Long-term Treasury yields were up slightly over last week as they continued to rebound from heavily oversold conditions.

Long-term Treasury yields were up slightly over last week as they continued to rebound from heavily oversold conditions. The US Treasury 10-year Yield Index (TNX) crossed back above 4%. The five-year yield index (FVX) also crossed back above the 4% threshold and now sits even with TNX at 4.05%.

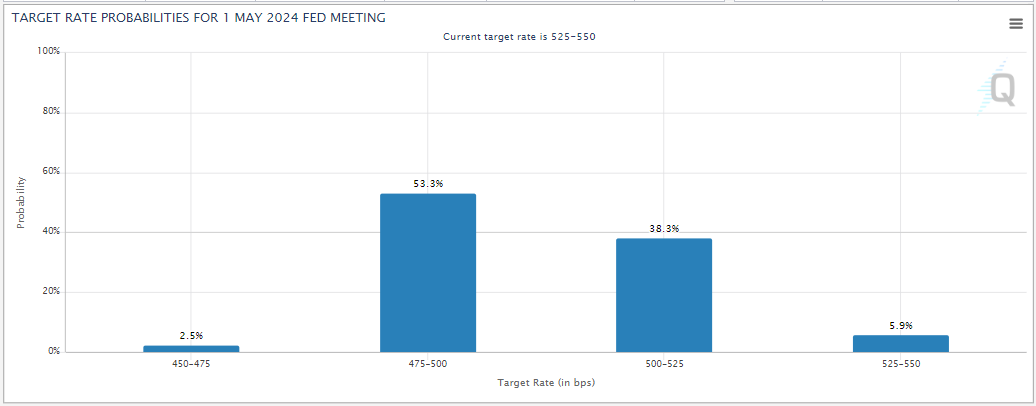

Fed futures have fluctuated recently, reflecting changing views about when the Fed will begin cutting rates. At this point, the Fed futures market is pricing in roughly a 68% chance of one rate cut by March and a better than 90% probability that the Fed will cut rates at least one time by May. The futures market is still pricing in at least 125 bps of cuts in 2024, with a better than 50% chance of at least 150 bps in cuts.

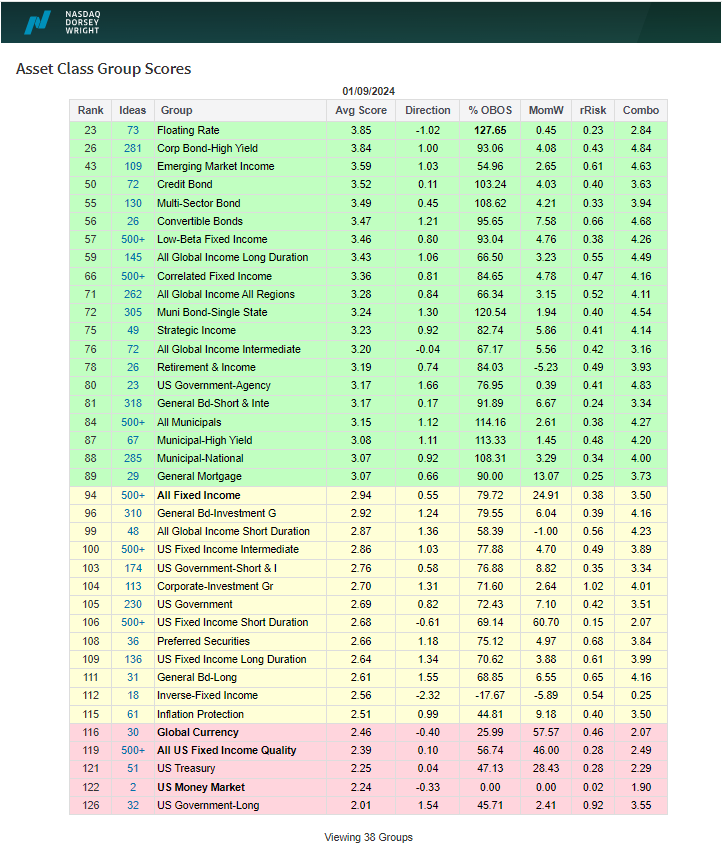

The recent rebound in yields has helped to put floating rates back atop the Asset Class Group Scores fixed income rankings. While floating rates can be seen as a defensive group, overall, the rankings still reflect a generally strong bond market with most groups sitting above the 3.0 score threshold. Despite the recent pullback in bonds, many groups remain in heavily overbought territory, suggesting the possibility we could see a bit more downside or a period of consolidation while prices normalize. One phenomenon that has continued recently is the positive correlation of bonds and equities – we have generally seen stocks and bonds move up and down together. This may be welcomed by investors currently as both assets have generally been going up over the last few months, however, it does present a challenge from an asset allocation standpoint as it undermines the diversification benefit of the traditional 80/20 (or 60/40) portfolio. As a result, investors may want to ensure that there is some diversification within their fixed income portfolio. One possible solution is to include instruments like floating rates, which generally have a slightly positive correlation with yields and low correlations to other areas of fixed income.