Daily Summary

Daily Equity Roster

Today's featured stock is AmerisourceBergen Corporation (ABC).

Analyst Observations

AMP, MA, BLK, VMC, HES, DD, CUBE, AVY, ELF, EXP, HUBB, FSLR, & APPS.

Daily Option Ideas

Call: BJ's Wholesale Club (BJ); Put: General Motors (GM); Covered Write: Six Flags Entertainment (SIX)

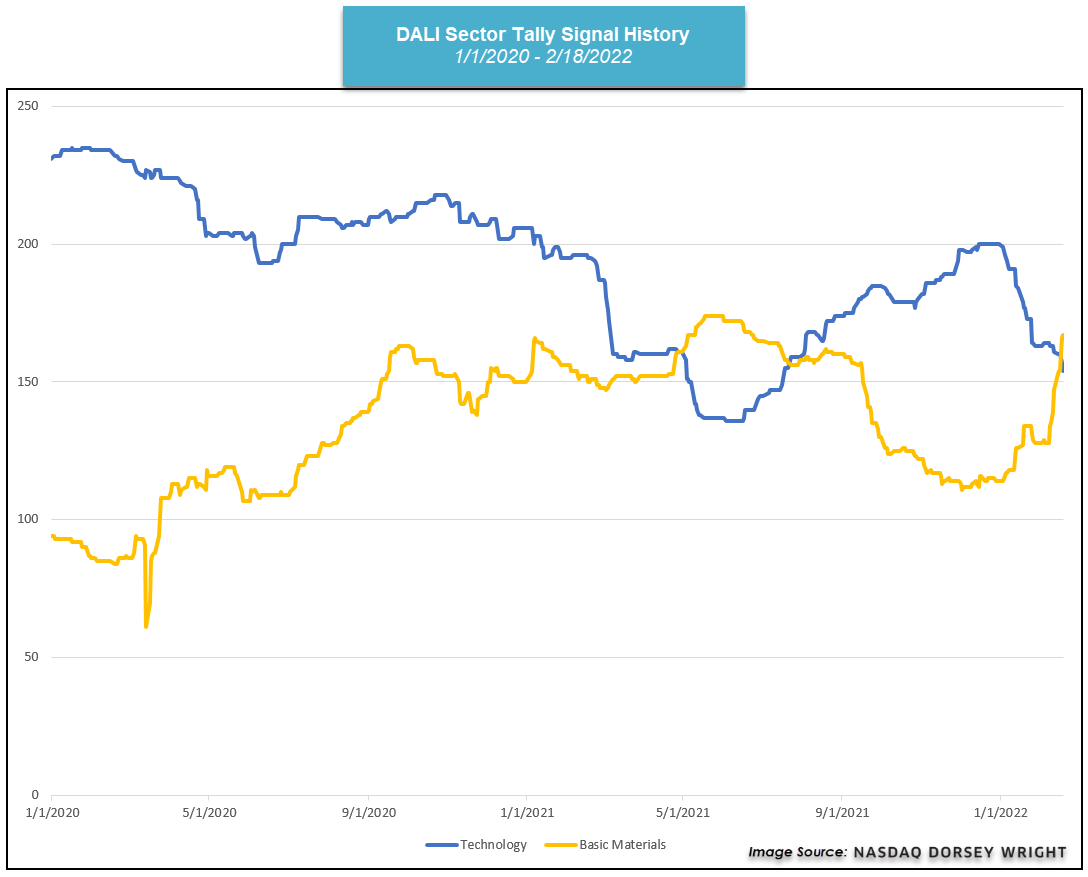

Market movement last week led to some notable changes in the DALI domestic equity sector rankings. Technology continued to show relative strength weakness as it fell to the fourth-ranked position, while basic materials improved to the third spot. The decline in relative strength from technology has been well documented throughout our research over the past several weeks. The sector has lost a total of 46 RS tally signals so far this year (through 2/18), with the majority of those being pruned in January. Even though February has not seen as much deterioration, technology has still lost nine signals this month, the second-worst drop of any sector (behind real estate at -14).

Keep in mind that the DALI rankings look at multiple representatives for each sector, with the number of buy signals for each representative added together to get a tally signal count for the sector as a whole. The internet and software representatives were largely responsible for the initial signal decline for technology, while the semiconductors representative remained elevated in the broader rankings due to their rapid improvement in the second half of last year. Some of that strength has begun to wane due to sharp declines seen from some semiconductor names over the past few weeks.

