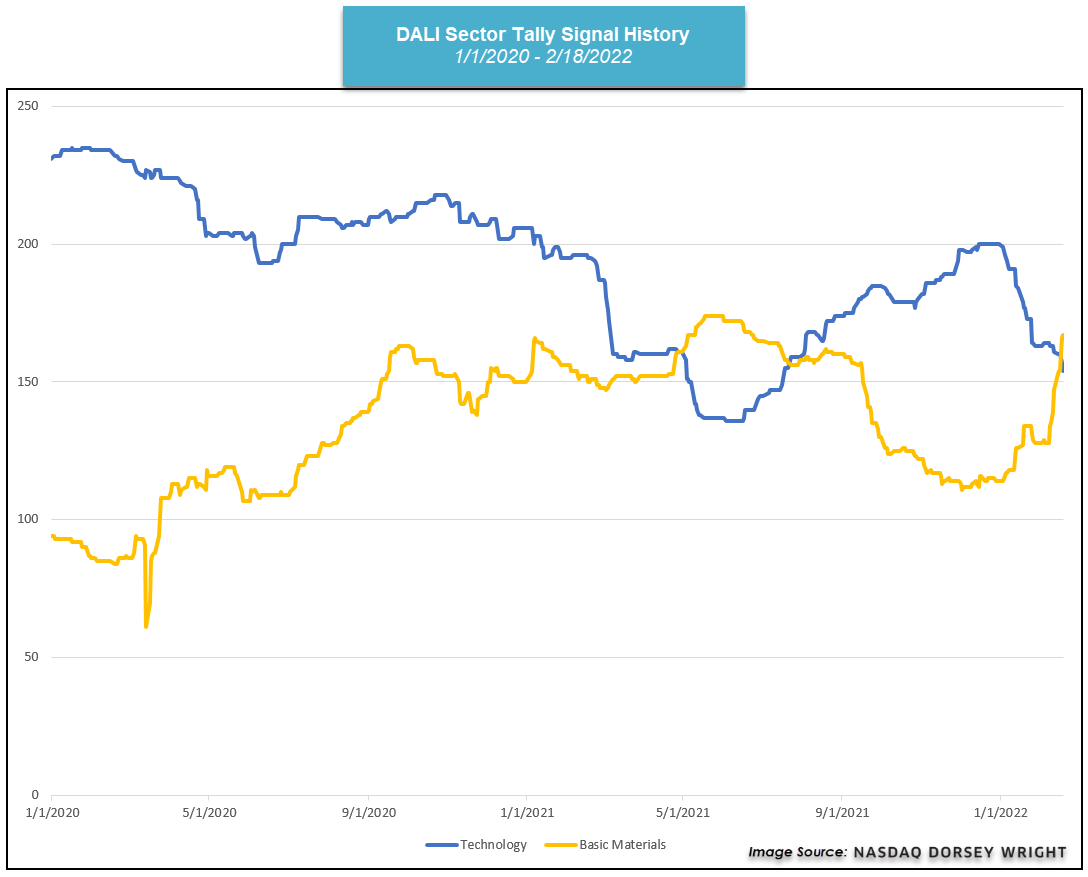

Basic materials have shown relative strength improvement to currently sit third in our DALI sector rankings.

Market movement last week led to some notable changes in the DALI domestic equity sector rankings. Technology continued to show relative strength weakness as it fell to the fourth-ranked position, while basic materials improved to the third spot. The decline in relative strength from technology has been well documented throughout our research over the past several weeks. The sector has lost a total of 46 RS tally signals so far this year (through 2/18), with the majority of those being pruned in January. Even though February has not seen as much deterioration, technology has still lost nine signals this month, the second-worst drop of any sector (behind real estate at -14).

Keep in mind that the DALI rankings look at multiple representatives for each sector, with the number of buy signals for each representative added together to get a tally signal count for the sector as a whole. The internet and software representatives were largely responsible for the initial signal decline for technology, while the semiconductors representative remained elevated in the broader rankings due to their rapid improvement in the second half of last year. Some of that strength has begun to wane due to sharp declines seen from some semiconductor names over the past few weeks.

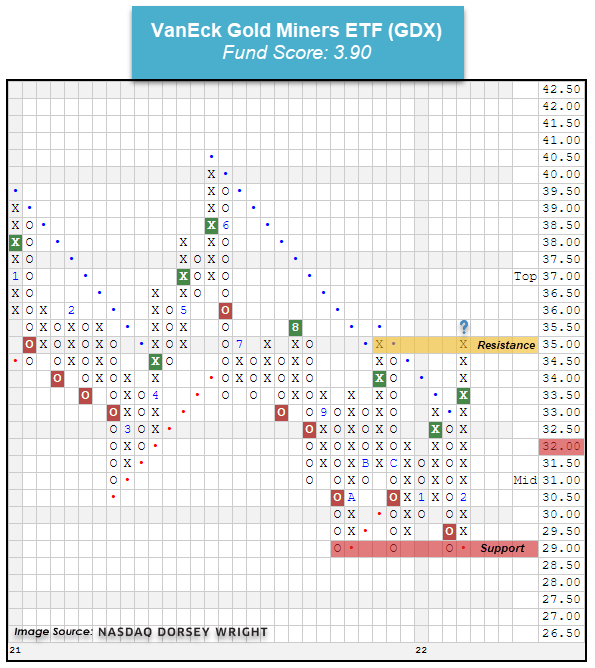

On the other hand, there have been several names in the basic materials space that have continued to pick up the pace of their improvement. One such name is the SDPR S&P Metals & Mining ETF XME, which we highlighted in last Wednesday’s report. This fund had been stuck in a rather large trading range between $40 and $48 until earlier this month when it returned to a positive trend before marking a new multi-year high at $50. That improvement from the broad metals & mining space has also carried over to more focused representatives such as the VanEck Gold Miners ETF GDX. This fund pushed higher last week to return to a positive trend and is currently positioned at the top of its own near-term trading range at $35. GDX also carries a favorable 3.90 recent fund score posting, paired with a strongly positive 3.75 score direction. Precious metals have been a laggard area within commodities over the past several months, but have shown near-term strength in February. Further strength from gold would be a tailwind for gold mining stocks, leading to the potential for more relative strength improvement from basic materials. GDX is pulling back slightly from overhead resistance at the time of this writing Tuesday but has near-term support offered on its ¼-point chart at $32. Further support can be found on the default chart at $29.