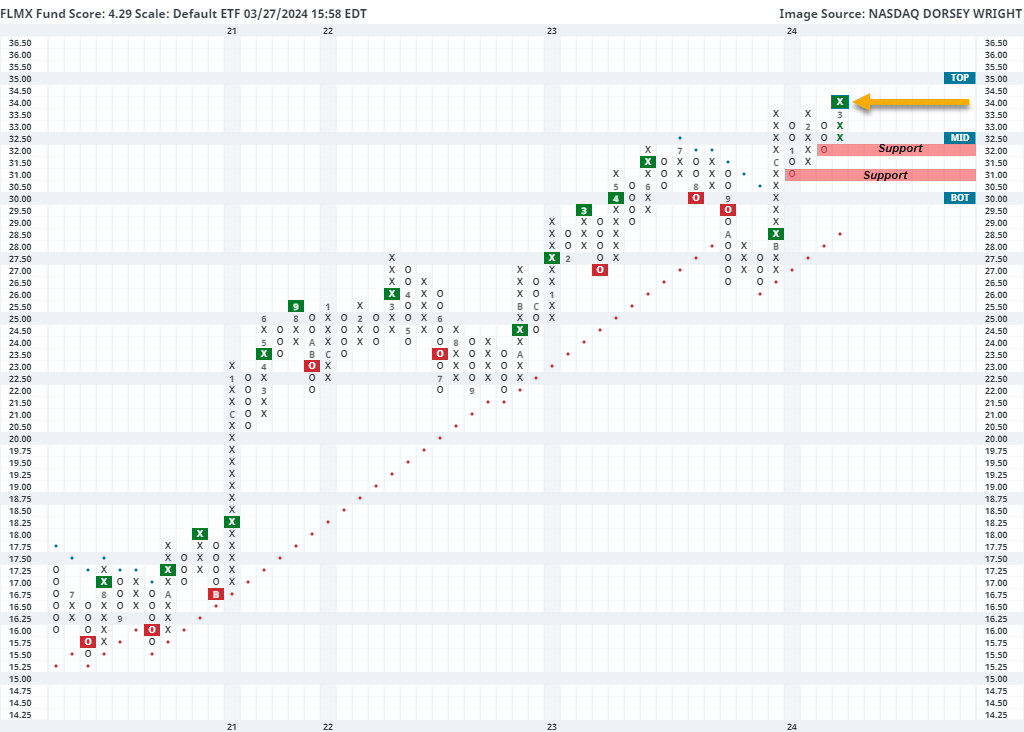

The Franklin FTSE Mexico ETF FLMX pushed higher Wednesday to break a triple top at $34, marking its highest level in over a decade. The fund has maintained an RS buy signal against the S&P Equal Weight Index SPXEWI since May 2022, helping it reach a robust 4.29 recent fund score posting that is paired with a strongly positive score direction. FLMX has not shown the same level of improvement so far in 2024 that we saw in the final few months of 2023, however, this week’s breakout provides further confirmation of an already positive technical backdrop. The fund still sits in an actionable trading range, with a weekly overbought/oversold reading of about 59% at the time of this writing. Weekly momentum also just flipped back to positive, suggesting the potential for further upside from here. Those looking to add exposure to Mexico may consider the fund on this breakout, with initial support seen at $32 and further support seen at $31. Note that FLMX is also a holding in the Franklin International Rotation Model (Franklin Report).