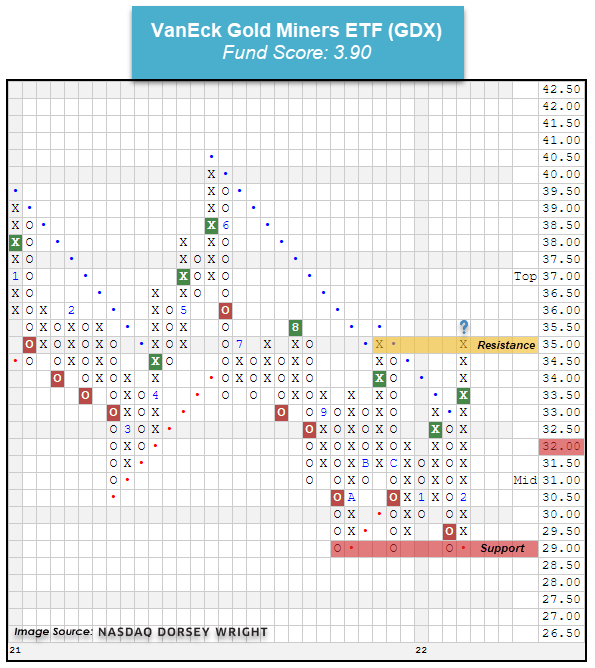

On the other hand, there have been several names in the basic materials space that have continued to pick up the pace of their improvement. One such name is the SDPR S&P Metals & Mining ETF XME, which we highlighted in last Wednesday’s report. This fund had been stuck in a rather large trading range between $40 and $48 until earlier this month when it returned to a positive trend before marking a new multi-year high at $50. That improvement from the broad metals & mining space has also carried over to more focused representatives such as the VanEck Gold Miners ETF GDX. This fund pushed higher last week to return to a positive trend and is currently positioned at the top of its own near-term trading range at $35. GDX also carries a favorable 3.90 recent fund score posting, paired with a strongly positive 3.75 score direction. Precious metals have been a laggard area within commodities over the past several months, but have shown near-term strength in February. Further strength from gold would be a tailwind for gold mining stocks, leading to the potential for more relative strength improvement from basic materials. GDX is pulling back slightly from overhead resistance at the time of this writing Tuesday but has near-term support offered on its ¼-point chart at $32. Further support can be found on the default chart at $29.

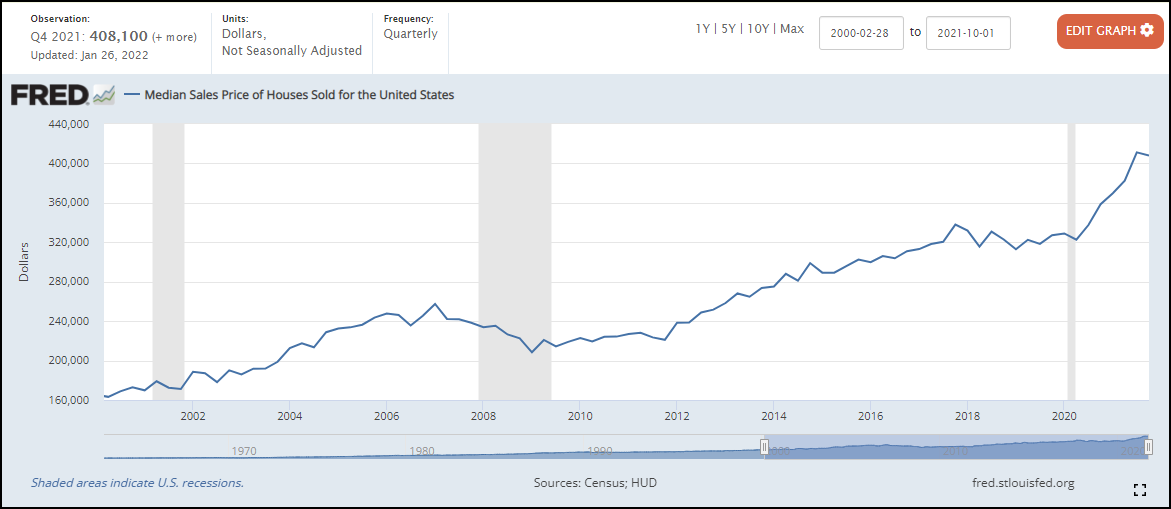

Over the last almost two years demand for residential housing has been immense as just about everyone has heard anecdotal stories from friends, family, or acquaintances that have either bought or sold homes recently. The lack of supply due to construction being halted or slowed by the pandemic and historically low mortgage rates were massive tailwinds for housing prices, as well as home builders. In later 2021 and so far in 2022, we have seen the trend of higher housing prices begin to stall as more supply comes to market, and mortgage rates have increased alongside interest rates in general.

