The past week saw no significant technical developments in the Technology, Financials, Energy, Basic Materials, Communication Services, Consumer Non-Cyclical, or Healthcare Sectors. Those that saw noteworthy movement are included below.

U.S. Sector Updates

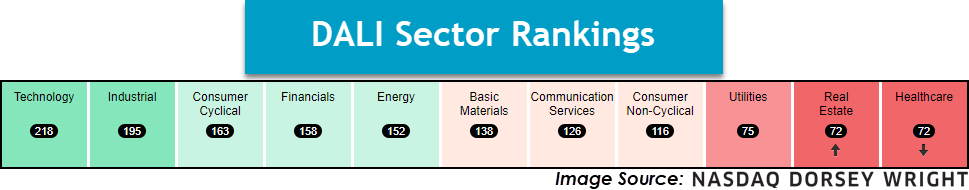

The past week saw no significant technical developments in the Technology, Financials, Energy, Basic Materials, Communication Services, Consumer Non-Cyclical, or Healthcare Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Industrial- Overweight

The industrial sector remains in 2nd place this week, as it has for quite some time now. Broad exposure remains viable here, as representative XLI holds a near 4.0 fund score and a string of buy signals on its default chart. Big headlines this week came from BA, which dropped back to the middle of the trading band following safety concerns after side-paneling on a Boeing plane came off mid-flight. Despite this, a reversal back into Xs could be technically constructive for this 3/5’er. A similar picture is in play for CAT, so consider setting an alert for a reversal back into Xs as a possible initiation point.

Consumer Discretionary- Overweight

Discretionary stocks pulled back over the last week with the SPDR Discretionary fund XLY falling 1.26% and bringing the fund closer to the middle of the trading band. Alaska Airlines ALK took headlines over the weekend but wasn’t impacted as much as other stocks involved within the news story and still maintains a negative technical picture with a 0 attribute rating. On the positive side of the coin, Abercrombie & Fitch ANF rallied to a new all-time high earlier this week and pulled back during Wednesday’s action. ANF presents a strong technical picture but has continued to trade within overbought territory for months now, so those seeking exposure to the stock may consider dollar cost averaging into positions. Other stocks within the broader sector that have reversed up into Xs this week and present positive technical pictures are Expedia EXPE and Amazon AMZN.

Utilities- Underweight

The SPDR Utilities fund XLU rallied 34 basis points over this past week, leading the fund to reverse back into Xs and again test the bearish resistance line. From here, a move above $67 would flip the trend back to positive and further improve the ETF’s fund score, which did uptick above 1 this past week. ONEOK OKE rallied to a new multi-year high and still trades within actionable territory. The stock is a 5 for 5’er that maintains a yield north of 5%. Otter Tail Power OTTR is a smaller cap name within the Electric Utilities space that is a 5 for 5’er and has pulled back from recent rally highs.

Real Estate- Underweight

Real Estate is fighting with Healthcare for the bottom rank in DALI, but the sector has near-term momentum and could likely overtake Utilities if the strength continues. Individual stock participation is still strong, with most stocks trading on a Point & Figure buy signal as well as above their 50-day moving average. Furthermore, now with an average fund score of 2.80, the sector is nearing the acceptable 3.0 score line. PLD will be the first notable name on the earnings deck, a breakout at $140 would be constructive.