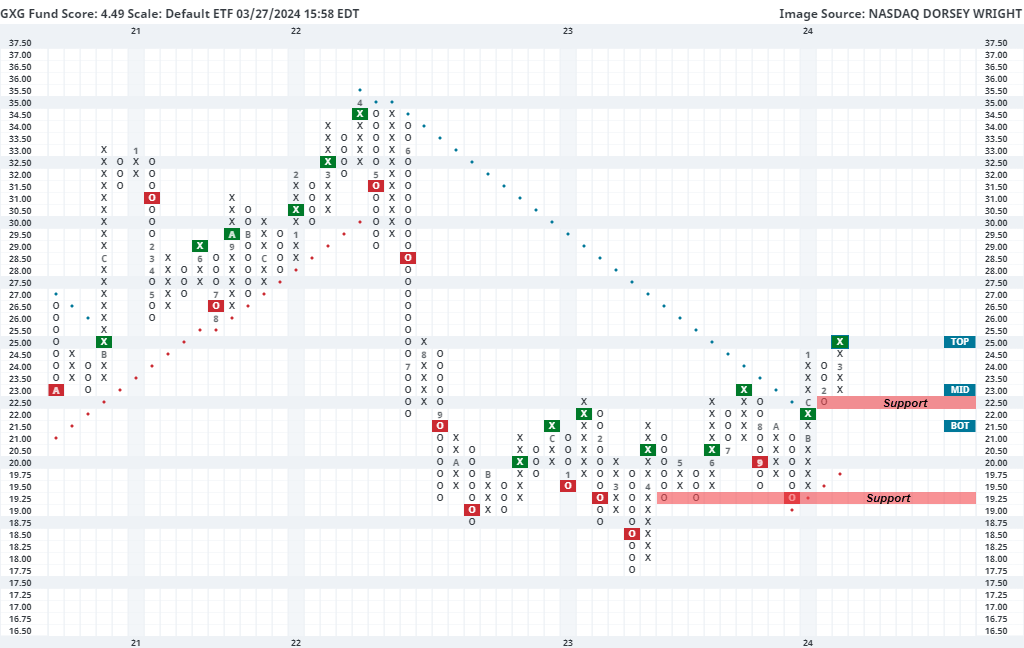

Colombia has shown consistent relative strength improvement since it began ascending from the last ranked position in our NDW Country Index Matrix ranking one year ago. Moving from the 42nd position in March 2023 all the way to the 4th position by March 2024 is no small feat. The Global X MSCI Colombia ETF GXG has also been indicative of this strength, with the fund pushing higher Wednesday to give a second consecutive buy signal at $25. GXG carries a strong 4.49 fund score paired with a sharply positive 2.73 score direction. We saw it move back to an RS buy signal against the market in January and saw weekly momentum recently flip positive, suggesting the potential for further upside from here. The fund also carries a 6.94% yield. Note that the recent appreciation has left GXG on a stem, with an intraday weekly overbought/oversold reading north of 93% at the time of this writing Wednesday. Those looking to add exposure may be best served to wait for a pullback or normalization in the trading band. Initial support can be seen at $22.50 with further support offered at $19.75 and $19.25.

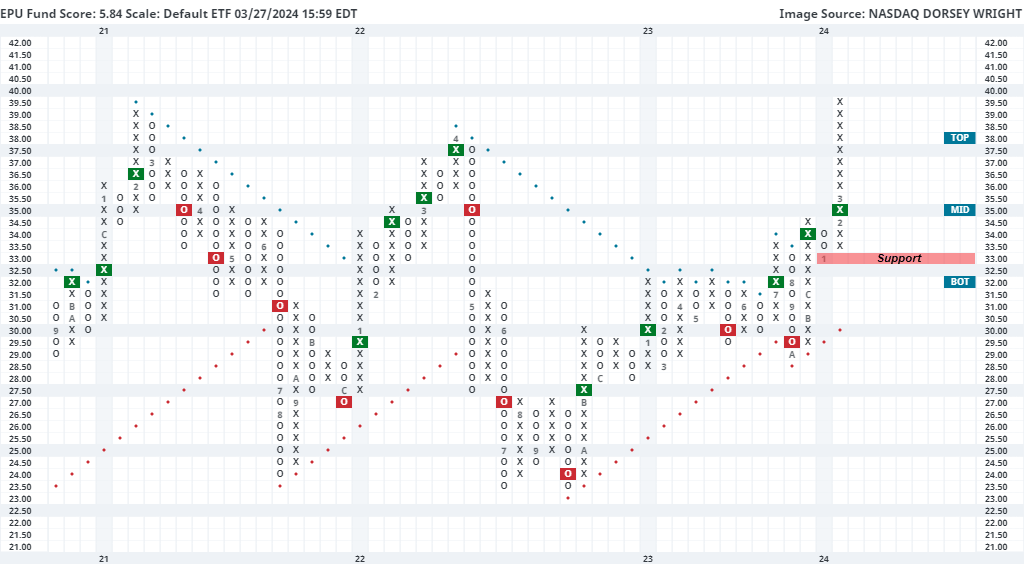

The final country we will highlight today is Peru, which is the lowest ranked of today’s three countries in focus at the 12th position out of the 42 countries in the NDW Country Index Matrix Ranking. Still, 12th is not bad, and we have seen Peru climb four positions in the past month, a greater rise than Mexico or Colombia have experienced in the past two months. This rapid appreciation has been seen on the default chart of the iShares MSCI Peru and Global Exposure ETF EPU, which climbed to a multi-year high of $39.50 earlier this month after reversing higher from the $33 position in February. EPU carries a near-perfect 5.84 fund score paired with a positive 2.35 score direction. This drastic appreciation has left EPU in an extended position, with a weekly overbought/oversold reading north of 100%. Initial support is also not seen until $33. Those looking to add exposure toward EPU may want to wait for some consolidation given the extended technical position. Remember, securities can pullback through price or pullback in time, as sideways movement around the current level would also lead to a normalization in the trading band. Further overhead resistance may be seen around $40 with additional resistance near $44.50.