To start off, let’s look at the Median Sales Price of Houses Sold For in the US. In the chart below one can see that housing prices had trended higher since the GFC but began to stagnate around the $320,000 level from 2017 until 2020 before swiftly rising to around $400,000. That is an increase of about 25% in one year! Now, we do see a bit of a plateau on the chart below in the fourth quarter of 2021 signaling there may be some slowing down in housing prices, but this is just one quarter and is inconclusive on where we may be headed from here.

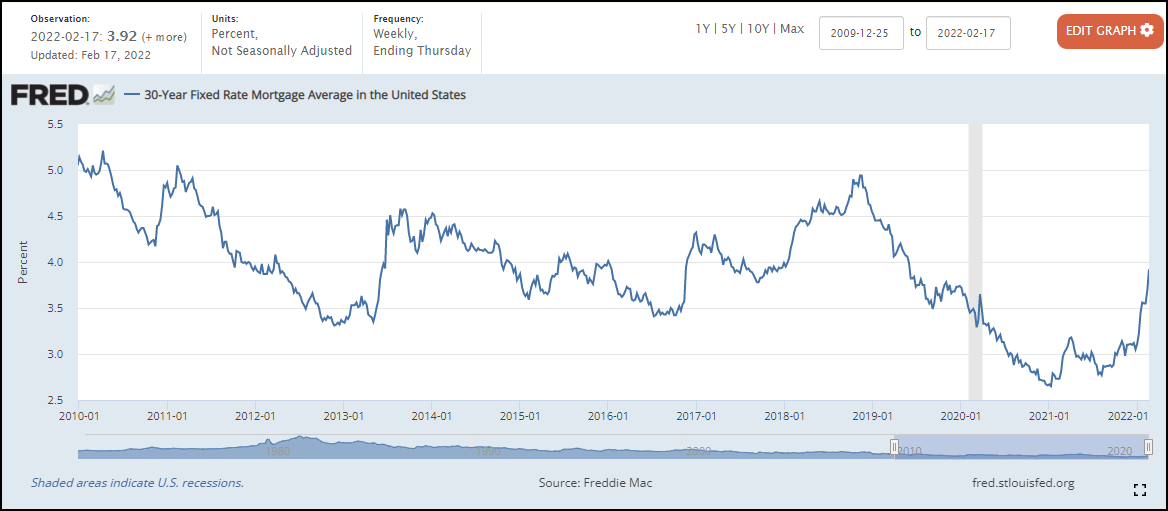

After looking at the increase in housing prices, what about the ability to finance these houses? The 30-Year Fixed Rate Mortgage Average in the US is now back above pre-pandemic levels with a reading of 3.92% and has increased quite drastically since the start of 2022. Coupled with rhetoric from the Federal Reserve of their plans to raise interest rates, it seems likely that mortgage rates will also continue higher. Not only has housing become more expensive, but the ability to finance these homes is also becoming more expensive. Lastly, on the economic data front, New Privately-Owned Housing Units Started: Total Units looks to have recovered since the pandemic slowed new developments. Right now, there are 1.638 million housing units started as of January of this year which is one of the highest readings since the GFC, but from a long-term historical perspective in the US, it is about average (FRED). Nonetheless, housing production is above where it was prior to the pandemic and looks to be making up for the lost time in 2020. You can view the Total Housing Starts on a Point & Figure chart on our system with the symbol ^HOUSESTARTS.

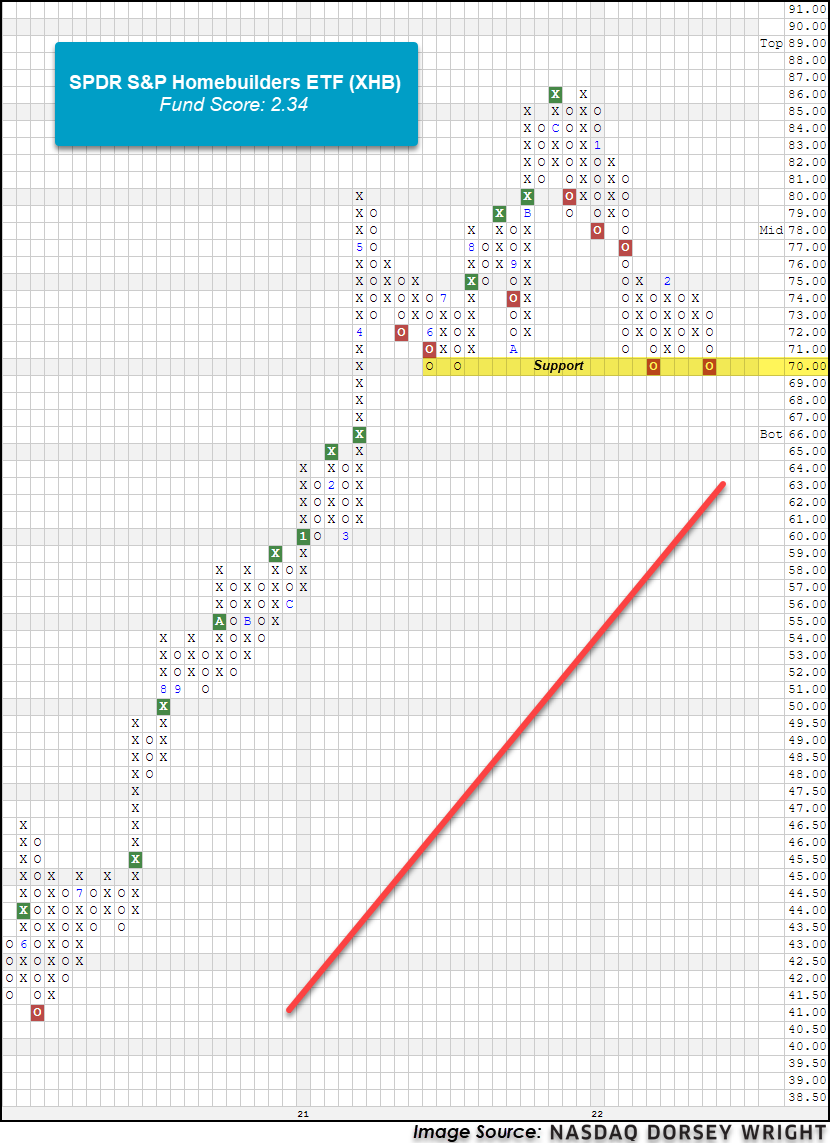

While the macroeconomic tailwinds for sharply rising home prices may be subsiding the technical picture for home builders has been weakening as well. The SPDR S&P Homebuilders ETF (XHB) has a fund score of 2.34 with a highly negative score direction of -3.52, pointing to the rapid deterioration of strength. XHB is trading on five consecutive sell signals and has formed a spread quadruple bottom at $70, its current chart level. The fund remains in a positive trend still partly due to its strong performance in 2020 and 2021, but the technical picture is deteriorating rather quickly as the fund has posted a year-to-date return of -18.05%. XHB isn't a perfect proxy for pure homebuilders as it has stocks like Home Depot (HD) and Lowes (LOW) nor is it necessarily tied to home prices, but its technical deterioration is noteworthy.

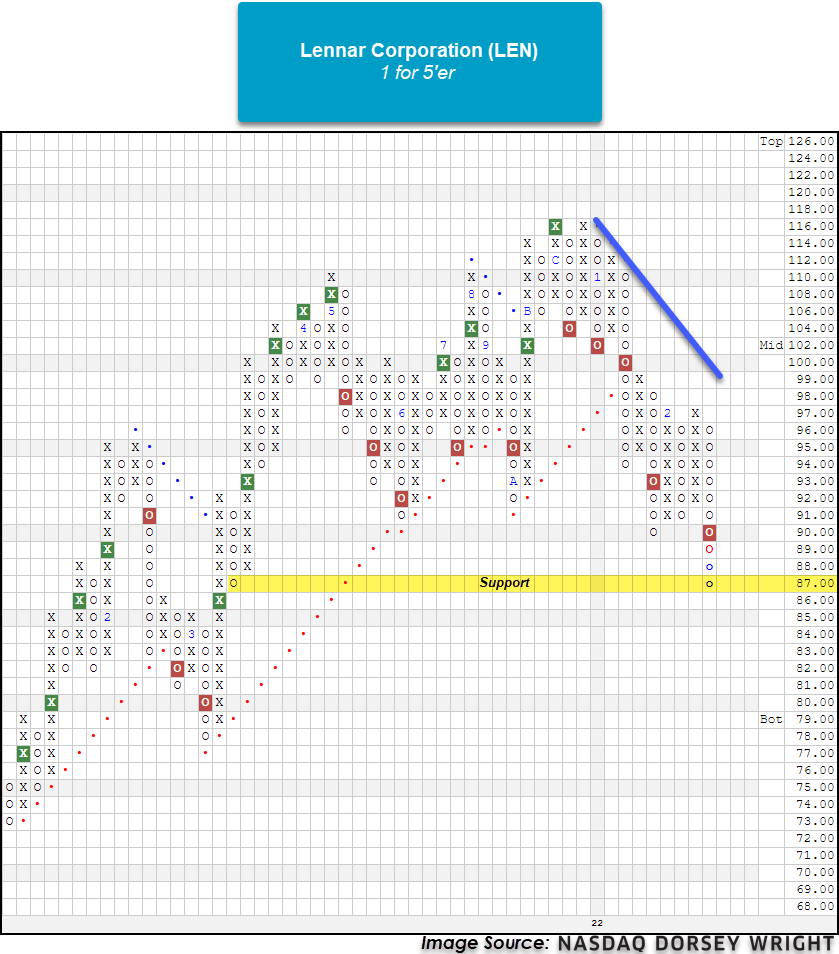

Individual stocks involved in residential real estate have also seen technical deterioration. Lennar Corporation (LEN) and D.R. Horton, Inc. (DHI) are companies more heavily involved in residential real estate development. Both LEN and DHI are weak attribute names with similar chart patterns as each has recently broken through major support levels. In the case of LEN, the stock is a 1 for 5'er and is trading on five consecutive sell signals. LEN broke through strong support in the $90 - $91 range last week and has continued lower in today's trading to test another area of support at $87. In conclusion, a combination of macroeconomic and technical headwinds have hit homebuilders quickly to start 2022. While macroeconomic data can be useful in crafting an explanation for the technical weakness we've seen in homebuilders, technicals are still paramount in the decision-making process. Economic data can be construed and interpreted in many different ways, but price is our guide.

Average Level

-30.68

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| AKR | Acadia Realty Trust | Real Estate | $21.26 | 20 - 22 | 28 | 18 | 4 for 5'er, #6 of 154 in REAL sector matrix, one box from RS buy signal, 2.7% yield |

| FOE | Ferro Corp | Chemicals | $21.84 | high teens to low 20s | 35 | 16 | 4 for 5'er, 8 consec buy signals, pullback from recent high, pos trend, top of DWACHEM matrix Earnings 2/23 |

| SWCH | Switch, Inc. Class A | Internet | $24.88 | 25 - 28 | 54.50 | 22 | 4 for 5'er #6 of 51 in INET sector matrix, spread triple top, R-R>5.0, Earn. 2/24 |

| EQH | Equitable Holdings Inc | Insurance | $33.17 | mid to upper 30s | 47.5 | 27 | 5 for 5'er, pullback from ATH, 3 consec buy signals, pos weekly momentum flip, 2.2% yield |

| TROX | Tronox Incorporated | Chemicals | $21.22 | mid 20s | 43.50 | 20 | 5 for 5'er, top 1/3 DWACHEM matrix, 3 weeks pos weekly mom, pullback from rally high, 1.65% yield |

| TTM | Tata Motors Limited (India) ADR | Autos and Parts | $32.67 | low-to-mid 30s | 68.50 | 28 | 5 for 5'er, 4th of 58 in AUTO sector matrix, one box from multi-year high, R-R>5.0 |

| CWK | Cushman & Wakefield Plc | Real Estate | $22.62 | low to mid 20s | 30.5 | 17.5 | 5 for 5'er, 6 consecutive buy signals, all-time highs, top 25% DWAREAL matrix, positive trend, pos mon mom, Earn. 2/24 |

| BCS | Barclays PLC Adr (United Kingdom) ADR | Banks | $10.49 | 9.50 - 11 | 17.50 | 8.50 | 4 for 5'er, top half of favored BANK sector matrix, one box from peer RS buy, multiple consec buy signals, 1.5% yield |

| OZK | Bank OZK | Banks | $47.28 | mid $40s - $50s | 94 | 38 | 5 for 5 TA, 3 consec. buy signals, pullback to middle of trading band from rally high, 2.49% yield |

| DVN | Devon Energy Corporation | Oil | $54.78 | upper 40s - low 50s | 82 | 42 | 5 for 5'er, #5 of 74 in favored oil sector matrix, bullish catapult, 3.8% yield, R-R>3.0 |

| FANG | Diamondback Energy Inc | Oil | $131.47 | mid 120s - mid 130s | 184 | 104 | 5 for 5'er, top 20% of favored OIL sector matrix, R-R>2.5, 1.55% yield, Earn. 2/22 |

| SBCF | Seacoast Banking Corporation of Florida | Banks | $37.21 | mid-to-upper 30s | 55 | 29 | 5 for 5'er, top half of favored BANK sector matrix, spread triple top, R-R>2.5, 1.4% yield |

| MT | ARCELORMITTAL SA (Netherlands) ADR | Steel/Iron | $30.33 | low-to-mid $30s | 58 | 26 | 4 for 5 TA rating, top half of steel/iron RS matrix, R-R > 4.5 |

| SNV | Synovus Financial Corp. | Banks | $51.88 | low-to-mid $50s | 72 | 43 | 5 TA rating, top quintile of BANK sector matrix, pos. trend, 2.58% yield |

| RJF | Raymond James Financial Inc | Wall Street | $108.52 | mid 100s - low 110s | 143 | 91 | 5 for 5'er, #2 of 28 in favored WALL sector matrix, bullish catapult, 1.12% yield |

| UPS | United Parcel Service, Inc. | Aerospace Airline | $209.36 | 200s - 220s | 306 | 176 | 5 for 5'er, 2nd of 45 in AERO sector matrix, multiple buy signals, 2.76% yield, R-R>2.0 |

| CPRI | Capri Holdings Ltd | Retailing | $67.81 | mid $60s to low $70s | 103 | 56 | 5 TA rating, top of RETA sector matrix, recent positive momentum flips, R-R > 2 |

| CFG | Citizens Financial Group Inc | Banks | $53.25 | low-to-mid 50s | 84 | 46 | 4 for 5'er, top third of BANK sector matrix, one box from RS buy signal, spread quad top, R-R>3.0, 2.9% yield |

| PBF | PBF Energy Inc. | Oil | $18.01 | $16 to $19 | 34 | 14.50 | 5 TA rating, top quintile of OIL matrix, consec. buy signals, R-R > 3.5 |

| NLOK | NortonLifeLock Inc. | Software | $27.97 | mid to hi 20s | 45.50 | 23 | 4 for 5'er, #2 of 117 in SOFT sector matrix, triple top, 1.7% yield, R-R>3.0 |

| ABC | AmerisourceBergen Corporation | Drugs | $141.50 | low $130s to mid $140s | 182 | 112 | 5 TA rating, top decile of DRUG sector matrix, consec. buy signals, 1.29% yield |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| BMBL | Bumble, Inc. Class A | Internet | $25.19 | hi 20s - low 30s | 21.50 | 35 | 0 for 5'er, bottom 25% of unfavored INET sector matrix, bearish triangle |

Removed Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| AMP | Ameriprise Financial | Finance | $300.56 | 440 | 260 | AMP was removed as it moved to a sell signal Tuesday. Those with current exposure can maintain a stop at $260. |

Follow-Up Comments

| Comment | |||||||

|---|---|---|---|---|---|---|---|

|

|

|||||||

DWA Spotlight Stock

ABC AmerisourceBergen Corporation R ($140.56) - Drugs - ABC has a 5 for 5 TA rating and is ranked in the top decile of names in the drugs sector RS matrix. This stock moved back to a positive trend in late-2021 and gave two consecutive buy signals before reaching a new all-time high at $144 earlier this month. Since then, ABC has seen price normalization to arrive at a current position near $140. Weekly momentum also just flipped positive, suggesting the potential for further upside from here. The stock also carries a 1.29% yield. Long exposure may be added in the low $130s to mid $140s. Out initial stop will be set at $112, which would violate multiple support levels on the default chart. We will use the bullish price objective of $182 as our price target.

| 21 | 22 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 144.00 | X | 144.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 142.00 | X | 142.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 140.00 | X | 140.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 138.00 | 2 | 138.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 136.00 | 1 | X | 136.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 134.00 | X | O | X | 134.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 132.00 | X | O | X | Mid | 132.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 130.00 | • | X | O | X | 130.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 128.00 | X | X | • | X | O | 128.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 126.00 | • | X | O | X | X | O | X | 126.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 124.00 | 5 | X | • | • | 8 | O | 9 | O | B | O | X | 124.00 | |||||||||||||||||||||||||||||||||||||||||

| 122.00 | 4 | O | X | O | X | • | • | X | O | X | O | X | X | O | X | 122.00 | |||||||||||||||||||||||||||||||||||||

| 120.00 | X | O | X | O | X | O | 6 | • | X | O | X | O | X | O | X | O | X | 120.00 | |||||||||||||||||||||||||||||||||||

| 118.00 | X | O | X | O | X | O | X | O | X | O | X | A | X | O | X | O | X | • | 118.00 | ||||||||||||||||||||||||||||||||||

| 116.00 | X | O | O | X | O | X | O | X | O | • | O | • | O | • | O | X | • | Bot | 116.00 | ||||||||||||||||||||||||||||||||||

| 114.00 | X | O | O | • | O | X | • | • | • | C | • | 114.00 | |||||||||||||||||||||||||||||||||||||||||

| 112.00 | X | X | X | • | 7 | • | • | 112.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 110.00 | X | X | O | 2 | X | O | X | • | • | 110.00 | |||||||||||||||||||||||||||||||||||||||||||

| 108.00 | • | X | O | X | O | X | O | X | O | 3 | • | 108.00 | |||||||||||||||||||||||||||||||||||||||||

| 106.00 | X | • | X | O | X | O | X | O | X | O | X | • | 106.00 | ||||||||||||||||||||||||||||||||||||||||

| 104.00 | X | 8 | O | • | X | O | X | O | O | O | X | • | 104.00 | ||||||||||||||||||||||||||||||||||||||||

| 102.00 | X | X | X | O | X | O | • | • | X | O | X | O | • | 102.00 | |||||||||||||||||||||||||||||||||||||||

| 100.00 | X | O | X | O | X | O | X | O | X | • | X | • | X | O | X | • | 100.00 | ||||||||||||||||||||||||||||||||||||

| 99.00 | X | O | X | O | X | O | O | X | O | • | • | X | O | X | C | X | • | 99.00 | |||||||||||||||||||||||||||||||||||

| 98.00 | X | O | X | O | X | O | X | O | X | • | X | O | X | O | X | • | 98.00 | ||||||||||||||||||||||||||||||||||||

| 97.00 | 6 | O | X | 7 | X | O | X | O | X | X | O | X | O | B | O | X | • | 97.00 | |||||||||||||||||||||||||||||||||||

| 96.00 | X | O | X | O | X | 9 | X | O | X | O | X | O | X | O | X | O | X | • | 96.00 | ||||||||||||||||||||||||||||||||||

| 95.00 | X | X | O | X | O | O | X | O | X | O | X | A | X | O | X | 1 | • | 95.00 | |||||||||||||||||||||||||||||||||||

| 94.00 | X | O | X | O | X | O | O | X | O | X | O | • | O | X | • | 94.00 | |||||||||||||||||||||||||||||||||||||

| 93.00 | • | X | O | X | O | O | • | O | X | • | O | • | 93.00 | ||||||||||||||||||||||||||||||||||||||||

| 92.00 | X | X | • | X | O | X | • | • | O | • | • | 92.00 | |||||||||||||||||||||||||||||||||||||||||

| 91.00 | X | O | X | O | X | O | • | • | 91.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 90.00 | X | O | X | O | X | • | 90.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 89.00 | X | O | X | X | O | X | • | 89.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 88.00 | X | 5 | X | O | X | O | X | • | 88.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 87.00 | X | O | X | O | X | O | X | • | 87.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 86.00 | • | O | • | O | • | O | X | • | 86.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 85.00 | • | • | O | X | • | 85.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 84.00 | O | X | • | 84.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 83.00 | O | X | • | 83.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 82.00 | O | • | 82.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 21 | 22 |

| AMP Ameriprise Financial ($296.43) - Finance - AMP shares moved lower today to break a double bottom at $296 to mark its first sell signal. This 5 for 5'er has been in a positive trend since May 2020 and on an RS buy signal versus the market since November 2020. AMP is trading near the middle of its trading band with a weekly overbought/oversold reading of -14%. From here, support is offered at $288. |

| APPS Digital Turbine Inc. ($44.02) - Computers - Shares of APPS fell Tuesday to mark a second consecutive sell signal at $46 before falling to $44 intraday. This 2 for 5'er moved to a negative trend in November and ranks in the bottom half of the computers sector RS matrix. The technical picture is weak and deteriorating. Avoid long exposure. Further support may be seen at $41, while initial overhead resistance is potentially found at $51. |

| AVY Avery Dennison Corporation ($179.08) - Business Products - AVY continued lower Tuesday giving a second consecutive sell signal when it broke a triple bottom at $178. Although the stock retains a favorable 4 for 5'er TA rating, those with open exposure should monitor the position as it has recently violated multiple levels of previous support. |

| BLK BlackRock, Inc. ($749.54) - Wall Street - BLK shares moved lower today to break a spread triple bottom to market its third consecutive sell signal. This 4 for 5'er has been in a positive trend since April 2020 and on an RS buy signal versus the market since October 2020. BLK is trading in heavily oversold territory with a weekly overbought/oversold reading of -85%. From here, support is offered at $672. |

| CUBE CubeSmart ($47.92) - Real Estate - Shares of CUBE broke a double bottom at $48 on Tuesday, resulting in a second consecutive sell signal a test of the final level of nearby support. The stock remains a 5 for 5'er ranked in the upper half of the real estate stock sector matrix, but the near-term picture is weak. No new exposure. A breakdown past current support, at $48, could signal greater concern. Demand would reenter the picture with a breakout at $53. Note earnings are expected on 2/24. |

| DD DuPont de Nemours Inc. ($77.91) - Chemicals - DD fell to a sell signal and violated its trend line on Tuesday, which will drop it to a 0 for 5'er. Long exposure should be avoided. From here, the next level of support sits at $76. DD carries a 1.7% yield. |

| ELF Elf Beauty Inc ($26.24) - Household Goods - ELF shares completed a bearish catapult on Tuesday with a double bottom sell signal at $26. The stock maintains a 5 for 5 attribute rating and high placement in the household good stock sector matrix, but the near-term picture is concerning. Further support is offered at around $25 while resistance is positioned firmly overhead between $30 and $33. |

| EXP Eagle Materials, Inc. ($136.74) - Building - Shares of EXP broke a triple bottom at $138 on Tuesday, resulting in a second consecutive sell signal and a potential retest of key support. The stock currently carries 3 of 5 technical attributes in its favor and ranks in the top third of the building stock sector matrix, but the weight of the evidence is currently negative. Key support is offered at around $130. |

| FSLR First Solar, Inc. ($65.85) - Electronics - FSLR fell Tuesday to break a triple bottom at $67 before falling to a new 52-week low at $66 intraday. This 1 for 5'er moved to a negative trend in December and has been on an RS sell signal against the market for over a year. The weight of the technical evidence is negative here and weakening. Additional long exposure should be avoided. Note that the fund is at an oversold position and has the potential for further support seen at $60. Initial overhead resistance may be found at $72. Earnings are expected on 3/1. |

| HES Hess Corporation ($94.13) - Oil - HES returned to a buy signal on Tuesday when it broke a quadruple top at $97. The overall outlook for HES is positive as it holds a strong 4 for 5 technical attribute rating. From here, the first level of support sits at $93, with further support at $90. |

| HUBB Hubbell Inc ($177.94) - Electronics - HUBB shares broke a spread quintuple bottom at $178 Tuesday and now tests the trough of its trading range established over the past year. The stock remains a 3 for 5'er but the near-term setup is not constructive. A breakout below $174 could signal additional trouble and serve as a place to trim exposure. Demand would reenter the picture with a breakout at $194. |

| MA Mastercard Incorporated Class A ($370.16) - Finance - MA shares moved lower today to break a double bottom at $364 to mark its second consecutive sell signal. This 4 for 5'er has been in a positive trend since January and on an RS buy signal versus the market since August 2011. MA is trading near the middle of its trading band with a weekly overbought/oversold reading of 5%. From here, support is offered at $332. |

| VMC Vulcan Materials Company ($184.30) - Building - VMC broke a triple bottom and violated its trend line on Tuesday adding evidence to an already negative picture. The trend line violation will drop the stock to a 1 for 5'er. VMC now sits against support at $182, with further support at $180. |

Daily Option Ideas for February 22, 2022

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| BJ's Wholesale Club Holdings Inc - $63.67 | BJ2217F60 | Buy the June 60.00 calls at 8.40 | 55.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Stag Industrial Inc ( STAG) | Jun. 40.00 Calls | Stopped at 39.00 (CP: 38.86) |

| Bank of America ( BAC) | May. 46.00 Calls | Stopped at 2.70 (CP: 2.46) |

| United Airlines Holdings Inc. ( UAL) | Jun. 50.00 Calls | Stopped at 46.00 (CP: 46.84) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| General Motors - $47.07 | GM2217R47 | Buy the June 47.00 puts at 4.75 | 52.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| The Gap, Inc. (GPS) | Jun. 18.00 Puts | Raise the option stop loss to 2.50 (CP: 4.50) |

| Oracle Corporation (ORCL) | May. 82.50 Puts | Raise the option stop loss to 8.15 (CP: 10.15) |

| NIKE, Inc. (NKE) | May. 150.00 Puts | Initiate an option stop loss of 14.30 (CP: 16.30) |

| Lennar Corporation (LEN) | May. 92.50 Puts | Initiate an option stop loss of 8.20 (CP: 10.20) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Six Flags Entertainment Corporation $44.78 | SIX2217F47.5 | Jun. 47.50 | 3.10 | $20,852.15 | 40.73% | 19.98% | 5.92% |

Still Recommended

| Name | Action |

|---|---|

| Macy's Inc. (M) - 25.70 | Sell the May 28.00 Calls. |

| Continental Resources Inc. (CLR) - 52.77 | Sell the June 55.00 Calls. |

| Live Nation Entertainment Inc. (LYV) - 117.44 | Sell the July 120.00 Calls. |

| Seagate Technology (STX) - 108.64 | Sell the June 115.00 Calls. |

| Macy's Inc. (M) - 25.70 | Sell the May 26.00 Calls. |

| AerCap Holdings NV (AER) - 65.77 | Sell the July 70.00 Calls. |

| Performance Food Group Co Formerly (PFGC) - 53.31 | Sell the June 55.00 Calls. |

| Nucor Corporation (NUE) - 122.93 | Sell the May 125.00 Calls. |

| Citizens Financial Group Inc (CFG) - 53.25 | Sell the June 55.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

| Dick's Sporting Goods, Inc. ( DKS - 103.85 ) | June 120.00 covered write. |